- DOT is up almost 12% in the last 7 days

- Sustained developments and integrations of RWA have also changed the market sentiment.

While most altcoins have seen major bouts of depreciation lately, according to crypto analyst Michael Van De Poppe, a sizeable rally is taking shape on the DOT charts. In fact, DOT rose by 11.88% over the past week, leaving analysts optimistic about Polkadot’s future.

For his part, De Poppe is quite confident in the long-term trend of the altcoin. The analyst stated:

$DOT is likely to follow Ethereum in its upward expansion. This means that Polkadot’s current valuations are extremely low. With all the new segments, I expect a lot from the Polkadot ecosystem.”

RWAs boost DOT market sentiment

One of the most notable factors driving DOT’s recent resilience is its adoption and integration of real-world assets. In fact, according to Esra Bulut’s,

After posting on X, RWAs are now the focus of the current bullish outlook. She shared,

“Real-world assets (RWA) are gaining momentum in the crypto space, and @Polkadot $DOT is at the forefront of this trend with its innovative development. “The integration of the RWA industry by the Polkadot team is a game-changer and paves the way for a long-term bullish outlook.”

The integration is driving a positive market outlook for several reasons.

For starters, RWAs are growing and have significant market potential. According to estimates, RWAs will grow to reach between $4 trillion and $16 trillion by 2030. Therefore, DOT has huge potential in RWAs due to its scalability and security.

As RWAs in traditional markets look for reliable, secure, scalable, and affordable chains, Polkadot may be well positioned to thrive.

Is DOT Poised for an Uptrend?

In the last 7 days, the altcoin rose significantly on the price charts. The same was also evidenced by AMBCrypto’s own analysis, which revealed how the market trend changed from bearish to bullish due to a sudden price surge and an increase in buying pressure.

Source: Tradingview

AMBCrypto analysis also revealed that DOT had a negative MACD and signal line, while there was a positive histogram.

The positive histogram, while the MACD is above the signal line, usually indicates the trend reversal and the start of the uptrend. Simply put, the downtrend appeared to weaken and the market was in the early stages of a bullish reversal.

Source: Tradingview

Also, the RSI 51, which was slightly above neutral, underlined the beginning of an uptrend. The RSI rose from 39 over the past 3 days to 51, indicating a sustained weakening of the bearish momentum.

Source: Tradingview

Finally, the DMI indicated a bullish divergence, with the positive directional indicator moving from a low of 12.4 to a high of 21.

In fact, the negative directional indicator fell from a high of 33 to a low of 26 in 7 days. What this means is that the bearish momentum has been weak and the bulls may be pushing the market in their favor.

Source: Santiment

It is also worth looking at other metrics here. Over the past seven days, for example, development activity increased from 2.2 to 2.9. The increase in projects on tokenized RWA can be interpreted as a sign of consistently attractive development on Polkadot.

for investors and traders.

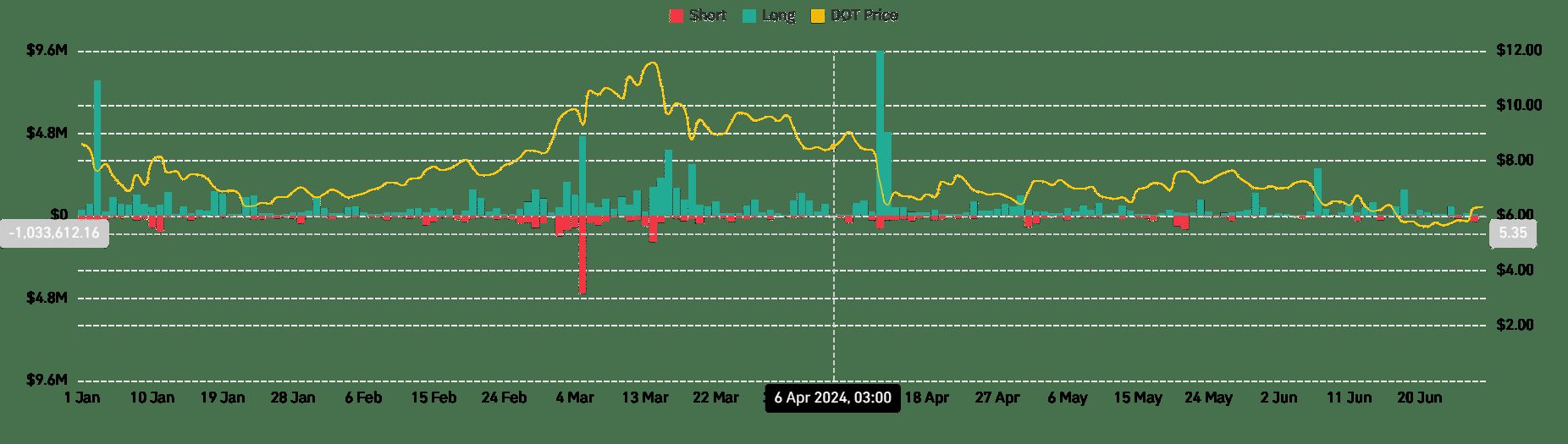

Source: Coinglass

Finally, Coinglass highlighted the decrease in liquidations for both long and short positions. Low liquidations indicate market stability, and investors hold their assets to sell in the future.

There is little profit taking or sell-off, resulting in stability or confidence in the prevailing trend.

Next: Bitcoin: Trading Interest Is on the Rise, Will BTC Price Follow Suit Soon?

This is an automatic translation of our English version.