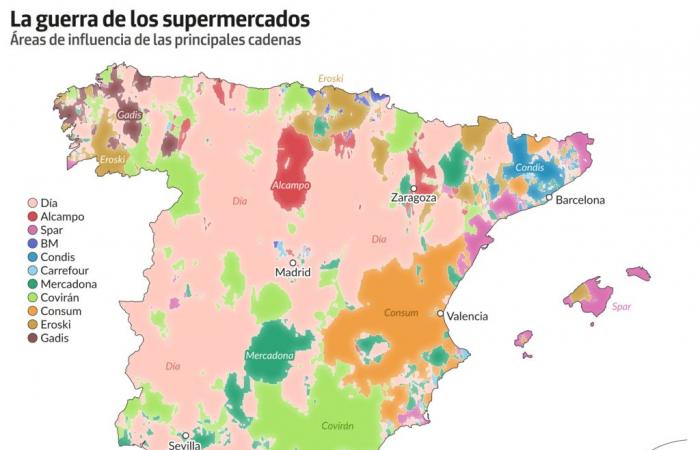

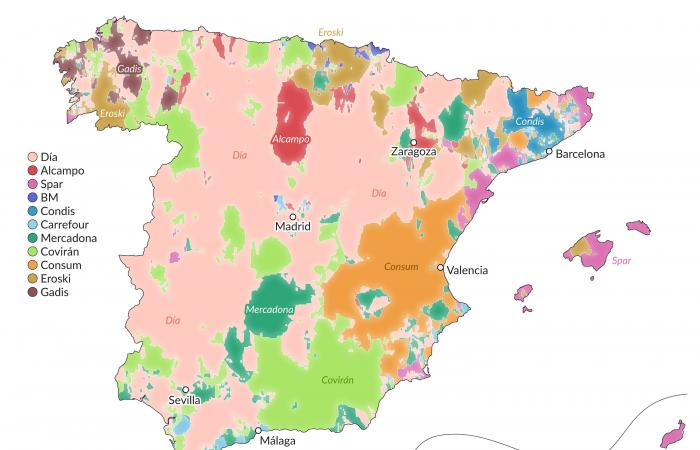

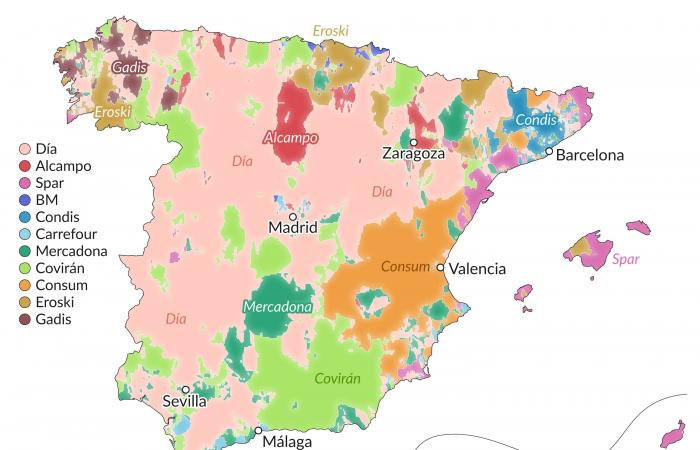

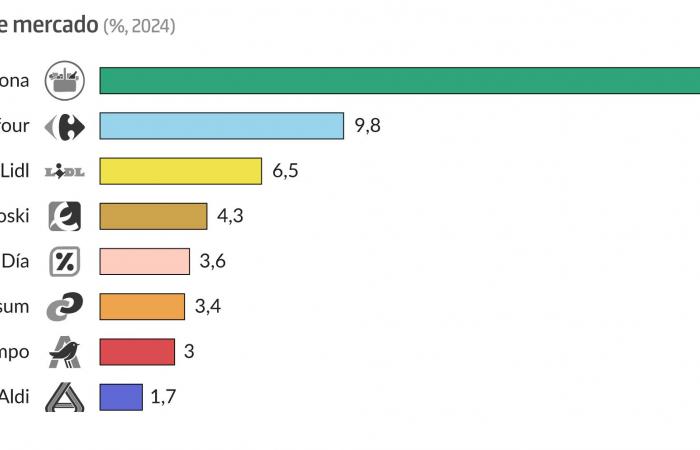

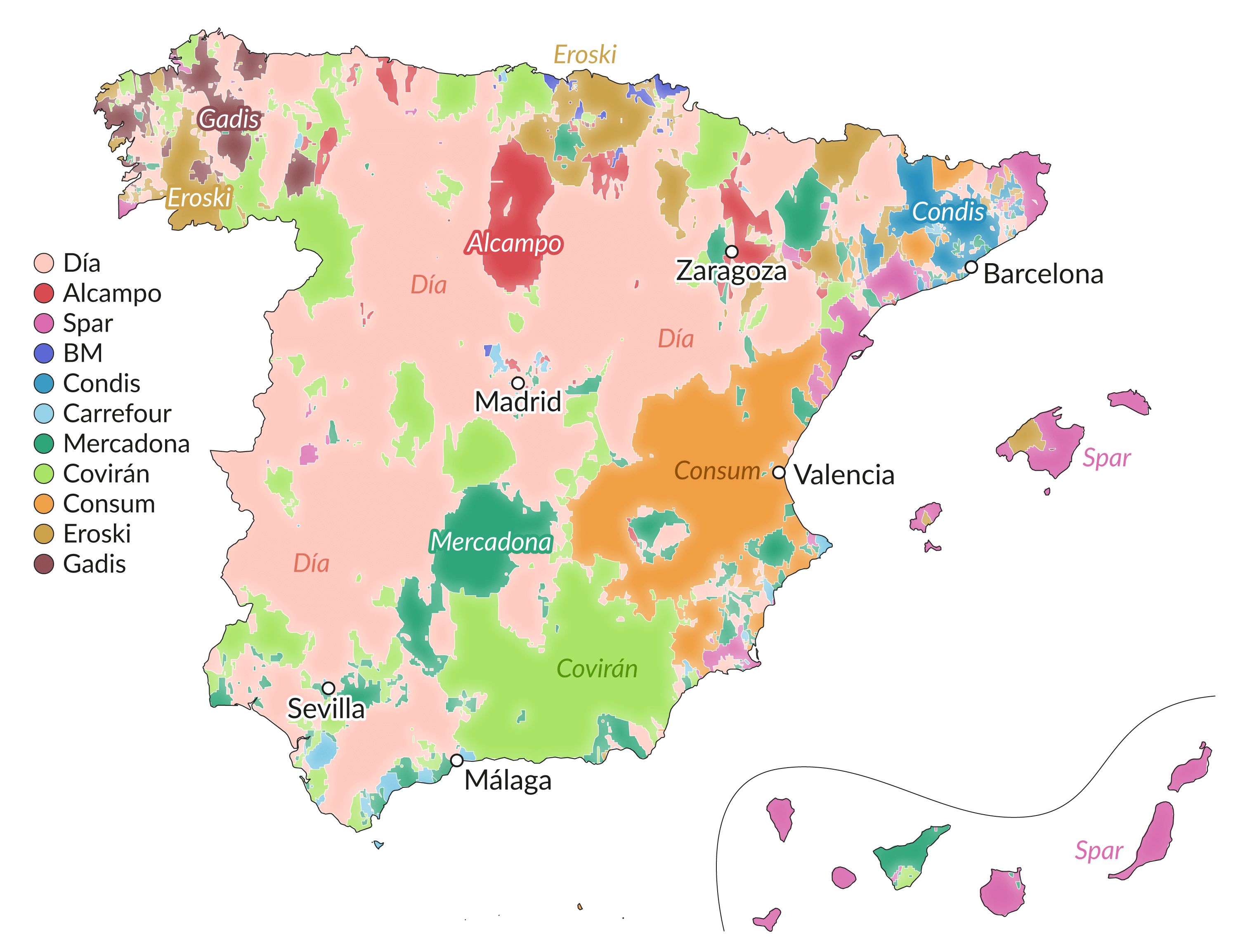

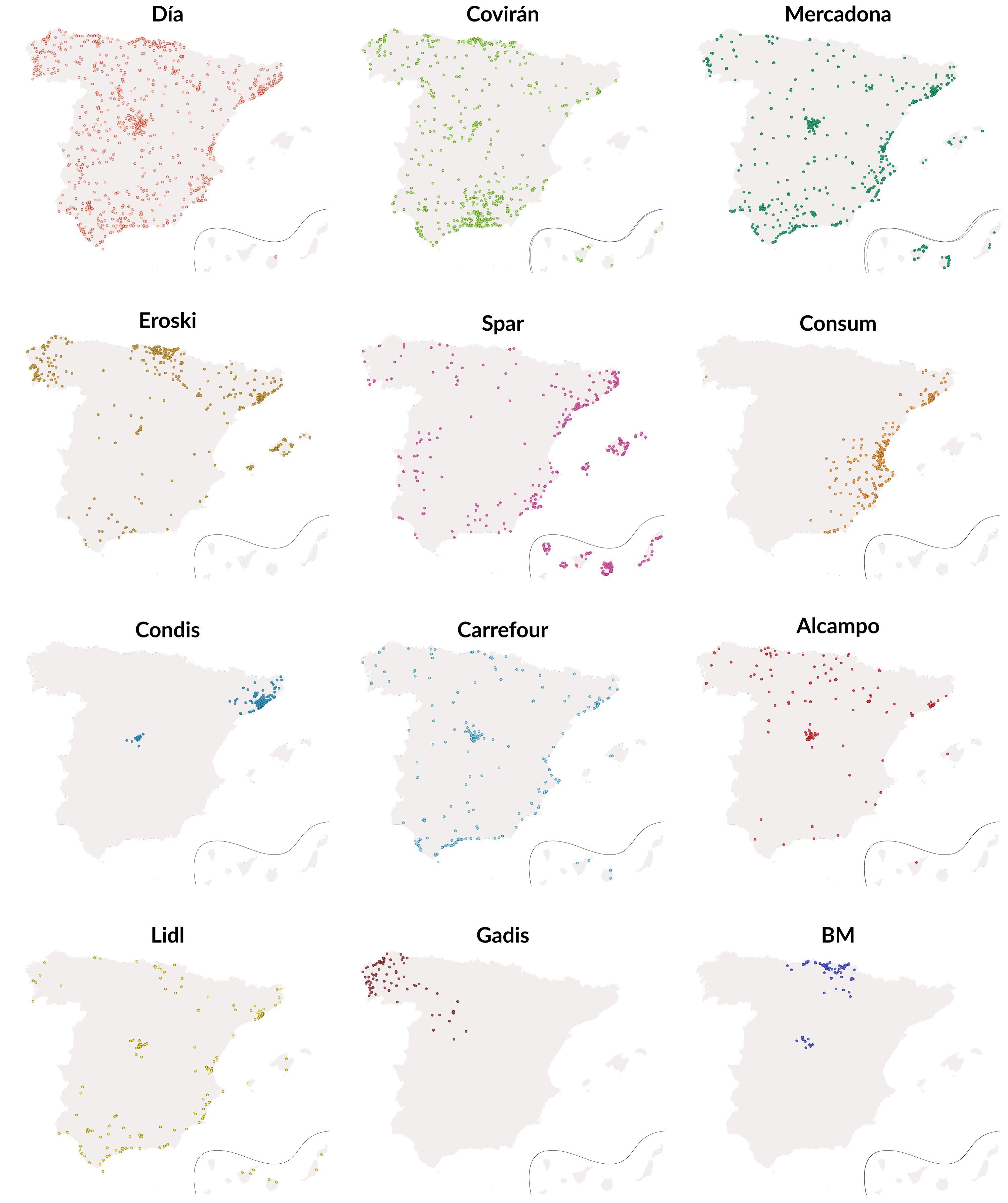

“Every day closer.” Although Mercadona is the king of supermarkets in Spain by sales volume, its territorial domain is tiny when compared to that of the day group, the chain that barely accumulates 3.6% of sales but has made its motto a commercial strategy. Its 2,300 stores make it the largest group in Spain and the reference super for the middle of the country.

Areas of influence of each chain

From the analysis of more than 6,000 locations of the most common distribution chains in Spain, in The world order We have mapped their territorial influence to see which of them is the closest option at each point in the country (see methodology for more details). The result is a very diverse map that acquires even more detail on its margins.

The role of day, especially in emptied Spain, contrasts with the long process of closures and sanitation that the group has crossed since 2018, during which it has lost a third of its infrastructure and has been acquired by the Luxembourg Fund Letterone. Despite this, after eight consecutive years losing market share, day has begun to recover land and plans to open 300 new proximity stores by 2029.

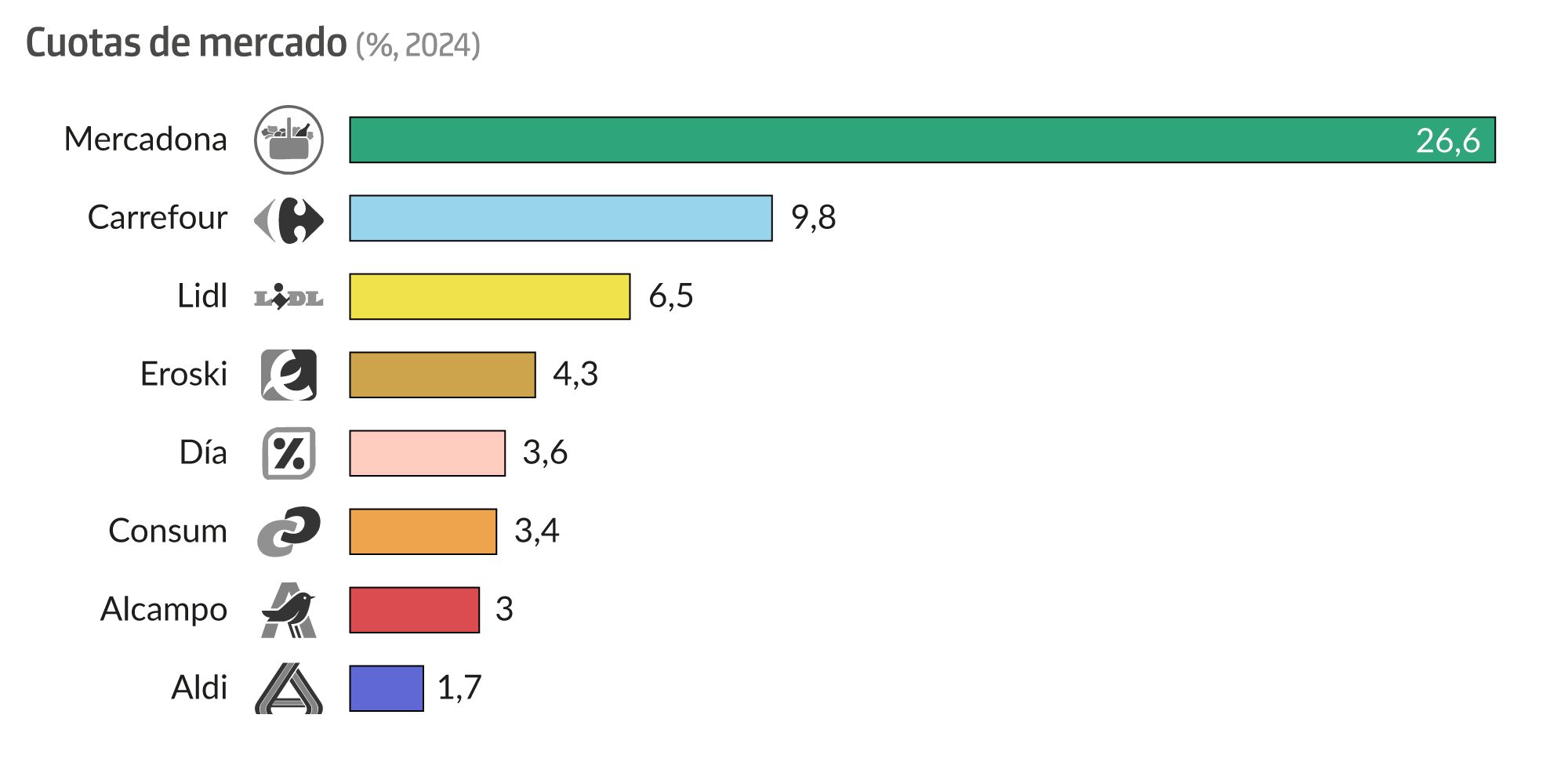

Opposite case is that of Mercadona. The Valencian company Juan Roig has continued to strengthen his leadership after the pandemic and the inflationary crisis to exceed the threshold of 25% of Spanish sales, putting land in between with the rest of the brands. Mercadona is, in fact, the most profitable supermarket of the great chains in the world. And yet, its 1,600 stores are so scattered that they barely manage to impose themselves in the Spanish territory, with the only exception of the province of Ciudad Real.

Its territorial implementation is overcome even by Covirán, acronym for Cooperativa Virgen de las Angustias. Once in Granada, this chain presumes to be the only purchase option in 322 municipalities with less than 2,000 inhabitants and has become strong in the eastern half of Andalusia or Cantabria. Coviran is next to day the brand with the lowest medium surface per supermarket, which allows both opening more points of sale with a smaller logistics and investment.

Meanwhile, other chains with large sales volumes such as Carrefour or Lidl barely participate in the struggle for territorial domain, since they concentrate their efforts in large capitals.

In this sense, Spain is one of the European countries with more competition in the distribution sector and supermarkets: its five main chains barely monopolize half of the sales, according to data from the end of 2024 of Kantar, compared to 56% of Italy, 70% of Portugal, 73% of Germany, 75% of the United Kingdom or 85% of France. Two are the reasons: the preference of the Spaniards for fresh foods, which translates into a still important weight – around 15% – of traditional stores such as fruit shops, butchers or fishmongers, and the rise of regional chains.

Regionalism in the purchase list

The Great Competitor of Mercadona are not other European giants such as Carrefour, Lidl or day, who barely fight to maintain or as much makeup in the Spanish distribution, but more humble supermarkets but with great penetration in specific areas of Spain such as Covirán, Eroski (Basque Country), Consume (Community Valencian), Condis (Catalonia), Gadis (Galicia) Basque).

These types of brands already represent 18% of sales in the distribution sector, more than any other generalist group. Their presence has increased by 0.7% only in the last year thanks to their commitment to the fresh product and personalized attention, which is allowing them to capitalize a large part of the transfer of buyers from neighborhood stores.

Its success is also explained by its expansion to new geographical areas: 68% of its new clients of the last five years come from areas outside their community of origin. The best example is Consum: The Valencian Cooperative is already the sixth group of supermarkets by sales volume of Spain and its territorial domain is quickly penetrating from the Valencian Community in the provinces of Murcia, Albacete, Cuenca or Teruel.

The spar case is also striking. In its case, instead of a regional implementation, the chain is part of a Dutch multinational supermarkets, but also shows a very localized presence: the coast. The islands and the Catalan coast are the great areas of Action of SPAR, a more recognized brand by European tourists, so it is not surprising that the group prioritizes areas with a large influx of foreign visitors.

Creative Commons BY-NC-ND

Methodology

The supermarket locations have been extracted from OpenStreeMap. The final sample includes only those of the twelve most numerous chains, including its franchises, as is the case of Charter with Consum. In this way, regional chains with a more discreet presence at the national level such as Dinosol (Canary Islands), magnifying glass (Cantabria), Alimerka (Asturias) or Froiz (Galicia) have been out of the analysis.

To estimate the territorial control of the different supermarkets, the closest neighbors (KNN) has been used.

This piece of Washington Post It served as inspiration.