- Despite Fundamental Differences, Bitcoin and Dogecoin Share a Strong Correlation

- Short-term trajectory pointed to rising DOGE price and falling BTC

Not many cryptocurrencies have survived a decade of existence. And still, bitcoin [BTC] and Dogecoin [DOGE] They have been on the market for more than 10 years, despite this, not many know the difference between the two.

In this article, AMBCrypto will take a deep dive into the similarities and differences between Bitcoin and Dogecoin. You will also learn about their respective price actions and on-chain conditions.

Bitcoin vs Dogecoin: Who takes the crown?

Bitcoin and Dogecoin have a few things in common. The most notable is that they both use the Proof-of-Work (PoW) consensus mechanism.

This similarity is why blockchains are among the top projects that still stick to mining, rather than adopting the use of validators. However, the main difference between them is their offering.

While Dogecoin’s supply is unlimited, Bitcoin’s maximum supply is 21 million coins, making it a more scarce cryptocurrency asset than DOGE. At the time of this publication, DOGE was changing hands at $0.12.

This represented a 38.19% increase on a year-over-year (YTD) basis. As for Bitcoin, its value was $61,579, representing a 39.42% increase over the same period.

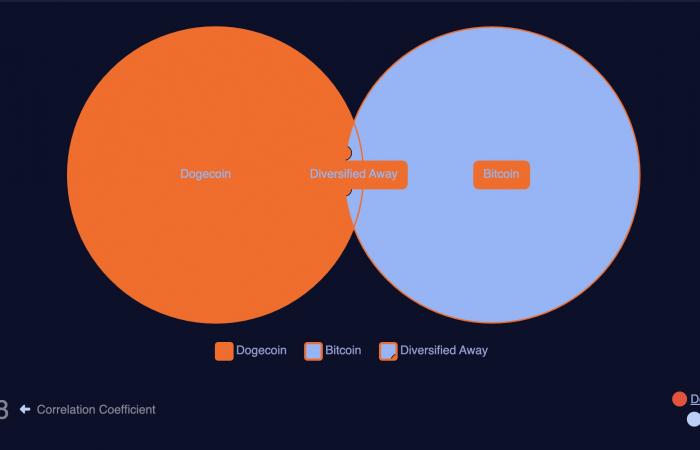

When we evaluated the prices of both cryptocurrencies, we noticed that there was a strong correlation. For example, according to Macroaxis, the correlation between Bitcoin and Dogecoin stood at 0.98.

Source: Macroaxis

Correlation coefficient values range from -1 to +1. When the reading is close to -1, it means that prices diverge and rarely move together.

However, a coefficient close to +1 implies the opposite. Therefore, the correlation between BTC and DOGE showed that if you invested some money in both coins from the beginning of the year, you would get almost the same returns.

However, Bitcoin’s returns would be slightly higher. So, the question is: will prices continue to move in the same direction? Let’s see.

DOGE takes the lead this time

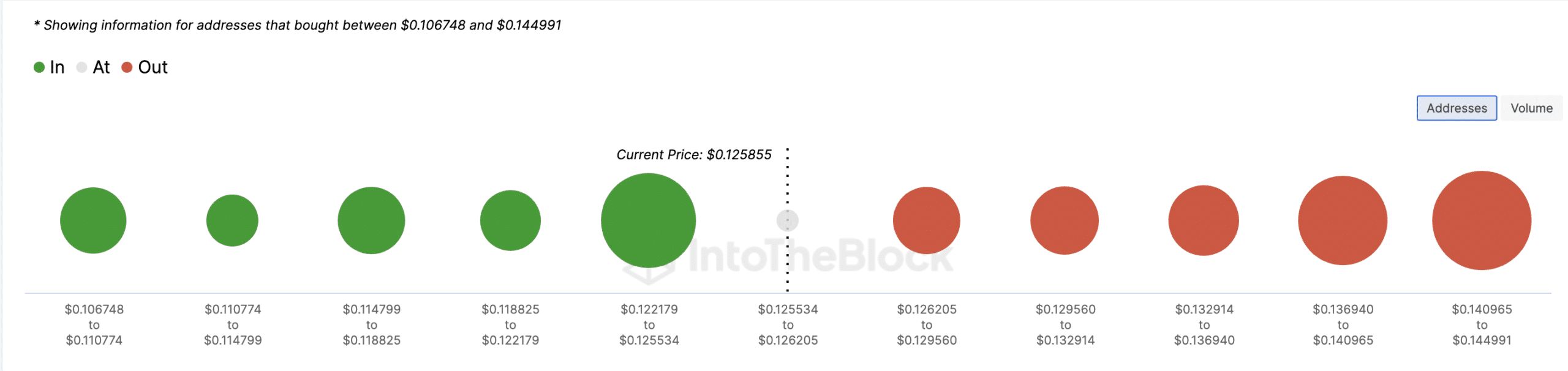

To determine this possibility, AMBCrypto analyzed the money in and money out price (IOMAP). This indicator, provided by IntoTheBlock, detects support and resistance levels.

To do this, it groups addresses that bought in a certain price range. Some of which will generate profits and others losses. Typically, the larger the group of directions, the stronger the support or resistance it provides.

At press time, AMBCrypto discovered that a sell wall appeared at $62,134. At this point, 1.64 million addresses purchased 759,670 BTC. At the other extreme, 755,240 addresses purchased 445,280 BTC at around $60,793.

Source: IntoTheBlock

Considering the difference, Bitcoin is likely to face another drop. If this is the case, the coin is at risk of falling below $60,000. As such, it may not be the best time to buy BTC.

For Dogecoin, it was a completely different scenario situation. Unlike Bitcoin, DOGE had its support at $0.12. This is because 86,480 addresses purchased 6.87 billion DOGE at that price.

These are more than 33,520 addresses that purchased 717.77 million coins at a higher value. Thanks to this condition, DOGE could trade at a higher value in the short term.

Source: IntoTheBlock

Whether realistic or not, here is DOGE’s market cap in terms of BTC

Furthermore, the possible target for Dogecoin is between $0.13 and $0.15. Simply put, memecoin could offer better performance than Bitcoin in the short term.

Next: AVAX and Aptos: Will ETF-mania affect these coins soon?

This is an automatic translation of our English version.