The absolute return fund managed by Jon Withaar, director of special situations investments at Pictet Asset Management in Asia, has established itself as a differential strategy that takes advantage of opportunities in markets as significantly important as the Asian ones and in companies in special situations. In an interview with FundsPeople, the manager of the Pictet Total Return Lotus fund shared details about the fund’s investment strategies and its focus on special situations, delving into his preference for Japan.

Investment strategies in corporate transformation and M&A

The Corporate transformation situations are events that can have a significant impact on the value of companies. Jon Withaar defines these special situations as internal eventsrestructurings, debt refinancing and sales of business lines; and external events, such as changes in regulation or the global economy. “We are focused on situations where companies are creating or destroying value. This can be due to internal or external forces,” explains Withaar.

The Pictet Total Return Lotus fund focuses on identify these opportunities with the aim of taking advantage of these changes which includes identification of mergers and acquisitions (M&A) events. According to Withaar, these transactions can have a significant impact on company valuations, and the fund seeks to capture value through a market neutral investment strategy, maintaining a balance between profitability and stability.

“Our goal is to provide an absolute return throughout the cycle, whether the market rises or falls. We do not want to take excessive risks, but rather maintain a balance between profitability and stability,” highlights the expert.

Opportunities in Japan and Asia: Corporate governance reforms

Japan and Asia are strategic markets for the Pictet Total Return Lotus fund. Withaar emphasizes the importance of Japan as a strategic ally for the West and the growing interest of foreign investments in the region. Besides, Asia, with countries such as Vietnam, Thailand and Indonesia, offers significant opportunities due to its rapid economic growth and also because they are receiving investments, including from China, to avoid increasing tariffs against their products.

Delving into Japan, a country highlighted by the manager, the corporate governance reforms initiated in 2015 and reviewed in 2017 (followed by the corporate governance code of 2017 and the revision in 2018), have had a profound impact on the investment strategies of the background. These reforms have driven changes in the structure of Japanese companies, improving their efficiency.

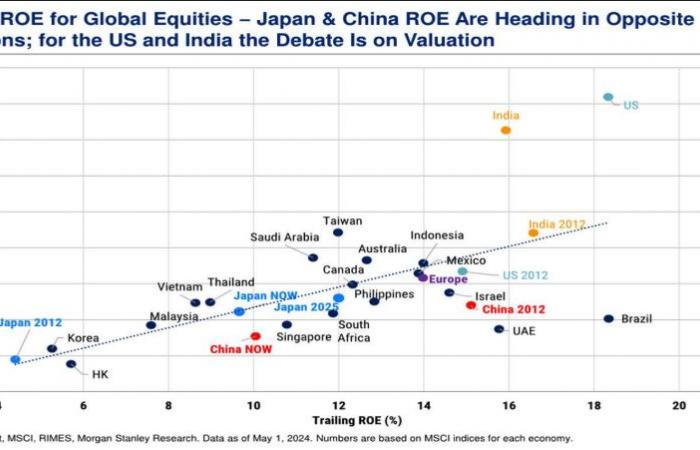

“These reforms have created significant opportunities for us, as Japanese companies are changing their structure and their approach to corporate governance. On the other hand, seeking to make companies profitable, the reforms include monitoring the price to book value, ROE of the companies, and one way to boost it is via share buybacks or dividends,” explains Withaar.

These changes have affected specific sectors, such as the defense and automotive industries.. For example, changes to military procurement laws have created opportunities for companies in the defense sector, while companies like Toyota have benefited from their excellent supply systems during the pandemic. Additionally, cross-shareholding practices in Japan are also being reviewed to reduce inefficiencies and conflicts of interest, which presents additional opportunities for the fund.

China is going in the opposite direction to Japan

Regarding China, Withaar comments that Over the past two decades the country has enjoyed robust economic growth, with GDP growth rates close to double digits. This growth boosted the creation of value in many companies, resulting in a generally high ROE. However, In recent years, the Chinese economy has begun to slow down significantly. Factors such as deflation, the stagnation of the real estate market and the decline in consumption have negatively affected the country’s macroeconomic prospects, ROE going in the opposite direction to that of Japan:

Competition, Differentiation and Risk Management

The bottom Pictet Total Return Lotus It differentiates itself from the competition due to the manager’s extensive experience of more than 20 years and his more conservative approach. for this type of investment strategies. “There are not many competitors that do what we do. Our competitors are within the hedge fund platforms, but they do not offer individual products (UCITS) like ours,” says the expert.

Add that The fund’s goal is to provide an annual return of around 10%. “Although the fund has achieved this objective since its launch, at the end of 2022, (even though the strategy has almost nine years of experience), we are aware of the geopolitical and macroeconomic risks that may affect the market,” concludes Withaar.