Since in September 2024 it was decided that Automotive records They no longer have the obligation to collect stammed tax or demand the report of debt -free free and patents when registering a new car or carrying out the transfer of one used, the automotive sector became part of a general debate proposed by the national government regarding the responsibility and incidence of Tax policies of the provinces in the “Argentine cost of living.”

On the way to continue with the Tax reduction that has begun and that the automotive industry I had been asking since the first meeting with the economic team led by Luis Toto Caputoat the end of last year, it also began to speak of the need for a similar policy of all jurisdictions, because taxes such as municipal rates or gross income Not only do they impact the cost of cars, but the entire production chain that includes the suppliers of the automotive.

The cost of patent or automotive taxas it should be defined correctly, it is one of those taxes that is also under observation, but on which the national government cannot intervene by the Autonomy of the provinces guaranteed in the National Constitution.

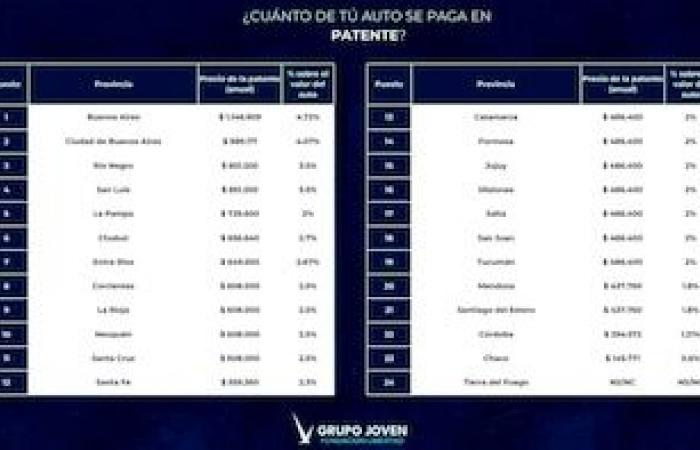

A report made by the Young Group of the Libertad Foundation details the automotive tax rate that each jurisdiction charges in Argentina today. To do so easier to understand, it was decided to take the price of a peugeot 208the best -selling car in the local market in 2024 and the one that also leads sales after the first four -month period of 2025.

Ordered from highest to lowest, and Taking a price of $ 24,300,000 For the most accessible model of the Stellantis group brand, the district that charges a higher aliquot is the province of Buenos Aires, which applies 4.72% on the value of the car, which implies an annual amount of $ 1,146,909 in patent. The second jurisdiction that the highest percentage of the car price applies for the automotive tax is the Autonomous City of Buenos Airesthat charges a 4,07%. In this case, a Peugeot 208 of the pay access range $989.717 per year.

Inside, the provinces of Río Negro and San Luis They are the ones with the largest patent aliquot. In this case, the 3,5%which is equivalent to charging $ 851,200 per year. The 5 jurisdictions that are most charged for automotive tax are completed with La Pampawhich receives 3%, which in the case of Peugeot 208 implies an annual cost of $ 729,600.

At the other extreme, the provinces that apply a lower percentage are Chacothe lowest in the country, where the 0.6% that represents $ 145,771 per year is charged, Córdobawhich charges an aliquot of 1.21% patent, $ 294,572 per year; and Mendoza and Santiago del Esterowhich apply 1.8%, so that the annual patent cost is $ 437,760.

Distortion is notorious. The same car as in Chaco pays $ 145,771 per year as a patent, in the province of Buenos Aires Paga $ 191,151 per quarter. However, it is more curious to compare with the contiguous provinces, because in Corrientes the same car pays $ 608,000 per year, in Santa Fe $ 559,300, in Santiago del Estero $ 437,760 and in Salta $ 486,400.

The same report emphasizes that a car of that same cost pays in the Florida state, in the United States, just USD 35.60 per yearand establishes the comparison with the lowest and highest province in Argentina in dollars, noting that in Chaco USD 121 is paid per year, while in the province of Buenos Aires The equivalent automotive tax is 960 dollars.