The dollar went down on Wednesday at the beginning of the day, waiting for the United States Secretary of the Treasury, Scott Besent, and the Chief Commercial Negotiator, Jamieson Greer, will meet this weekend in Geneva with China’s most economic head of China, He LIFEG, To maintain conversations that could be the first step towards resolving a commercial war that disturbs the world economy.

In addition, the Federal Reserve, Fed, He already met today to analyze the rate cut, and kept them at the same level.

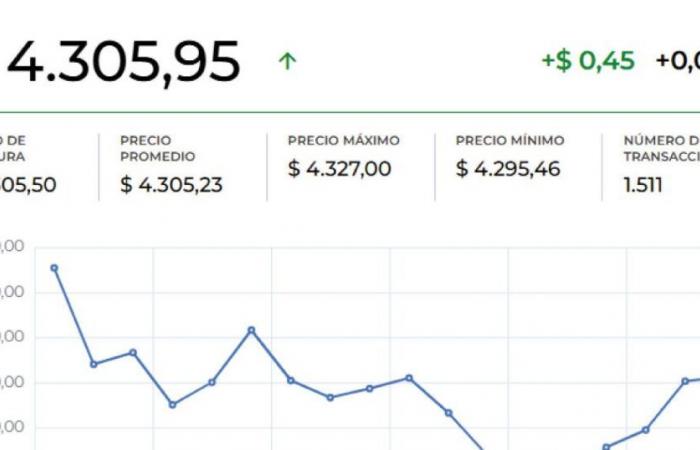

Faced with this panorama, the dollar price in Colombia closed on Wednesday at the rise at $ 4,306.77which represented an increase of $ 1.75 compared to the representative market rate, TRM, certified of $ 4,305.02. At the beginning of the day there was a minimum price of $ 4,283.33 and a maximum of $ 4,322.

In addition, at the end of the price 1,757 transactions were recorded for an amount of US $ 1,134 million.

Reuters reported that the news of the meeting, announced by Washington at the last minute of Tuesday and subsequently confirmed by Beijing, It caused a strong climb from the futures of the US stock market rates, while China and Hong Kong bags also advanced at the beginning of the Asian session on Wednesday.

In addition, he emphasized that the dollar remained “Virtually stable on Wednesday”, before the Federal Reserve meeting in which monetary policy will be decided to continue before an uncertain economy, while the main Asian investors continued to make money from US assets.

-Since last week, the sale of dollars seems to have sentpromoted by investors around the world, especially in emerging markets of lower performance, which change the currency or repatrian funds.

According to Tony Sycamore, Ig analyst, the green ticket had a “micro bounce” for the imminent commercial conversations, but the general pessimism about the US economy and the dollar remains intact.

Oil

Reuters stressed that oil prices rose on Wednesday, keeping slightly above the recent minimum of four yearswhile investors focused on commercial conversations between the United States and China and the signals of lower American production.

Brent Lcoc1 crude futures rose US $ 73 cents the barrel, 1.2%, to US $ 62.88 the unitwhile the American crude West Texas Intermediate Clc1 advanced US $ 81 cents, 1.4%, at US $ 59.90 a barrel.

Both references collapsed to minimum of four years recently after OPEC+ decided to accelerate production increases, Earning the fears of an excess of supply at a time when US tariffs have increased concerns about demand.

“The news that the United States and China will initiate commercial conversations this weekend have made Brent Cotice upward, extending a ‘rebound in oil in oil in oil“Ing raw material analysts said Wednesday.