The Argentine market showed a strong reboundin the second stock wheel of the week, unmarked from the main international reference rates, such as Wall Street, which operated in negative terrain. The S&P Merval rose 3.4% and the Argentine ADRs in New York advanced up to 7.4%, headed by YPF. The sovereign debt in foreign currency, in addition, operated with rises of up to 1.1% on average.

In a very favorable wheel for Argentine assets, the S&P Merval rose 3.4% to 2,129,994 basic points. While in dollars, it held a 3.2% rise to 1,755 basic points, but maintains a fall in more than 18% so far this yearreflecting persistent exchange pressure.

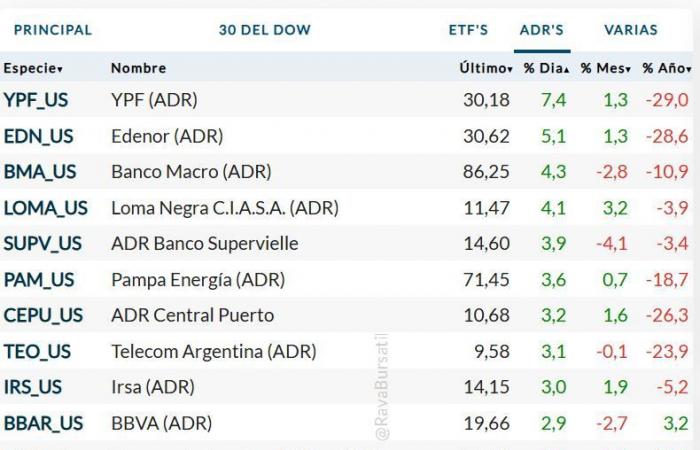

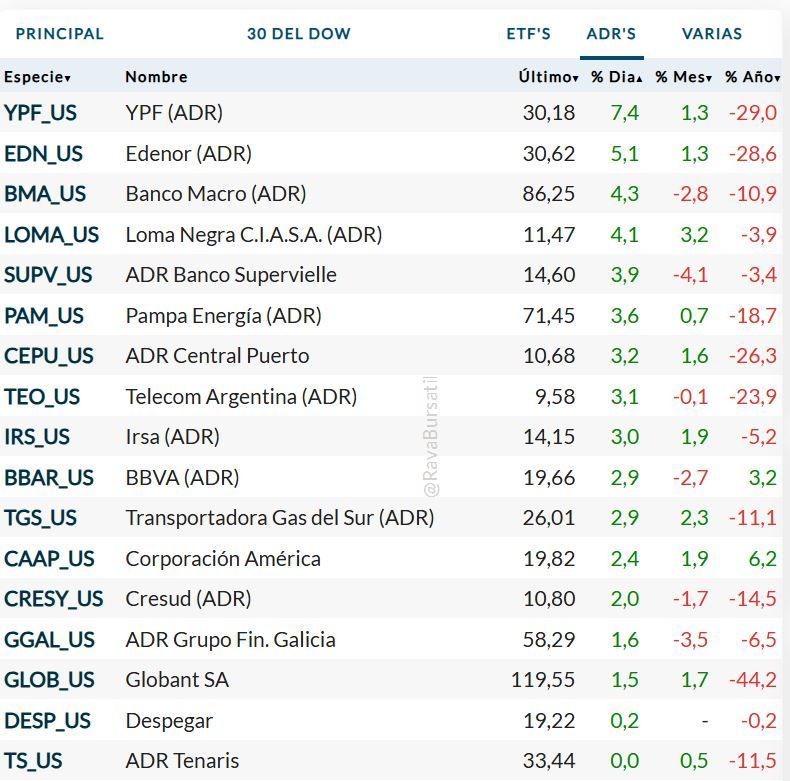

adrs 6-5

In the leading panel, the most pronounced promotions were those of Silver Commercial Society (+7,1) YPF (+6.6%), bank of Securities (+6,1), Edenor (+5.4) Supervielle Bank (+5,3), Metrogas (+4,41) and Loma Negra (+4,12).

Among the ADRs operated in dollars on Wall Street the profits were extended. Highlighted on the wheel the 7.4% rebound in YPF shareswith impulse of an improvement in the oil price of 3.4%, to approach the USD 60 a barrel. Edenor won 5.5% and Vista Energy, 4.3 percent.

MERVAL 6-5

In the fixed income segment, the Sovereign bonds in dollars They operate mostly on the rise, led by the Global 2038 (+2.35%), followed by the Global 2035, which advances 1.4%. Meanwhile, the titles in pesos adjusted by CER show rises of up to 0.5%, with the TX26 leading the improvements.

The country risk, indicator of the JP Morgan bank, closed at the 741 basic points.

6-5 bonds