The main banking entities in Colombia expect that the Bank of the Republic will make a new decision this Friday interest rate cut to an average of 11.25%.

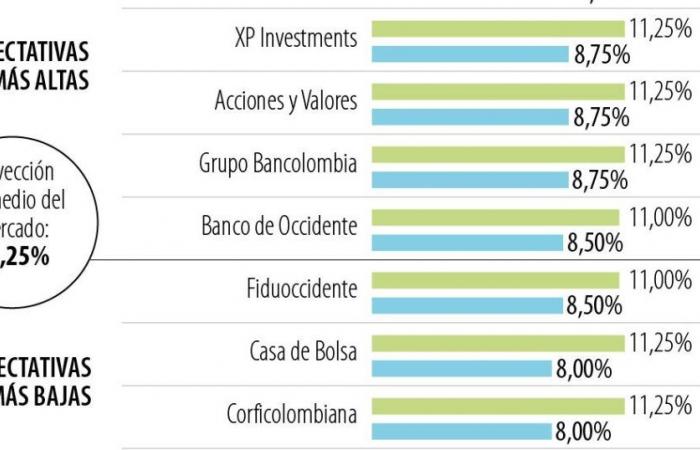

Some of the firms that point to the highest expectations are: Agrarian Bank, Axa Colpatria, XP Investment, Shares and Securities, Bancolombia Group and Banco de Occidenteaccording to the most recent Citibank expectations survey.

The figures provided by the previous organizations As for the expectation, they range between 8.50% and 9.25% by the end of 2024.

On the other hand, Organizations with the lowest projected rates, As for the closing of 2024, they are Fiduoccidente, Casa de Bolsa, Corficolombiana and Positiva, which indicate figures from 8.25% to 8.50%.

“What could happen at the meeting of the Bank of the Republic is that they will maintain or reduce the intervention rate slightly. The reasons for this are that inflation has stagnated, which gives signs that it is not being reduced at the speed that the issuer desires,” said Adrián Garlati, director of the Economics program at the Universidad Javeriana.

Additionally, the analyst said that “the Economic Monitoring Indicator for April came out well; then we could continue to maintain high rates and thus reduce inflation”.

And he pointed out that the peso is devaluing due to the possible maintenance or increase of rates by the US Federal Reserve.

“I don’t think the Bank is going to reduce rates, because if it does, It would mean more dollar outflows and more devaluation, and that has an impact on inflation.“said the expert.

On the other hand, Diego Gomez, local economy analyst at Corficolombianaassured that the entity’s expectation points to a 50 basis point cut in the interest rate. “In addition, we ratify our 2024 closing rate projection at 8%“, Gomez said.

“The disinflationary process and the positive surprises in GDP growth from the Economic Monitoring Indicator and the labor market in April, suggest that the economy has already begun to recover, although slowly”, he noted.

What does Anif say?

A survey by Anif mentions that there is consensus among the analysts to extend the relaxation of the monetary policy of the Bank of the Republic.

The study center states that “The surveyed entities are expecting an interest rate between 8% and 9% for the end of 2024”. Also, they affirm that inflation will continue to decline and that in 2024 “There is still room to continue the decreases in the interest rate, which could give a boost to the economy.”