Bloomberg — The Asian stock markets are set to fall in a week that includes inflation measures that will help guide bets on the outlook for global interest rates.

The Stock futures in Australia, Japan and Hong Kong point to early losses when the markets open on monday. U.S. stock contracts were steady in early Asian trading after the S&P 500 fell on Friday amid a big options expiry.

The movements occur when the markets are at a critical juncture to position themselves in the second half of 2024, with the outlook for rates of interest of the central banks of New Zealand, Japan and the USA. unclear. Inflation figures from Australia and Tokyo, as well as the Federal Reserve’s preferred gauge of consumer costs, could help, after data showed U.S. services activity rose at the fastest pace in more than two years.

This week, in addition to analyzing inflation data, traders will be attentive to growing political risks. It is planned first US presidential debate between Joe Biden and Donald Trumpas well as the first round of the French legislative elections, which will take place next weekend.

World stock markets set a new record this month and wonder how long the rally can last(MSCI, Bloomberg)

The Traders and strategists are starting to wonder how long the rally can last.while the Fixed-income and currency markets reel on shifting bets on rate cuts of central banks and electoral uncertainty in Europe. A gauge of global equities has risen 2.3% this quarter, marking its third consecutive quarterly rise, while US stocks have hit new highs this month amid the AI frenzy.

At the stock market level, a correction is already beginning to occursince the market breadth is extremely weak and the momentum of a few stocks has practically not diminished, according to Morgan Stanley. However, this could continue into the second half until there is a change in the macroeconomic outlook, such as inflation indicating the need for a rate hike or growth slowing substantially, wrote Michael Wilson, chief income strategist. US variable, in a note to clients on Sunday.

“Until the fixed income market retreats through a higher term premium, or growth slows more significantly, We expect this tight market performance to persist“, wrote.

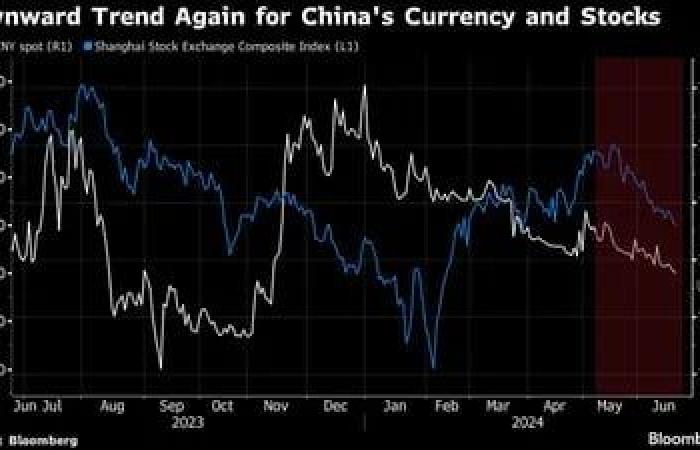

In Asia, investors in Chinese assets sold again last week, as policymakers showed no urgency to deploy more stimulus. He yuan fell to its lowest level in seven monthsand the Shanghai’s benchmark composite index fell below the 3,000 level on Friday for the first time since March.

Meanwhile, China and the European Union have agreed to start talks on the bloc’s plans to impose tariffs on electric vehicles imported from the Asian nation.

Downtrend again for currency and Chinese stocks(Bloomberg)

He S&P 500 fell 0.2% on Fridayexpiring some $5.5 trillion in options during the quarterly event ominously known as the “triple witch.” Nearly 18 billion shares changed hands on US stock exchanges, more than 55% above the three-month average. Nvidia Corp. played an added role, with the value of contracts tied to the chipmaker being the second largest of any underlying asset, behind only the S&P 500.

He greenback remained stable in early Asian trading, while the Japanese yen settled below 160 per dollar, as traders remain wary of officials lifting verbal warnings about the currency’s movement. Retail investors appear to be reloading bets on a yen rally, after its 1.5% drop this month raises the risk of intervention.

The 10-year Treasury yields closed little changed Friday, at 4.26%, after S&P Global’s preliminary June US manufacturing and services sector PMIs beat estimates. The stronger data undid an earlier rally in Treasuries following softer European PMI data. France’s risk premium with respect to Germany closed at its highest level since 2012.

In raw materials, Oil fell 1.8%, below $81 per barrel, amid a stronger dollar and a technical indicator suggesting the recent rally has gone too far. He Gold fell amid a rethinking of the Fed’s rate cut prospects.

Some of the main market movements:

Actions

- S&P 500 futures were little changed at 7:27 a.m. (Tokyo time).

- Hang Seng futures fell 0.3%.

- S&P/ASX 200 futures fell 0.2%.

Foreign exchange

- The Bloomberg dollar spot index was little changed.

- The euro was exchanged at $1.0692.

- The Japanese yen was exchanged at 159.76 per dollar.

- The yuan was exchanged at 7.2906 per dollar.

- The Australian dollar was exchanged at $0.6639.

Cryptocurrencies

- Bitcoin stood at $63,695.25, with little variation.

- Ether fell 0.5% to $3,417.26.

Raw Materials

- West Texas Intermediate crude oil fell 0.2% to $80.60 a barrel.

- Spot gold barely changed.

This article was produced with the help of Bloomberg Automation.

Read more at Bloomberg.com