IMF TABLE.jpg

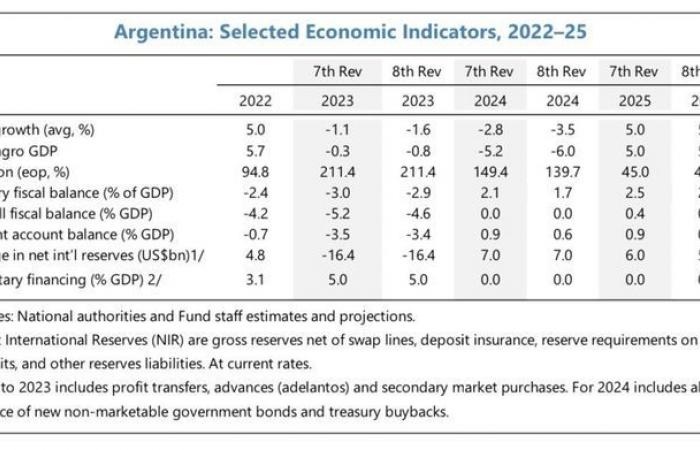

The IMF estimates a drop in GDP for this year, but foresees a rebound for 2025.

Inflation and activity

Due to a sharp drop in activity in recent months, the Fund worsened its GDP forecast, which would reduce 3.5% this year (in the previous forecast it was -2.75%).

However, “A turnaround in activity is expected during the second half of this year, as the obstacles of fiscal consolidation are eased, real wages begin to recover and investment gradually recovers.””.

In addition, Monthly inflation is expected to fall further, converging to around 4% by the end of 2024 (140% YoY vs. 150% previously), and declining further in the medium term, as demand for pesos recovers from current historically low levels.

Meanwhile, it is expected that reserves remain unchanged, as less favorable terms of trade are largely offset by higher net capital inflows. In this regard, it specifies that after having received negative net reserves of US$11.2 billion on December 7, 2023, the situation was reversed and The latest data shows that they are positive, although only at US$300 million.

Sustained fiscal and external surpluses in the medium term – supported by strict policies, productivity increases and structural improvements in the energy balance – will strengthen reserves and ensure prospects for access to international markets.

Fiscal policy

The IMF highlights that “The authorities are fully committed to achieving a primary surplus of 1.7% of GDP this year, in line with the general balance.”

The Fund’s assessment is that “around two-thirds of the planned adjustment (around 5 pts. of GDP) had been achieved by the end of April.” And, he maintains that it was obtained “mainly through temporary higher import-related taxes, lower subsidies and discretionary spending cuts.”

Base Law

The document says that Congress is expected to approve the Executive’s fiscal package including the modification of the income tax, the tax amnesty, an improvement in taxes on personal property and the application of special taxes on tobacco).

As the Government plans to balance public accounts, the IMF considers that to meet this objective, reforms must be carried out in “ tax, pension and income sharing (co-participation) systems, including to eliminate distortive taxes.”

Coin Competition

At the level of monetary and exchange policies, the aim is to “support disinflation and safeguard the accumulation of reserves.”

To support the transition to a new monetary regime (“currency competition”), The Central Bank will ensure that monetary policy rates move into positive territory in real terms. In this sense, the Minister of Economy, Luis Caputo, He declared days ago that “the negative interest rate is over.”

Regarding the exchange rate policy and in line with what was proposed by the Argentine authorities, he points out that “will become more flexible by relaxing capital flow measures (CFM) as conditions permit.” In this way, the IMF agrees with what was indicated by the Treasury Palace in the sense that “will try to lift the stocks as quickly as possible, but without taking risks that endanger the stabilization scheme.”

For this reason, the document states that “The authorities remain committed to the prompt elimination of capital controls and the most distorting exchange restrictions.”

He also states that “further rationalization of banking regulations is necessary to strengthen monetary transmission and continue unlocking private credit.”

Mismatches

Economic driving will continue to correct relative price imbalances (i.e., for example, continue to increase public tariffs) and create a more market-oriented economy.

It is insisted that the approval “of the historic legislative reform (Bases Law) will support the recovery and boost productivity”

According to the organization, this will be possible through:

- Greater labor market flexibility

- Improvements in the legal framework and appropriately designed incentives for large long-term investments in hydrocarbons and other strategic sectors (RIGI)

- Reduction of state participation in the economy

- Elimination of barriers to entry and policies to safeguard competition

Public debt

The agency’s technicians point out that the authorities’ strategy consists of continuing to “focus on reducing refinancing risks, while gradually reducing vulnerabilities by extending maturities, avoiding securities linked to the exchange rate and inflation, and moving from overnight securities from the BCRA to Treasury bonds.”

Regarding external credit, it indicates that “firm financial guarantees have been sought from multilateral and regional development banks.”

cool backgrounds

From this point of view, official sources told Ámbito that the World Bank could grant “important loans” based on a new program with the IMF. In this sense, conversations with the economic team have already begun to define a new agreement. Likewise, it was one of the topics that the president, Javier Milei, discussed this weekend with the head of the IMF, Kristalina Georgieva.

The Fund shows its reluctance to grant more funds to Argentina by indicating that the risks due to its credit exposure with Argentina “they remain significant” although they have moderated.

From now on, they consider that “Continued efforts to address imbalances and sustain twin surpluses will be critical to ensuring Argentina’s return to external markets in a time frame compatible with debt refinancing needs.”

The risks perceived by the IMF

The staff evaluates that “risks remain high, although they have become more balanced following bold measures to restore stability” arranged by the Government.

However, they warn that “External conditions could become less favorable and the current recession could be prolonged, fueling social tensions and complicating the implementation of the program.”

Among the risks, he points out that the “greater delays in the approval by Congress of the fiscal packages and the Base Law.” The eventual delay “could hamper stabilization efforts” which would lead the government to “take strong compensatory measures, as necessary, to ensure all program objectives.”

In this regard, both the Minister of Economy and the Chief of Staff, Guillermo Francos They warned that if the initiatives were not approved, it would be necessary to apply a “major adjustment in public accounts.”

As it had already been pointing out in previous reports, the Fund points out that it is necessary “ensure adequate burden sharing and generate consensus for reform, given the fragile social and political landscape.”