For more than a century, International trade was one of the motor forces of global economic development, but Argentina had an intermittent insertion in that process.

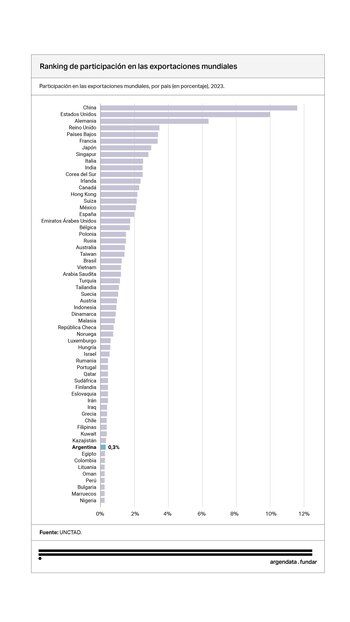

Although it is still one of the main world food suppliers, its participation in global exports is today marginal: it represents only 0.3% of the world total. In comparison, its weight in the global GDP is more than double (0.7%), which reflects a disconnection between the size of the economy and its ability to integrate in a sustained way into international markets.

Can you do it in the coming years? The current competitiveness challenges are important, not only due to problems of the domestic economy (whose dollar costs were greatly more expensive, the government did not yet advance with structural reforms and the weight can be seen every day more), but also because of the global context. What are then the perspectives for this 2025, which did not start a thriving in terms of exports, and the years that come?

According to a founding report, in 2024 Argentine exports reached USD 96,899 million, of which 82% corresponded to goods, strongly concentrated in the agroindustrial complex, and the remaining 17.7% were services, especially those based on knowledge and tourism. Primary products – as soy, corn and wheat – and manufactures of agricultural origin -ceites, pellets, meats- make up approximately half of the total exported.

82% of exports corresponded to goods, strongly concentrated in the agro -industrial complex, and the remaining 17.7% were services (founding)

The growth of Argentine exports has been very unequal in recent decades. While between 1880 and 1915 the country managed to insert itself strongly in world trade, reaching a 4% participation in global shipments, that trend was reversed from the second half of the twentieth century.

Since 1975, Argentine participation in global trade is around 0.3%, with marked stagnations. In particular, since 2007, exported volumes barely vary, both in goods and services.

At the regional level, the setback is also evident. In 1948, Argentina was the most exporting economy in Latin America; Today it occupies the fourth place behind Mexico, Brazil and Chile. These countries, unlike Argentina, managed to insert themselves better in global value chains through commercial treaties and effective regional integration.

One of the main challenges facing the country is the concentration of the export pattern. Most sales to the rest of the world continue to depend on a limited group of traditional sectors.

“It is very difficult for us to be an important exporting country if only 15 companies sell more than USD 1,000 million per year, and barely 60 exceed USD 100 million,” he warned Infobae Marcelo ElizondoSpecialist in International Trade. For him, the key is to strengthen the internal front: generate macroeconomic conditions that allow companies to climb, gain productivity and invest in technology.

The low current competitiveness is a clear limiting, but Elizondo is confident that once the economy is stabilized, the stage of the structural reforms that will allow the Government that will allow the government to lower taxes and other costs that will compensate that they do not earn by the exchange road will come. Stabilization plans usually lead to exchange rate appreciations and that is not good for competitiveness, “but after stabilizing and with the economy growing, if the Government can advance in lowering retentions or taking out the check tax, for example, that will improve,” he said.

It is very difficult for us to be an important exporting country if only 15 companies sell more than USD 1,000 million per year, and barely 60 exceed USD 100 million (Elizondo)

-

Industrialists have been claiming “leveling the court” for several months, even more in a context in which they are not only difficult to compete with the world to export but also in the domestic market, in the face of the competition of imported products. Days ago the government gestured to the industrial sector through the decrease to 0% of the export rights of more than 4000 tariff positions of manufactures of industrial origin (MOI), and in the UIA They applauded the measure, but they propose that it is just a small sign on the path of competitiveness, according to its brand new president, Martín Rappallini.

The consultant economists Fell Experts in foreign trade, Marcela Cristini y Guillermo Bermúdezhighlighted in a recent report that, despite the opportunities it has, Argentina faces a “productive-competitive paradox.” They emphasize that while the country has the capacity to produce at competitive prices at origin, internal logistics costs, poor infrastructure and macro volatility prevent this offer from reaching favorable conditions to global markets. The low public investment in connectivity and transport – 16% of GDP in the last decade, below the regional average – has been a structural brake for export development.

Also, Argentina presents one of the lowest opening coefficients in the world: only 12% of GDP comes from exports and imports, compared to a world average of more than 30%. This reflects not only internal barriers, but also a historically closed commercial policy, aggravated by the low participation in international free trade agreements.

On the conjunctural plane, the government of Javier Milei It has advanced in an economic stabilization program focused on fiscal equilibrium, inflation and deregulation reduction. One of the most significant steps was the partial elimination of the exchange rate in April, which now allows greater freedom for access market by changes by companies and people.

However, the impact of this opening is still considered limited. In the first quarter of 2025, exports grew only 5.3%, while imports increased 35%, reducing the commercial surplus to USD 761 million. Part of this deterioration was compensated by the improvement of the terms of the exchange, since import prices fell more than those of export.

In the first quarter of 2025, exports grew only 5.3%, while imports increased 35%, reducing the commercial surplus to USD 761 million

The faithful report also emphasizes that Argentina is still one of the 10 main food exporters in the world, but has failed to diversify its export basket or take advantage of favorable price cycles to boost investments.

The global scenario adds uncertainty. The intensification of the commercial war between the United States and China, combined with the fall in agroindustrial, mineral and energy commodities prices – around 5% on average – further complicates the perspectives.

In this environment, advancing an international insertion strategy becomes key, says the report. Fiel highlights the need to activate mechanisms such as Mercosur, close agreements with the European Union, EFTA and United Arab Emirates, and explore new markets in dynamic regions such as India, Vietnam or Africa.

The last meeting of Mercosur Foreign Affairs in May was a step in that regard. It coincides with this point Elizondo, who insisted on resuming the agreement with the EU and advancing with the United States, if that is the goal. “Today it is very difficult to export if you do not belong to the large international impact agreements,” said the analyst.

Argentina faces a double challenge: to leave the chronic export stagnation and take advantage of the opportunities offered by the world, even in a context of geopolitical tensions. Macroeconomic stabilization is a necessary, but not sufficient condition.

Without reforms that improve competitiveness, reduce logistics costs, modernize infrastructure and diversify markets and products, the country will continue to export below its potential.