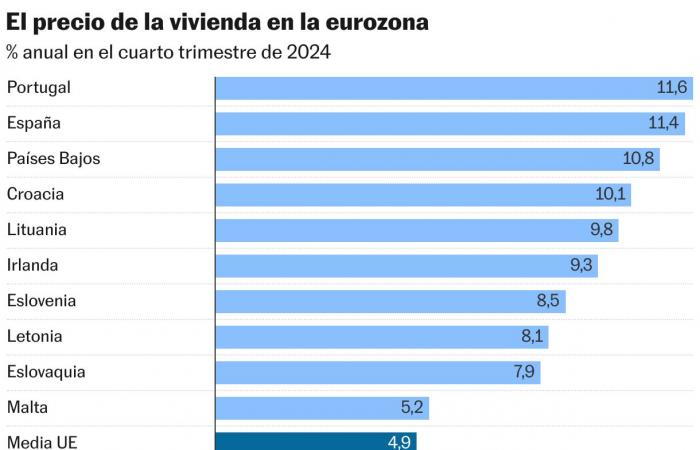

Housing prices have stepped on the accelerator in Spain. It was the second country in the Eurozone where the houses were most more expensive last year: 11.4%, according to the latest data released by Eurostat, behind the 11.6% rise that Portugal recorded. Both neighbors stand out for the general dynamism of their economies, in the face of European stagnation. Although if you look at the whole of the twenty -seven, two other countries outside the common currency saw the real estate prices grow even more for 2024. In Bulgaria they shot 18.3%; And in Hungary they did 13%.

In contrast, house prices grew 4.9% in the whole of the European Union (EU). In the Eurozone, in the fourth quarter of 2024 a 4.2% more than a year earlier was paid for the house. In both cases, the average includes the result of very different national dynamics. Faced with the bulky percentages of the countries indicated and others (in Holland and Croatia there were also double -digit increases), the amounts retreated almost 2% in France and Finland. And in Germany, Austria and Luxembourg had a very discreet progression.

“From the pandemic, the housing behavior has been very different in countries,” summarizes the economist José García Montalvo, a professor at the Pompeu Fabra University. “The dynamics of the economic cycle marks the housing price dynamics,” he adds. “Spain in the last year is one of the sites where housing goes up the most, but it is also a year in which it has stood out very positively as the European economy of best performance,” coincides Judit Montoriol, the main economist of Caixabank Research.

That explains that prices in Spain are already almost 20% more expensive than at the start of 2022, when Russia invaded Ukraine. That unleashed a generalized inflationary crisis, which is not yet completely controlled and on which the threat of a commercial war unleashed by the US is now loom. But that rise in the cost of life has not been of the house in countries such as Germany or France, where the houses are cheaper than in the first quarter of 2022.

If the price growth is discounted accumulated since then, in fact, the house has been reduced in Europe. This is not the case of Spain, where the defendant amounts remain 8% more expensive, being the fourth market with the greatest increase after Portugal, Croatia and Lithuania. In these countries, the increase in interest rates with which the European Central Bank responded to inflation has not twisted the direction of the real estate market. But in others “there have been very important corrections,” says Montoriol, who points to France, Germany or Sweden.

70% increase in 10 years

In the long term, the data show a generalized price increase. The percentage that Spain accumulates since 2015 is almost identical to the community average. In the last decade, housing has increased 36% in real terms (that is, discounting inflation). Without taking into account that effect, the amounts are 70%more expensive, and there is Spain off both from the community average (58%) and that of the Eurozone (50%).

In relation to other community partners, Spain stays in half a table: in tenth position between the twenty countries of the common currency (the EU statistical portal only offers data from 19, since it does not include those of Greece), and in 14th between the twenty -seven (26 without Greece). Ten EU states have seen prices double in the last decade; And in Hungary they have more than tripled.

This abrupt rise in prices that the old continent has suffered in the last decade reflects the crisis of housing that extends through most European countries and that has aroused the interest of the community executive, which already studies measures to placate this effect.

The two experts consulted are also agreed on the causes of this general increase. Beyond that it has been a positive economic cycle, “the common factor,” says García Montalvo, “has to do with the offer.” This is unable to respond to the strong demand in the main cities “which are the ones that mark the tendency of the countries and determine the prices a lot,” adds the professor.

These nuclei attract population (especially if the labor market shows dynamism, as is the case of Spain in recent times) and also investments. But that demand finds on the other side an offer that barely grows: “There are OECD studies that indicate to urban restrictions to the new construction,” says Montoriol. And whether for geographical or regulatory reasons, that brake “drives the rising price,” says the economist.

This adds other “additional factors”, such as tourist rental or institutional investment (“a study of the ECB says that they have helped the climb in some countries, but not so much in Spain”), but it emphasizes that they are not “the main cause.” And can a general economic cooling contribute to lower house prices? “Uncertainty does not help,” replies Caixabank’s economist in allusion to the commercial war, “but now we do not contemplate that scenario as the central.” “For us the central is that a few tenths are subtracted from growth and that would have an almost null impact,” he concludes, although he believes that “the central banks could be seen in the tesiture of how to act in the face of a combination of inflation with little growth, which could impact on the real estate in that way.”