Bitcoin (BTC) has entered a cautious phase while Investors await the Federal Reserve decision (Fed) of the United States About interest ratesscheduled for tomorrow, Wednesday, May 7, 2025.

At the time of this publication, as can be seen in the cryptootic price calculatorBTC quote around USD 94,00013% below its historical maximum of USD 109,300 registered on January 20, coinciding with the presidential assumption of Donald Trump.

This pause in the bitcoin bundle impulse reflects the uncertainty surrounding the next announcement of the Fed And, in particular, the subsequent discourse of its president, Jerome Powell, whose words could offer key clues about the course of monetary policy in the coming months.

The following graph, provided by TrainingView, shows how Bitcoin has fluctuated since January 1 of the current year:

As cryptootics reported yesterday, There would be only 1.8% probability of reduction in interest rates tomorrow. These rates have remained in the range of 4.25% to 4.5% since January 2025, after three consecutive cuts in the previous months.

The Fed position, led by Powell, has been clear: the US economy continues to show strength, with a solid labor market and inflation that still does not justify immediate action.

This strategy of “waiting and seeing” seeks to evaluate the impact of the commercial policies of the Trump administration, especially import tariffs, which have generated fears of inflation and recession.

Although the decision on rates is important, investors are more attentive to the tone and the signs that Powell can offer in his speech after the ad.

Historically, their comments have generated high volatility in markets, especially in assets considered “risk” such as Bitcoin, cryptocurrencies and actions. when Powell adopts an optimistic posture about the economy, markets tend to consolidate or climb; Instead, a cautious or pessimistic tone usually triggers downward corrections.

In this context, Powell’s words could anticipate whether the Fed plans feat cuts at June or July meetings.

What about Altcoins?

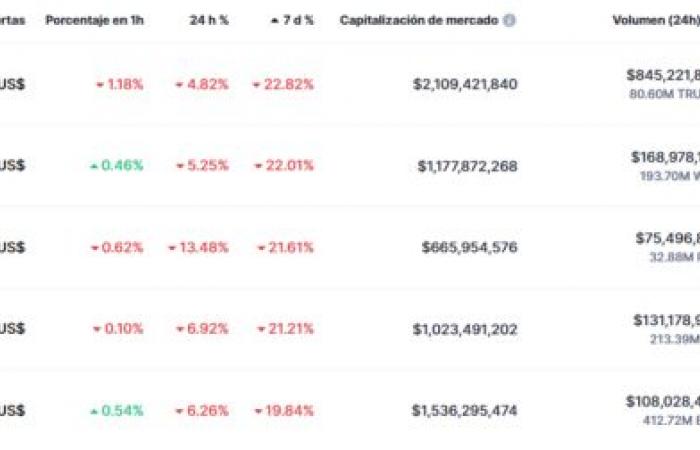

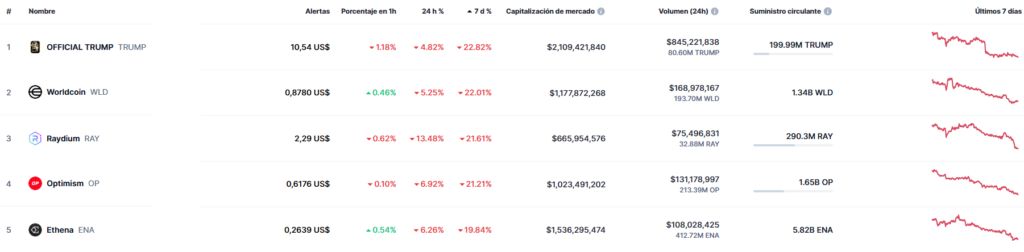

While BTC slows its upward course, cryptocurrencies show diverse behaviors. But, within the top 100 for market capitalization, Most digital assets are with weekly returns (last 7 days) negative.

The American presidential memecoin, Official Trump (Trump) takes the worst position of the ranking, with a drop of almost 23% in the last seven days.

Others that have had great falls, as can be seen in the following image, are Worldcoin (world), Raydium (Ray), Optimism (OP) and Ethena (ENA).

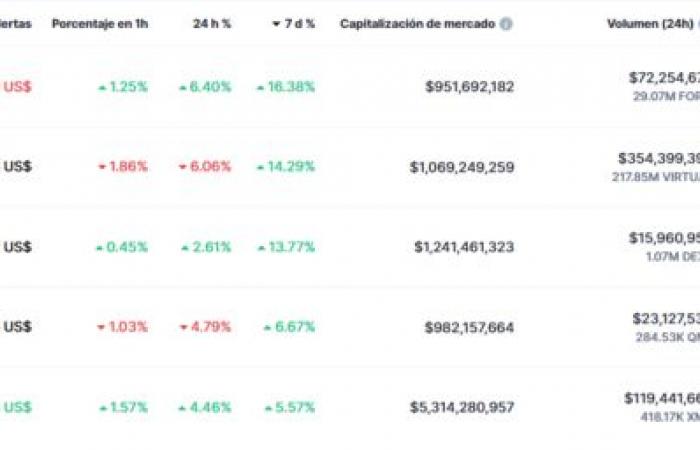

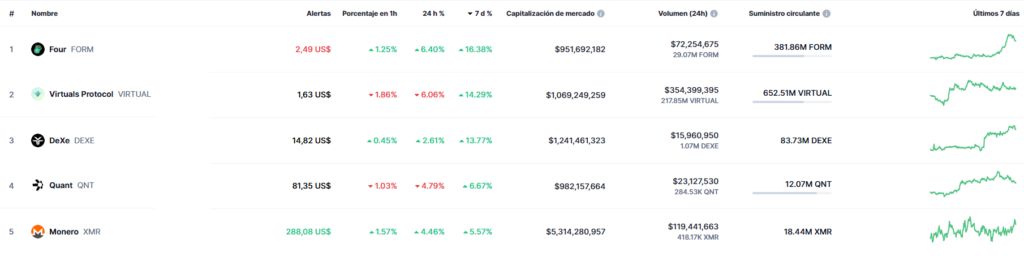

In the antipodes, among the digital assets that still maintain a positive weekly return are FOUR (form), Virtuals Protocol (virtual), Dexe (Dexe), quant (QNT) and Monero (XMR)

Unlike what happened last week, now there are no memecoins between digital coins with greater rise. This is an indication that The appetite for risk has been diluted and investors have become more cautious.

Why does it matter so much what Fed says if Bitcoin is “independent”?

At first glance, it may seem a contradiction that Bitcoin – a currency born with the purpose of challenging the traditional monetary order – is so affected by the decisions of the United States Federal Reserve.

After all, Bitcoin was created as an alternative to the centralized banking system and, in theory, it should operate outside the state economic policies.

However, the reality of the markets is much more complex, and there are several weight reasons why Jerome Powell’s words can move the BTC price both (or even more) and any intrinsic event of the bitcoin ecosystem.

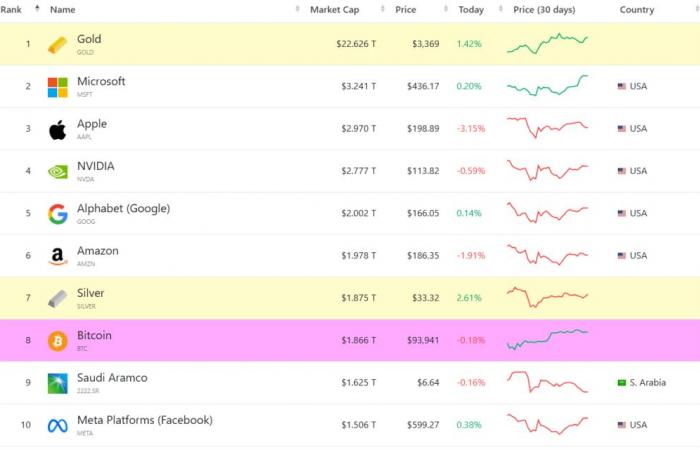

Although Bitcoin was devised as a decentralized and sovereign currency, Today is deeply integrated in global financial markets. In fact, it is one of the 10 most valuable financial assets in the world, as can be seen in the image below:

The existence of Bitcoin ETF in cash, derived financial products and trading platforms regulated in the United States (which is the greatest global financial power), demonstrates that a significant part of the capital that circulates in BTC comes from institutional investors and funds that respond to traditional incentives.

When interest rates are high, those same funds find attractive opportunities in treasure bonds or savings accounts, decreasing their exposure to Bitcoin. On the contrary, when anticipation of fees are anticipated, the appetite for alternative assets grows. So, Although Bitcoin does not need the traditional financial system, a good part of its liquidity does come from actors who actively participate in it.

To this we must add that Bitcoin can be a value reserve for some, but in international markets he continues to quote in dollars. Therefore, Fed monetary policies impact their relative price. A rise or decrease in interest rates directly affects the strength of the dollar, and with it, the value of the BTC measured in that currency.

When the dollar is strengthened, as usually happens with high rates or expectations of monetary hardening, Bitcoin (like other assets) tends to lose value in front of it. Not because its intrinsic value changes, but because the market values it based on the purchasing power of the dominant currency.

Finally, you have to understand that Much of the capital that enters Bitcoin does not seek to make revolution, but to maximize returns. The majority of current market participants are probably not cypherpunks Neither anarchocapitalists: they are traders, investors, investment funds and common users who seek to protect or increase their assets. For them, the performance matters more than ideology.

Because of that, if Powell speaks of recession, inflation or rates, that public usually reacts similar to how he would with any other financial asset. It is a mistake to think that everyone who invests in Bitcoin shares the same “anti -system” vision; Many simply consider it a good opportunity.

Probably, to the extent that time progresses and the Fíat system continues to degrade, there are a greater number of investors who understand what is the true value of Bitcoin and why it is extremely important. Meanwhile, as the Trader Willy Woo says, each fall is an opportunity to buy BTC at low prices.