Key facts:

-

In every mistake, there can be a lesson to learn.

-

It is essential that every investor does their own research before making any decisions.

Robert Kiyosaki, popular writer specializing in personal finance and author of best seller ‘Rich dad, poor dad’, was convinced that bitcoin (BTC) would touch $100,000 in June of this year.

As CriptoNoticias reported at the time, Kiyosaki made that prediction in February 2024 through his account on the social network X:

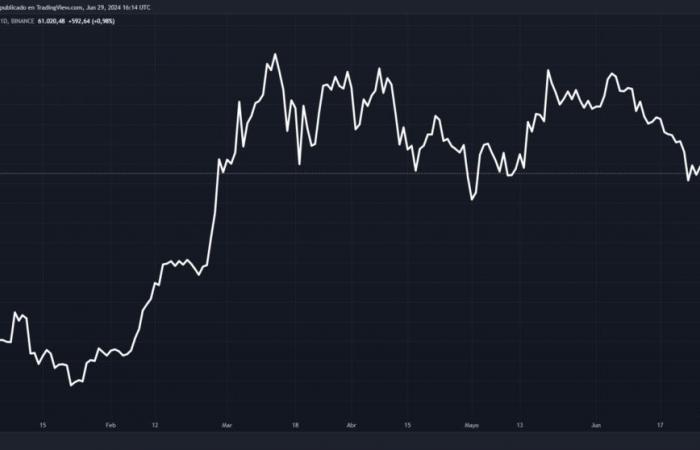

With just a few hours left until June comes to an end, it can already be said that bitcoin is far from the $100,000 predicted by the influencer and that the prediction has not been accurate.

At the time of writing, as seen in the TradingView chart below, BTC is trading for around $61,000 on major exchanges.

Regardless, anyone who bought BTC in February has done well with their investment (albeit not to the extent Kiyosaki predicted). By the day the writer posted his tweet, bitcoin was trading at around $52,000, meaning that is currently in profit.

In every mistake, there is a lesson

The writer John Maxwell argues that In every mistake there can be a lesson to learn. This is what he says in one of his books:

«Successful people approach failures in a different way [a los no exitosos]They don’t try to sweep failure under the rug; they don’t run away from their failures. Their attitude is never, ‘Sometimes you win, sometimes you lose.’ Instead, they think, ‘Sometimes you win, sometimes you learn.’ They understand that the greatest lessons in life are learned from our mistakes, if we approach them in the right way.

John C. Maxwell, ‘Sometimes you win, sometimes you learn’, Casa Creación, 2013, p.2

A possible lesson from Kiyosaki’s mistake is the importance of analyze all the factors that can influence the price of bitcoin and do not think that with a few indications you can make an accurate projection. This analysis must be exhaustive, considering both factors intrinsic to bitcoin itself and seasonal and market issues in general.

For example, it is almost a rule that the price of bitcoin (as well as that of many other financial assets) tends to perform not very well during the northern hemisphere summer. This seasonal trend could be related to lower activity in financial markets due to holidays and lower liquidity, which can make prices more volatile. Likewise, this “rule” has had exceptions, so it would not be wise to operate in the market based on that idea alone.

Furthermore, the Regulatory changes, market sentiment, technological innovations and the movements of large investors can also have a significant impact on the price of the digital currency..

Another valuable lesson for investors is the need to Don’t blindly follow a guru. Although Robert Kiyosaki is renowned in the field of personal finance, this does not mean that his predictions are infallible.

It is essential that investors consider all available opinions when analyzing a financial asset. Evaluate and compare bullish, neutral and bearish projections can provide a more balanced and realistic view of the potential return on an investment.

You should not put all your trust in a single source, no matter how respected it may be.Instead, it is advisable to seek a variety of perspectives and analysis to form an informed opinion.

Finally, when investing, it is very important to do your own research. You should not put money into a financial asset expecting certain results just because someone “predicted” it.

Independent research allows investors to better understand the associated risks and opportunities. Through this research, they can develop an investment strategy based on your own analysis and risk toleranceNo one can predict the price of bitcoin with certainty, and basing financial decisions solely on predictions can lead to disappointment and losses.

As an additional suggestion, a traditional rule of finance may be mentioned: Do not invest more money than you are willing to lose.. This takes on special importance if it is understood—as has been made explicit here—that all financial analysis can fail.

Recommended readings

For those interested in learning how to do their own research before investing in bitcoin or any financial asset, the following Cryptopedia articles will be useful: