The pension reform put several issues on the tableamong them the commissions that the AFPs will receive, but what is this and how does it change? In short, it is the money you give to the AFPs for managing the pension.

The reform establishes that as soon as it comes into effect, for the resources of the affiliates who integrate the contributory pillar in its average premium component, The AFPs will have a maximum administration fee of 0.7% on all assets under management and until the moment in which the comprehensive old-age pension is consolidated.

The above, plus a commission of up to 0.8% for those who have individual savings and earn between 2.3 and 25 minimum wages.. Said percentage, will cover the administration costs in the individual savings componentincluded within the contributory pillar.

Thus, there would be two commissions, however, Daniel Wills, technical VP of Asofondos, explained that the latter of 0.8% will become zero; but explained that they are not clear about how or when this will happen, and if it will be replaced.

But, How does this change with what is currently managed?

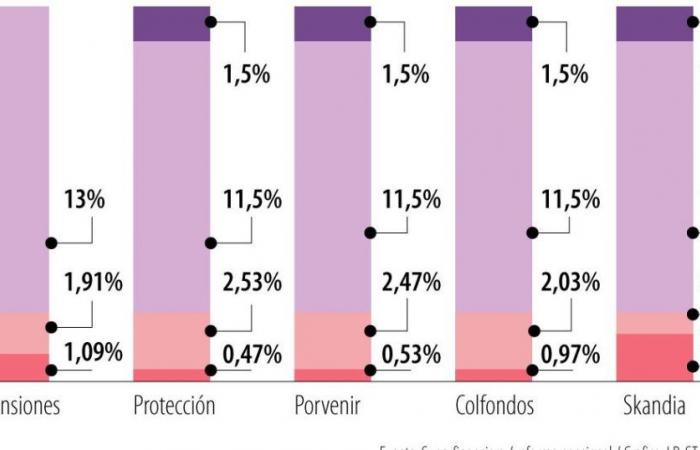

According to the Financial Superintendence, SFC, today, of the contribution made by members to pension funds, a percentage is charged each month to manage pension resources. By law, The sum of the commission for mandatory contributions and pension insurance cannot exceed 3% of the base contribution income, regardless of whether the entity is public or private.. In the case of Colpensiones, the pension insurance goes to the disability and survival reserve.

Based on that limit, and according to SFC figures, Today by commission, Protección obtains 0.47%, Porvenir 0.53%, Colfondos 0.97% and Skandia 2.05%.

With this, Luis Felipe Jiménez, founding partner at Logique Consulting, indicated that currently the administration commission is about flow, that is, “on income, on each time the person contributes. While now it is going to change to a commission they charge on savings”.

Regarding the adjustment of the reform, Wills expressed that “that 0.7% will only be applied to balances that total $200 billion. The AFPs will receive $1.4 billion, which is 0.7% of the $200 billion, and is the same as they received in 2023. Colpensiones will go from receiving $1 billion without reform to receiving $2.3 billion with reform.”

In contrast, Oliver Pardo, Director of the Fiscal Observatory of the Javeriana University, assured that “you will be charged commission to people who remain in the new regime, but who have been contributing in the old regimeand not only on the balances accumulated from the entry into force of the law, but also on the balances that were accumulated before. They are going to charge commission twice, first on the flow, then on the flow of quotes and now on the balance. It is an injustice to the contributors”.