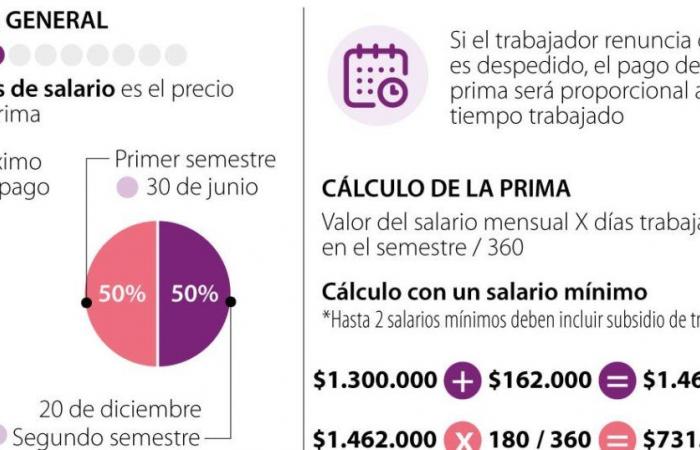

Those who have not received the premium are already counting down how many days are left to see this payment recorded in your payroll account. And it is that, Companies have until June 30 to make this payment..

That leads people to think about what to do with this money. Many think about what the next expense they will make will be, but others, They are analyzing where they can diversify this income through investments..

One of the options they have in the market are ETFs, but Before making an investment decision in these segments, it is better to know in detail what they consist of..

ETFs, also known as Exchange Traded Funds, arewith an exchange-traded fund that is made up of stocks, bonds and commoditieswith the objective of matching the performance of an index to obtain greater liquidity and more predictable returns.

Some market options are the Ibta, which tracks US bonds with a maturity of one to three years; the Cbuo, which also tracks the performance of US bonds; Cema, which follows the behavior of companies from emerging countries in Asia; l Iaup, which follows the behavior of stocks that allow indirect exposure to goldamong others.

Among the advantages, according to Yovanny Conde, co-founder of Finxard, is that people “access a variety of assets with a single investment. This reduces risk and gives access to global markets. Additionally, ETFs have lower fees and are easy to buy or sell on the stock market.“.

In line with this, Juan Pablo Vieira, CEO and founder of JP Tactical Trading commented that ETFs allow you to diversify your portfolio by investing as if it were a stock.

Knowing this, is it advisable or not to invest the premium there? Conde explained that Deciding whether to invest the premium there is relative; However, he stressed that he is not in favor of investing blindly.

“Timing of investment is key as it affects the future performance of my portfolio. It would be advisable to allocate a percentage of the premium to invest at the right time or divide it into parts to invest monthly if I am not sure when the best time is“, Conde said.

For his part, Omar Suarezequity strategy manager at Casa de Bolsasaid Investing in ETFs depends on each person, their risk profile, their investment objective, the amount, and the investment terms..

Thus, If you would like to invest your mid-year bonus in this alternativemust be a person with a moderate or aggressive profilenot with a conservative profile, since it is a higher risk investment.