- The XRP price struggles to maintain the support of 2.10 $ in the middle of the decrease in network activity.

- The commitment of users has not yet recovered from a strong fall from the peak of the first quarter of approximately 612,000 active daily addresses.

- Ripple whales are increasing their holdings, which suggests a feeling in improvement and possible breakout.

- XRP is negotiated below the key EMAS while the RSI indicator is approaching oversight in the 4 -hour graph, pointing out a strong bearish momentum.

The price of Ripple (XRP) has not yet managed to advance its broader recovery potential, with a medium -term target. The remittance token of cross -border money is located at $ 2.17 at the time of writing, with a slight increase in the day. The prolonged lateral movement of the price may be due to the decrease in network activity, particularly as the active addresses fall from their peak of the first quarter.

The XRP price falters in the midst of the decrease in network activity

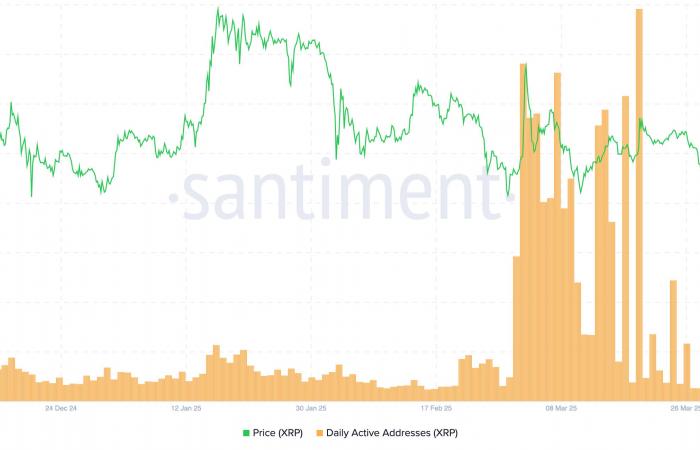

XRP’s main book is experiencing an important slowdown in the network activity compared to the levels seen in the first quarter. The Santimento chain data reveal that the daily active addresses in the protocol are located in a fraction of the maximum levels recorded in March.

At the highest point of the first quarter, XRP’s main book registered 612,000 active daily addresses, indicating a strong commitment of users and transaction activity. However, the graph below shows a dramatic fall through April and early May.

With only around 40,000 active daily addresses, less users make transactions in the XRP book, which could point out a decreasing interest or a lack of confidence in the short -term perspectives of the asset.

Daily Active Addresses of XRP | Source: Santiment

Historically, such falls in the activity often precede periods of stagnation or price decline, since the reduction of the volume of transactions erodes liquidity and purchase pressure. This makes the metric of daily active addresses an important indicator for traders, since it could help determine the potential of XRP price.

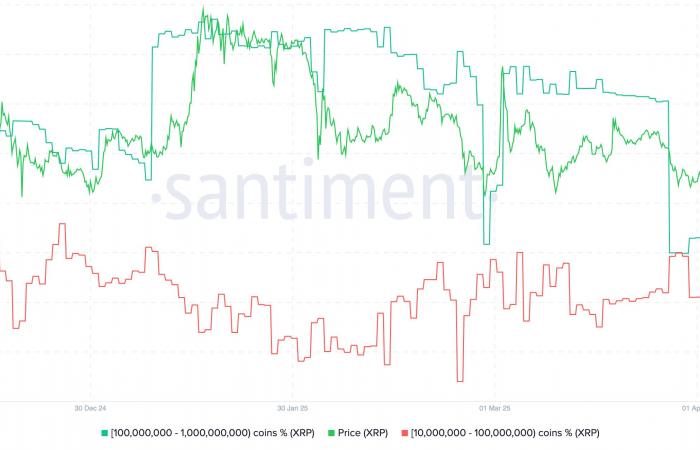

Despite the fall in daily active directions, whale groups in the ecosystem are relentless in their search to increase XRP exposure. Large volume holders have been buying XRP constantly since the beginning of April, which suggests a feeling of risk in improvement. For example, addresses with 10 million to 100 million currencies currently represent 12.32% of the total supply of XRP, which represents a significant jump from 10.91% of April 1.

The green line in the graph below shows that whales with between 100 million and 1,000 million tokens currently have 14.37% of the XRP total supply, an increase since 14.32% recorded on April 1.

XRP supply distribution | Source: Santiment

The accumulation by large holders (1 million to 1,000 million XRP) is generally an upward indicator because whales often accumulate for periods of consolidation or before increased price increases. This suggests that large groups of investors could anticipate positive developments such as an agreement between Ripple and the Bolsa and Securities commission (SEC) and a possible approval of XRP stock quoted funds (ETFs) in cash.

XRP Alcistas try a trend reversal

The XRP price is maintained above the short -term support by $ 2.10, while the bulls launch a new recovery attempt, with an objective of recovery towards $ 3.00. However, XRP position below the EMAS of 50, 100 and 200 could complicate things for the bulls, challenging the early breakout.

The relative force index indicator (RSI), which is below the midline in 43.30, indicates a growing sales pressure. However, its ascending trajectory suggests a possible increase above the midline, which could strengthen the bullish momentum soon.

4 HOURS OF XRP/USDT

Facing the future, if XRP converts the EMAS of 50, 100 and 200 in support, the technical structure would be strengthened, favoring a bullish result. Beyond the mobile socks, which converge around 2.18 -2.20 $, the resistance in the maximum of April 2.36 must be exceeded to encourage more traders to buy XRP, anticipating an upward trend towards $ 3.00.

Meanwhile, the decrease in network activity could hinder the XRP bullish momentum, limiting its higher scale due to the weak demand. The key support levels to be monitored include the close demand zone at 2.11 $, the critical brand of $ 2.00 and the minimum of April 7, $ 1.61.

Ripple FAQs

It depends on the transaction, according to a judicial sentence published on July 14: for institutional investors or extrabursat sales, XRP is a value. For retail investors who bought token through programmatic sales in bags, on demand liquidity services and other platforms, the XRP is not a value.

The United States stock stock commission (SEC) accused Ripple already its executives to raise more than 1.3 billion dollars through an unregistered token XRP asset offer. Although the judge ruled that programmatic sales are not considered stock values, the sales of XRP tokens to institutional investors are investment contracts. In the latter case, Ripple yes infringed the US Law on Markets and will have to continue litigating for the nearly 729 million dollars he received under written contracts.

The sentence offers a partial victory for both Ripple and the SEC, depending on what you look at. Ripple obtained a great victory over the fact that programmatic sales are not considered values, and this could be a good omen for the cryptocurrency sector in general, since most assets at the point of the SEC of the SEC are managed by decentralized entities that sold their tokens mainly to retail investors through exchange platforms, experts say. Even so, the sentence does not help much to answer the key question of what makes a digital asset a value, so it is not yet clear if this demand will be preceding for other open cases that affect dozens of digital assets. It is likely that issues such as the appropriate degree of decentralization are persisting to avoid the “value” label or where to draw the dividing line between institutional and programmatic sales.

The SEC has intensified its coercive actions towards the blockchain industry and digital assets, presenting positions against platforms such as Coinbase or Binance for alleged violation of the United States stock values Law. The SEC states that most cryptoactive values are stock market values and, therefore, are subject to strict regulation. While the defendants can use parts of the Ripple judgment in their favor, the SEC can also find in it reasons to maintain its current regulation strategy by applying the law.

Judicial resolution is a partial summary judgment. The ruling can be appealed once the judge is issued or if the judge allows it before. The case is in a phase prior to the trial, in which both Ripple and the SEC still have the possibility of reaching an agreement.