The June 2024 report from the “My Best Rate” site revealed that last year, “was not a good year for mortgage credit consumers.”

“Both inflation and the rate hike were a bad combination of factors. Although without a clear and absolute trend of permanent rate increases throughout the year, December 2023 closed worse (higher rates) than December 2022. In June 2024 an increase is observed compared to what was registered in March 2024, but the cost rates In the end, they remain lower than those of December 2023,” they add.

The report adds some graphs that show “the evolution of the final cost of credit for the 4 years” that the site tracks.

The report adds that “inflation is added to the increase in the interest rate: two negative effects for people who want to buy a home.”

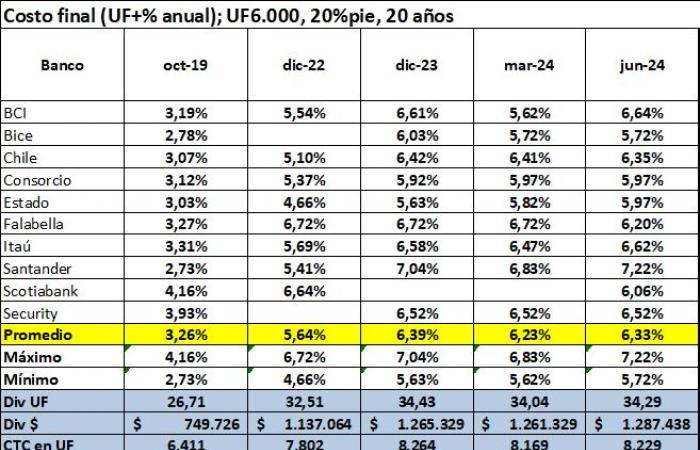

“In the case of a loan of 6,000 UF, 20% foot, 20 years, the final cost for the client reached an average of UF+6.33% annually in June 2024, lower than December 2023 (UF+6.39% annual), but higher than March 2024 (UF+6.23% annual). The average monthly dividend with insurance included is UF 34.29 ($1,287,438). In October 2019, the same was UF 26.71 ($749,726). This means that the monthly insurance dividend included increased $537,712, that is, 71.7% in the period (33.8% is explained by inflation and 37.9% is explained by the increase in the interest rate),” they add. .

“The difference between a person who took out this loan in October 2019 versus another person who took out the same loan today is that the latter, for the same financial product, will end up paying a premium of UF 1,818 ($68.2 million in today’s pesos). ) + the corresponding inflation for the next 20 years. On the other hand, the minimum income requirement to access this credit has also increased: in October 2019, to access this credit a minimum income of $2,998,905 was required; Today, the minimum income is $5,149,754”, they close.