The savers had an April in the best “roller coaster” style, where many of the investments collapsed after the different International news and threw as balance a month of losses for most options. And the end of the exchange rate for individuals also modified the scenario. In this tonic, Only three assets were winners in April, with an increase in accumulated “barely” up to 3.6%.

Now, Throughout 2025, the equation changedA, and gold is the only alternative that offers a positive income compared to accumulated inflation.

In short, the only instruments with Positive rent in all of April were Bitcoin, which advanced 3.6% in pesos, followed by the Fixed grape term (3.1%) and the traditional fixed term, with an interest around 2.5%.

That is, throughout the month, they barely equated the inflation what, According to a report from the consultora C & Tit was located in the 2.7% in the same period, A figure less than 3.7% in March.

Is that the tariff measures taken by Donald Trump Regarding imports and the consequent conflict unleashed with China, plus the pressures exercised to the Reserva Federal (FED) To lower interest rates, they generated uncertainty and volatility in world markets.

To this was added that, at the local level, the government unified the exchange rate in a Flotation band between $ 1,000 to $ 1,400, which adjusts 1% monthly, and agreed with the International Monetary Fund (IMF) and other international organizations to enter currencies.

All this News Combo hit the performance of several alternatives investment

For example, The gold, which in the whole month climbed in price 5.4% in dollars in wall Street, at the local level, saw this performance vanished by the fall of the value of the American ticket in the stock market (MEP and had liquidation), which was close to 10% in all of April.

More winning investments in April, led by Bitcoin, which rises 3.6% in pesos.

“Las Various US dollar definitions were ´Desinfla’s from the elimination of the stockpity for natural persons, but More loser was the official dollar since the month ended resulting in 16% cheaper than at the end of March. It is that although the retail ticket increased 9% in April, it should be remembered that the tax perception of 30% that affected it until the middle of the month was removed, which was applied for the purchase of foreign exchange in the banks, “says Andrés Méndezdirector of AMF Economy, to iprofesional.

And complete: “The mix between the application of flotation bands, instead of crawling peg that the Central bank applied daily, and the aforementioned suppression of the perception of 30% as a tax/personal property tax, determined that buyers to treasure can do so to a lower price at the beginning of April “.

In addition, the Actions of leading companies Argentinas, which belong to the Merval index, around 10% fell throughout the month.

In conclusion, according to Méndez, “Bitcoin and fixed deadlines were the alternatives that were used in April And the only options that avoided the nominal deterioration were. However, if the inflationary dynamics of the month are considered, it could be noted that, in real terms, they were almost overcome by the rise in internal prices. Specifically, who made consumption in the last days of March obtained greater profitability than the one who bet on any variant of financial or stock market placement. “

More winning investments of the year: only gold beat inflation

As for more winning investments From this first four -month period of the year, he leads by far the orowhat is The only alternative offered by a positive income compared to accumulated inflation.

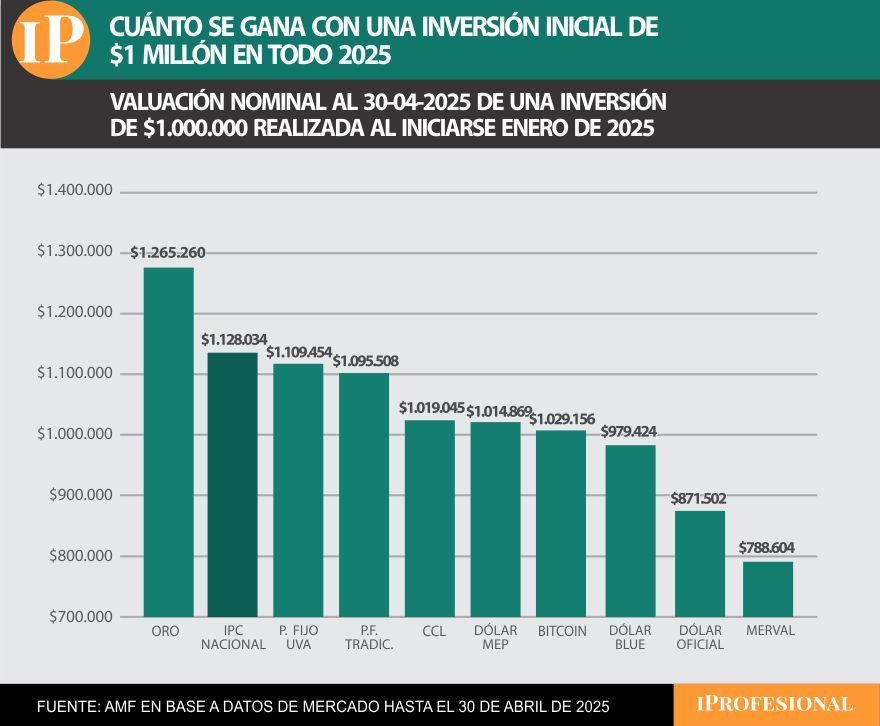

It is that that saving that placed $ 1 million in early 2025 in the purchase of this metal, currently has a total capital of $ 1,265,000.

As a reference, that Initial amount of $ 1 million placed at the beginning of January adjusted by the accumulated inflation Of all the current year, add an estimated $1.128.000.

Then, the fixed grape period and the traditional fixed term, With one profit close to 10% In the first four months of the year.

Throughout 2025, gold leads the most winning investments.

“For him accumulated of 2025, gold continues to be unbeatable for its valorization against the US dollar, resulting in the only alternative that surpassed the rise of the National CPI. In the antipodes, who positioned themselves in stock market assets, they nominally resigned in four months about 20% of the capital invested, “says Méndez.

The thing is, in all 2025, the main rate of actions of Companies, the Merval de Buenos Aires del Byma, falls 17%.

And if the investments made in early 2024 are taken into account, the fixed term UVA continues to result in the best alternative because it exceeded inflation, since the saving that deposited $ 1 million at that time, today has a total capital of $ 3,148,000.

In second place The Bitcointhat “He had a Excellent performance, although he fights ´Cabeza a head´ with inflation, slightly overcoming it on the end of April. A fight that other investment options are losing. “

So, who put $ 1 million in January 2024 In the purchase of this cryptocurrency, Today would have a capital close to $ 2.5 million.

What will happen to these investments in May

The month that starts a certain world volatility will continue, Waiting for commercial agreements between the United States and the rest of the countries to be defined, and with the look in the main economic variables, both at the local and international level.

“May expectations and subsequent months are concentrated in the Potential Effectiveness of the Government support which constitute the fresh funds contributed by the IMF and other agencies that are already counted in international reserves, and that generated a rise close to 50% in this central bank asset, “says Méndez.

In this regard, this analyst considers this “You can remove air from the devaluation of weight, subtracting attractiveness to the treasurement of dollars. ”

In this accommodation of the different investments, what is clear is that The Fixed UVA deadlines For a little higher inertia in the prices of the economy of the last two months. Therefore, if the IPC descends in the next periods, this will generate that due to the delay that these banking placements have in reflecting such price increases, in the short term they are favored by the previous “drag”.