Bloomberg — All base metals, from aluminum to zinc, they will steal the spotlight during the annual LME Asia Week in Hong Kong.

The EVs that will replace gas guzzlers over the next few decades will end up consuming a significant portion of the energy they consume. Natural gas from Russia continues to have a great influence on European economies.

Gas, pork and metals: five key charts to watch this weekChinese consumption, the largest in the world, has been moderate in contrast to the global rise. Photographer: Dhiraj Singh/Bloomberg(Bloomberg/Dhiraj Singh)

Below are 5 notable charts to watch in global commodity markets this week.

Read more: Hedge funds’ bullish bets on copper collide with China slowdown

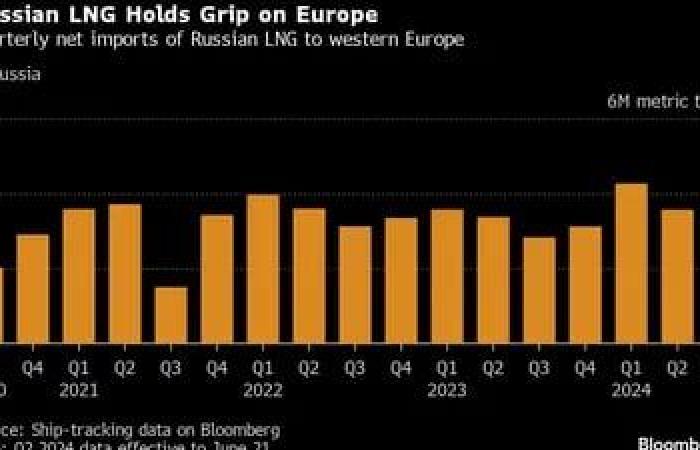

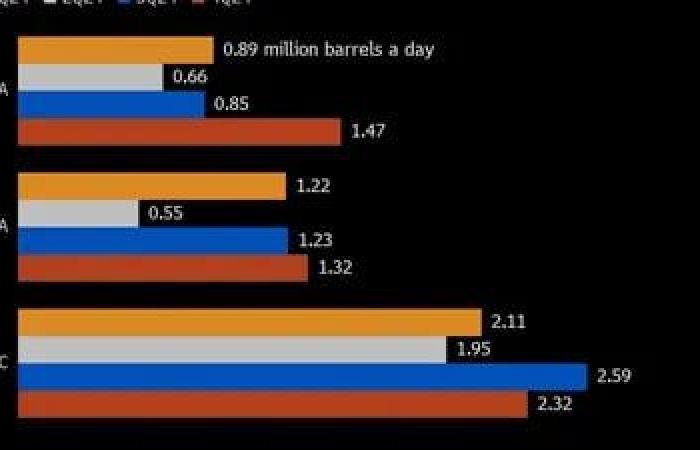

Natural gas

Although Europe has rushed to diversify its supply of Russian gas through gas pipelines, gas imports by tanker trucks continue to be important.

Some countries, such as France, Spain and Belgium, have increased their purchases of liquefied natural gas from Russia after the start of the war against Ukraine waged by the Russian government.

This is partially due to the general European willingness to buy more LNG on the global market. The EU authorizes imports of Russian liquefied natural gas for reasons of security of supply, although it prohibits the re-dispatch of shipments in its ports to consumers in other markets, such as China and India.

This Monday, natural gas prices in Europe fluctuated between gains and losses.

Gas, pork and metals: five key charts to watch this weekQuarterly net imports of Russian LNG to Western Europe. Source: Bloomberg Vessel Tracking Data

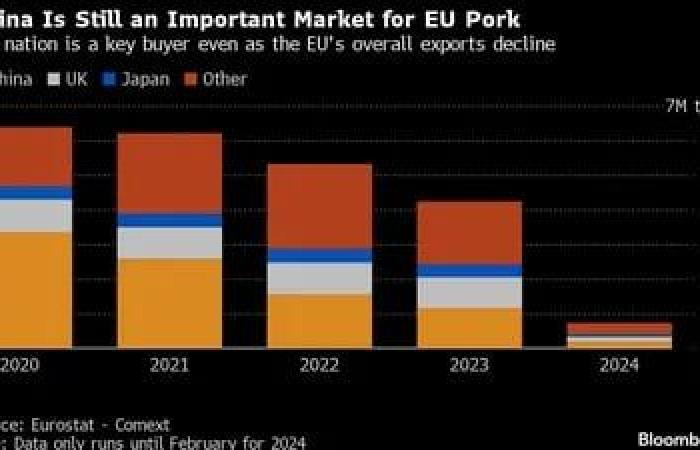

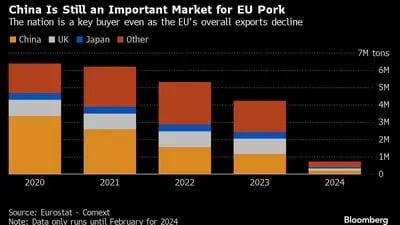

Pork Meat

The last thing the EU pork industry needs is the threat of China imposing tariffs on its pork.

An investigation of the sector by China could leave the European bloc out of the main global market of pork imports.

Although European Union exports have decreased in recent years due to African swine fever, the rise in input prices and lower consumption of pork have reduced European herds, China continues to be one of the most important buyers. .

Read more: Fossil fuel companies burned a record level of gas in 2023, according to the World Bank

Gas, pork and metals: five key charts to watch this weekChina is still an important market for EU pork. Source: Eurostat – Comext

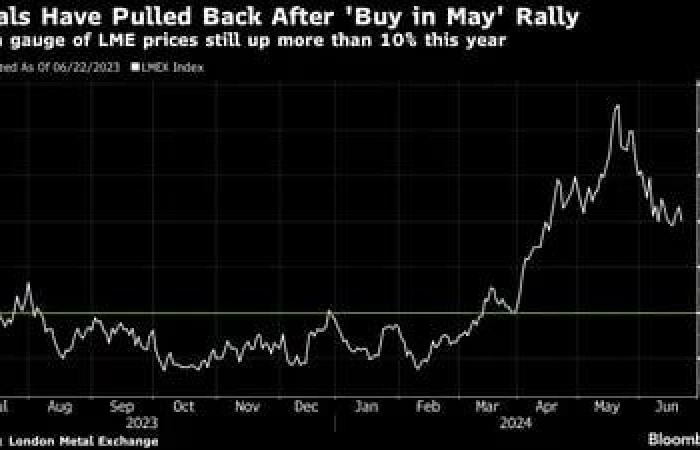

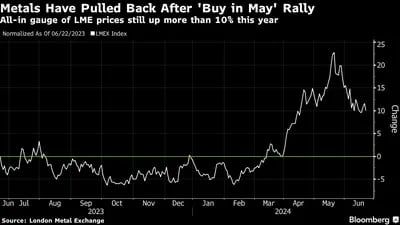

Metals

The Base metals have enjoyed an exciting few months after a relatively dull period for prices, and what happens next may depend on China. The world’s largest consumer of all types of metals, from copper to aluminum and zinc, has been unusually moderate, contrasting with global bullish sentiment.

The six-metal LMEX index hit a multi-year high in May before softening, and whether it maintains this year’s advance may depend on if Chinese demand manages to recover. That’s the key question for traders, investors and buyers at LME Asia Week.

Gas, pork and metals: five key charts to watch this week Metals have retreated following May’s buying rally, as LME prices continue to rise more than 10% in the last 12 months.

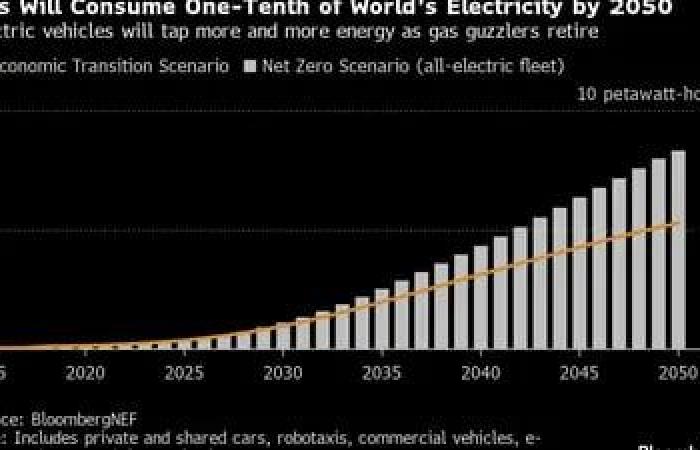

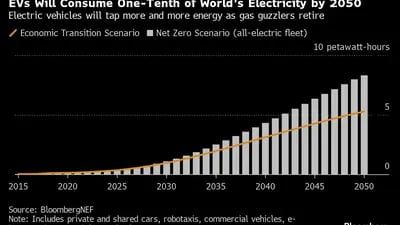

Electric vehicles

An all-electric vehicle fleet by 2050 is vital if the world is to achieve the net zero emissions goals of the Paris Climate Change Agreement.

That EV fleet of the future could need 8.3 petawatt-hours of electricity a year by thenas estimated by BloombergNEF in its latest Long-Term EV Outlook report.

That It represents more than 10% of the global electricity demand expected by mid-century, and 50 times more energy than the global EV fleet consumed last year.

Even the more conservative BNEF energy transition scenario shows that EV electricity demand in 2050 it will exceed 5 petawatt-hours, that is, more electricity than the US consumed last year.

Read more: Race for new oil reserves in Latin America leads to record investment

Gas, pork and metals: five key charts to watch this weekElectric vehicles will consume a tenth of the total global electricity by 2050. Source: BloombergNEF

Petroleum

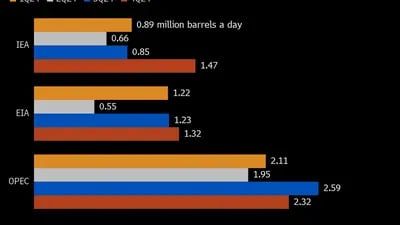

The three main oil forecasting organizations, the International Energy Agency (IEA), the US Energy Information Administration (EIA) and the Organization of Oil Exporting Countries Oil (OPEC) They predict that the growth in oil demand in the second half of 2024 will be higher than in the first. But that’s as far as his unity goes.

The producer group believes that consumption will increase twice as fast as its counterparts on the consumer side.

The divergence comes amid bullish signs for oil demand, helped by strong U.S. gasoline consumption during the summer driving season and a revival in air travel that is giving a seasonal boost to the fuel for planes. Oil rose on Monday.

Gas, pork and metals: five charts to watch this week Quarterly growth in crude oil demand. Sources: International Energy Agency, Energy Information Administration, Organization of the Petroleum Exporting Countries

Read more at Bloomberg.com