By Patricio Ballesteros Ledesma

In the last survey of the Argentine Chamber of Medium Enterpriseswhich includes 300 cases from all over the country, the companies surveyed valued the greater stability in the price of inputs last May, but showed their concern about the amounts that are being paid for energy consumption and transportation, in a context of such low demand.

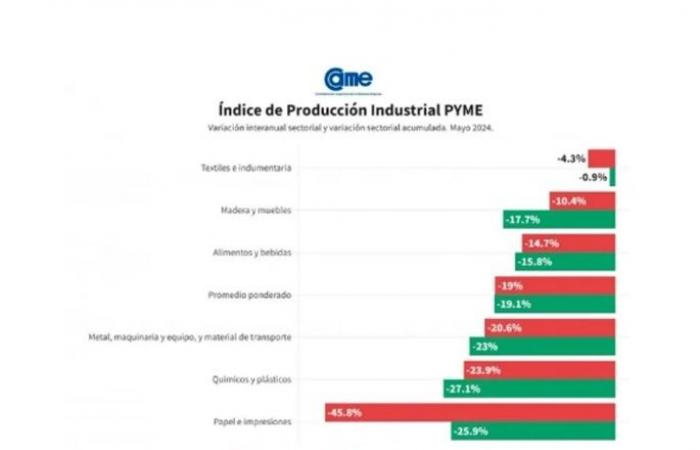

And according to published data, the activity index of manufacturing SMEs fell 19% year-on-year last month (81.3 vs 100.3) and accumulates a decline of 19.1% in the first five months of the year compared to the same period. of 2023. It is worth remembering that in January alone the year-on-year drop reached 30% (71.3 vs 101.9).

The six manufacturing sectors of the SME segment had sharp falls in the interannual monthly comparison, with the most affected being Paper and Printing (-45.8%) and Chemicals and plastics (-23.9%), while Textile and clothing, which was being almost the only branch that increased until Aprilfell 4.3% annually in Mayaccording to CAME.

These results show a weakening of demand and a deterioration in the financial situation of the firms, and despite the fact that some businessmen maintain that they are having a bad time and think that the constant tariff update will not give them relief, on the side of the domestic market expect another slight hopeful rebound.

In fact, In the seasonally adjusted monthly comparison, activity grew by 5.3% between April and May. In addition, a tiny increase of 0.2% was seen in the use of installed capacity compared to the previous month, which also remains at low values, with an average in all sectors of 70.3%.

In this context, 34.4% of the companies surveyed were reducing operating expenses, while another group, represented by 19.9% of the survey, reduced working hours to make up for the lack of sales.

Already at the beginning of the month, a survey by the Observatory of Argentine SME Industrialists among its partners showed that 7 out of 10 companies were facing problems due to the repeated drop in consumption in the domestic market, and one in three does not rule out reducing their workforce. staff.

That survey indicated that almost 80% of industrialists throughout the country were pessimistic about the future of their businesses during the next twelve months. The survey, which was carried out during the second half of May, revealed that 31.3% of the SMEs consulted went through a very bad situation during the first 5 months of the year, while 38.2% described it as bad and a 26.3% considered this stage good. But only 4.1% rated it as very good.

In this scenario, the president of IPA Daniel Rosato declared: “We have been warning that, without an industrial plan, there is no possibility of sustaining jobs. But what is worrying is the beginning of plans to close factories, faced with a future that is no longer uncertain, but with continuity of the crisis. At this point, and without valid interlocutors in the Government, we fear that the plan, in reality, is a new industrialicide, but faster and more damaging, that will leave Argentina on the verge of the primarization of its economy.”

The most important measures that SME industries expect is the reduction of taxes, which represents 33.9% of the responses, followed by the stimulus to domestic demand with 14.7% and almost at the same time the adequacy of labor relations, which occupies third place with 14.2%.

On the other hand, the two factors that stand out as the most considerable obstacles to the growth and stability of SMEs are the lack of sales, representing 45.1% of the responses, and the high production and logistics costs, which constitute 32.8%.

Like most productive sectors and society in general, the situation is one of endurance in the face of a Government that caused an unprecedented devaluation at the beginning of its administration and continues with a strategy of income liquefaction and economic depression, but the prospects for the future They are of uncertainty, deepening of the productive crisis and worse in general at the internal level.

55.3% of those surveyed by IPA predicted a worse scenario for the sector’s activity, while 23.5% predicted the continuity of the crisis it is currently experiencing as they did not expect relevant changes. Only 21.2% consider that production conditions will be better in the coming months.

For Rosato, the crisis will deepen to the extent that the import of finished products replaces national production and sets an example. “There are companies that are practically without production, that were previously operating at 20% or 30% of their installed capacity and are now at 10%, such as gas meter manufacturers that already compete with the first containers that arrived from China, that come without any type of technical control.”

As in the CAME survey, IPA associates surveyed indicate that 35% of SMEs could lay off staff, although 55% said that they are going to keep their staff, which they also formed and consider part of the industrial family, and only 10% think about incorporating employees in the next three months.

In the first quarter of the year, 11,000 jobs were lost in SMEs in the sector and now there are more than 60,000, reported from IPA, but in a recessionary context and with the opening of imports, the sector’s leaders warn that there may be more closures of factories across the country and a cut of 300,000 industrial jobs until the end of the year.