Argentine actions operate with profits this Friday, to overcome the lack of trend in the Wall Street indicators.

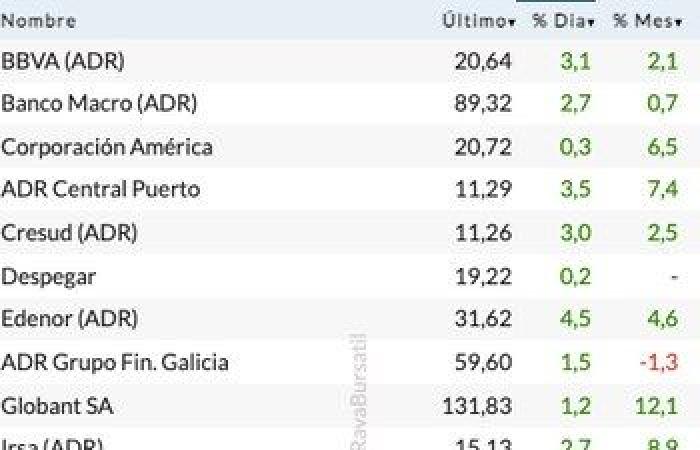

At 12:30 pm, the Dow Jones index of Industrials in New York falls 0.3% and the Nasdaq technological panel falls 0.1 percent. ADR and Actions of Argentine Companies negotiated in dollars on Wall Street They advance up to 4.7%, led by Telecom Argentina.

The index S&P Merval From the Buenos Aires Stock Exchange earns 0.5%, at 2,070,000 points. Sovereign bonds in dollars – bonars and global – yield 0.2% on average.

Gustavo BerEconomist of the Ber study, said that “the S&P Merval rebounds so far in dollars 1.5%, by the main ADR of banks and energy, which have recently been exhibiting higher swells by continuing to be the preferred vehicles by operators to quickly manage their bets.”

Personal investments portfolio He recalled that “the Argentine country risk cuts 25 basic points so far this week, from 703 to 678 basic points. This decrease reflects the good behavior of sovereign debt in dollars.”

“By way of extending the rebound of the latest wheels, which continues to contract the country below the 700 basic points”, with dollars in dollars that sign up an average improvement of 1% weekly, “since the rebounds are multiplied in favor of the longest titles since the most favored in compression scenarios of rates in time would be,” said Gustavo Ber.

The dollar in the local interbank segment floated quietly on Friday, in the middle of a divergent band set by the middle of April between 1,000 and 1,400 pesos for every dollar, at a time when the government of Javier Milei It seeks to remain the third economy of Latin America.

-After exchange flexibility, which eliminated the obstacles imposed on the change market (the so -called stocks), the local currency showed a revaluation and the Central bank stopped intervening in the market, after a hard currency selling series at the end of March and early April.

The wholesale dollar was negotiated near $ 1,100 pesos, which implied a reduced 4% gap compared to the other parities.

The Minister of Economy, Luis Caputosaid this week that the Government will encourage Argentines to use their dollars saved and mostly not declared estimated at about 200,000 million, to support economic activity.

What the government wants is that people buy with their dollars saved out of the financial and these that are in the system in a new money laundering, explained the economist Marina Dal PoggettoExecutive Director of the Ecogo consultancy. “What is sought is to bank the dollars,” he summarized.

“What you had this week is a sale of futures and everything indicates that it was the Central Bank in the December position,” said Dal Poggetto.

After the exchange unification, the average of the survey of the survey of market expectations (REM) May made by the Central Bank, expect monthly inflation above 2% to July, when in April, they foresee that in June drilles 2 percent.

“On the other hand, the forecasts on the official wholesale exchange rate (A3500 BCRA) by Puente.