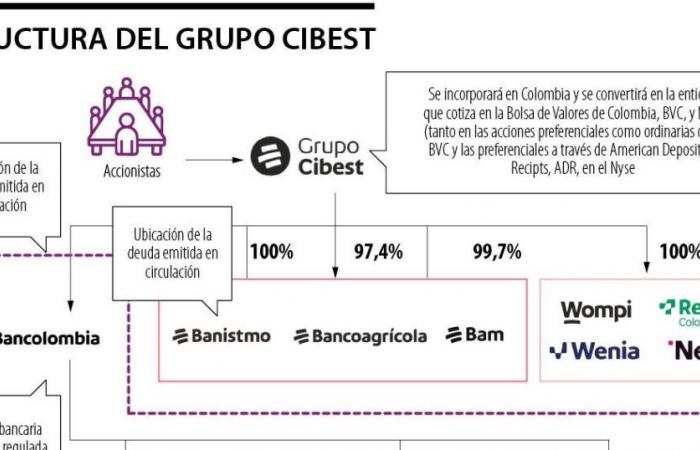

The local and Central America financial system received one of the most important news in the sector, since The Bancolombia shareholders, the largest bank in Colombia, gathered in the extraordinary assembly, approved the necessary operations for Grupo Cibst to be the matrix of all businesses, financial and complementary to the Bancolombia group business.

This approval, according to the entity, It seeks to separate the two roles that Bancolombia has, one as a bank, and on the other as the matrix of the Bancolombia group, which is the current owner of banking entities in Central America and other companies, such as Wompi, Renting, Wenia and Nequi, among others.

With this Cibest Group becomes the matrix or holding of all businesses, financial and complementary to the financial business, that make up the group, and that Bancolombia continues to develop its activities as a bank in Colombia.

Juan Carlos Mora, president of Bancolombia, said about the news that “Continuing this story requires focusing on listening carefully to all interest groups, holding high standards of corporate governance, developing new capacities and having the ability to reinvent ourselves with clarity and firmness in the future with sustainable growth.”

The benefits of this corporate evolution will allow to have an “optimal” structure that will result in a series of short and long term improvements for all interest groups, As it is to operate under this new structure, it will allow capital to be assigned in a “more efficient” way.

It will also allow strengthening the value proposition, promoted by the growth of business complementary to the financial business, by separating them from Bancolombia.

Finally, this structure will be in line with the way other regional and global entities that already have their financial groups under holding companies are organized, which makes “easier and more” the implementation of the organization’s strategy.

-The entity emphasized that Bancolombia and its subsidiaries already have the authorization of regulators in the countries where the group operatesas well as with the approval of the main market holders.

In the coming weeks the operations will be carried out for Bancolombia to transfer part of its assets and assets, Like banks in Central America, Nequi, Wenia, Renting Colombia, Wompi, among other companies, to Cibst Group.

This will be done with the registration of public deed, and with it, Bancolombia’s shareholders They will receive an action, ordinary or preferential, from Grupo Cibest for each action (ordinary or preferential) that have Bancolombia, under the same conditions that currently have them and will be listed in the stock exchanges of Colombia and New York.

This process is expected to culminate before Finish the first semester of this year.

Other decisions of the Assembly

Bancolombia will distribute an extraordinary dividend of $ 624 per sharein a single fee payable on April 29, for which it will allocate $ 610,180 million. The expenditty period will be from April 24 to 29, 2025.

This extraordinary dividend, added to the ordinary one that was approved on March 14, $ 3,900 per share, reflects a growth of 28% compared to the dividend of the previous yearand represents a distribution of 69% of the utilities of the period.

A new board of directors for Bancolombia was also chosen with 40% participation of women that is made up of: Ricardo Jaramillo Mejía, heritage member; Juan Esteban Toro Valencia, patrimonial member; María Angélica Arbeláez Restrepo, independent member; Sandra Marta Guazzotti, independent member and Luis Fernando Restrepo Echavarría, who is an independent member.