In this business, China has become the main vehicle exporter after multiplying its shipments to the world for more than five: From 1.2 million units in 2019 to 6.4 million in 2024.

Faced with diversions in commercial flows in search of new marketsthe recently opened Chancay port It could represent a key opportunity for Peru.

Also read: Byd closes record year and surpasses Tesla in income; China shares are triggered

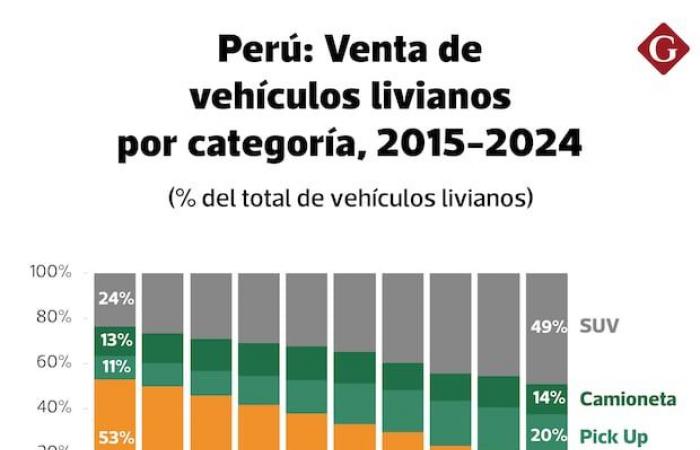

The automotive market in Peru has adjusted in recent years, migrating to larger vehicles. during the last decade, the sale of trucks grew by 59%, while that of cars fell into 69%.

Among the trucks, The greatest demand was concentrated in the SUV segment. Thus, at the end of 2024 one in two new vehicles acquired in Peru is a SUV.

Source: AAP, Preparation: IPE

This change has been possible, to a large extent, given the greatest income to Peru of brands from China, both in light and heavy vehicles.

Thus, between 2019 and 2024, the market share of Chinese origin brands almost doubled after 13% to 25%, located only behind the brands from Japan and Korea, which saw their dominance reduced.

Moreover, if the port of origin was considered (instead of the provenance of the brand), China’s participation would approach 35%.

Source: AAP, Preparation: IPE

Also read: Payment of cash arbitration yield to digital wallets, in what regions?

Despite the greatest competition, the number of new vehicles sold annually during the last decade has remained relatively constant between 160 thousand and 170 thousand units every year.

Thus, with 5 new cars sold per thousand inhabitants in 2024, Peru is well below other countries in the region such as Chile (16), Brazil (12) and Mexico (12), according to the World Bank.

Changing this is key to the age of vehicle park: About 30% and 50% of passenger and cargo transport vehicles, respectively, have an antiquity greater than 10 years.

One of the main factors behind this stagnation is linked to low access to financing. For example, at the end of 2023, according to Pandero, only 31% of light vehicles were purchased through financing.

This contrasts with similar figures in Chile and Mexico, in which this percentage amounted to about 80%, according to BBVA Research. In this sense, the recent implementation of the Movable Guarantee Information System in Peru would facilitate access to vehicular financing.

Also read: Digital wallets overflow credit cards: boom figures

Beyond the international situation, the automotive sector in Peru faces the challenge of continuing to promote the use of less polluting fuels and technologies.

In 2024, more than 6,600 electric vehicles were sold in the country, according to AAP. Although this figure has grown 18 times since 2019, the sale of electric cars barely represents 4% of total sales.

Source: AAP, Preparation: IPE

Also, between 2022 and 2024, more than 118 thousand vehicles to GNV adapted. While this is equivalent to the sum of what has become the previous eight years, it barely represents 3.5% of the National Vehicle Park.

In that sense, one of the main barriers for the adoption of vehicles with low emission is in the infrastructure. For example, according to the AAP, there are only 40 public points of recharge of electric vehicles, and barely eight are fast charging.

Likewise, continuing with the massification of the use of vehicular gas requires ensuring its greater availability outside of Lima; However, more than 85% of the 341 GNV stations are located in the capital.

Taking advantage of opportunities against potential adjustments in international trade flows and making use of new sustainable technologies requires advancing in financial inclusion and infrastructure development.

This should be not only road, in a country where two thirds of road networks are in inappropriate conditions, but also that which facilitates the use of cleaner energy sources.

To do this, more than tax incentives, the implementation of reforms that promote competitiveness, attract private investment and ensure adequate provision of public services is key.