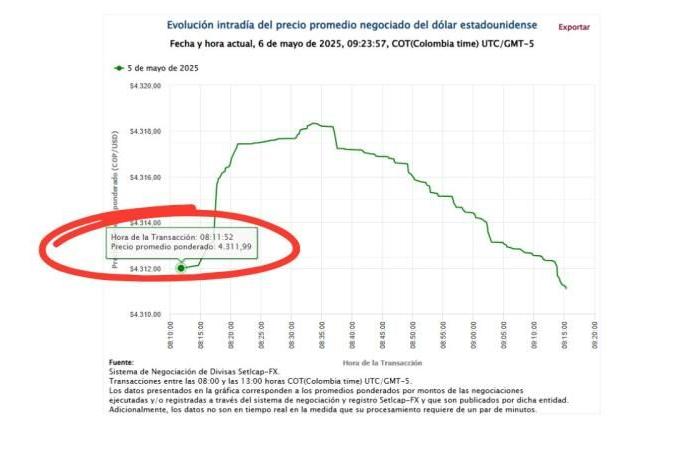

This Tuesday, May 6, 2025, the representative rate of the market (TRM) in Colombia opened at 8 in the morning at 4,311.99 pesos per dollar, according to the Bank of the Republic. This dollar price value represents a significant increase compared to the TRM of the previous day, which stood at 4,283.62 pesos. The difference of 28.37 pesos implies a 0.66% increase in a single day.

when comparing today’s TRM with yesterday, there is an increase of 28.37 pesos, which is equivalent to an increase of 0.66%. This increase is remarkable, considering that the TRM has shown fluctuations during the last week. In the month of May, the TRM has shown an upward trend. From May 1, when the TRM stood at 4,222.25 pesos, until today, May 6, the TRM has increased by 89.74 pesos, which represents an increase of 2.12%.

The behavior of the dollar in Colombia during the first four months of 2025 has been marked by significant fluctuations. In January, the TRM began the year at 4,404.92 pesos and closed the month by 4,198.00 pesos, showing a 4.69%decrease. In February, the dollar experienced greater variability, starting at 4,205.00 pesos and reaching a minimum of 4,073.56 pesos on February 24. The month closed by 4,120.11 pesos, reflecting a decrease of 2.02% compared to the start of the month. In March, the TRM showed an upward trend, starting at 4,192.57 pesos and closing at 4,274.03 pesos, which represents an increase of 1.94%. April presented greater volatility, with the TRM fluctuating between 4,416.69 pesos on April 10 and 4,243.80 pesos on April 30. In general, the dollar showed an upward trend towards the end of April, closing the month by 4,243.80 pesos.

Bank of the Republic

Price of the dollar in exchange houses in main cities in Colombia

This is a dollar price list for purchase and sale in the main cities of Colombia:

- Bogotá: Purchase: 4,140.00 pesos – Sale: 4,230.00 pesos

- Cali: Purchase: 4,060.00 pesos – Sale: 4,190.00 pesos

- Medellín: Purchase: 4,030.00 pesos – Sale: 4,240.00 pesos

- Barranquilla: Purchase: 4,020.00 pesos – Sale: 4,230.00 pesos

- Bucaramanga: Purchase: 4,080.00 pesos – Sale: 4,230.00 pesos

- Cúcuta: Purchase: 4,010.00 pesos – Sale: 4,220.00 pesos

- Meal: Purchase: 4,050.00 pesos – Sale: 4.210.00 pesos

- Cartagena: Purchase: 4,070.00 pesos – sale: 4,230.00 pesos

- Pereira: Purchase: 4,060.00 pesos – Sale: 4,220.00 pesos

Getty Images

Euro price in exchange houses in Colombia

- Bogotá: Purchase: 4,710.00 pesos – Sale: 4,830.00 pesos

- Cali: Purchase: 4,660.00 pesos – Sale: 4,790.00 pesos

- Medellín: Purchase: 4,630.00 pesos – sale: 4,810.00 pesos

- Barranquilla: Purchase: 4,620.00 pesos – Sale: 4,800.00 pesos

- Bucaramanga: Purchase: 4,650.00 pesos – Sale: 4,810.00 pesos

- Cúcuta: Purchase: 4,610.00 pesos – Sale: 4,790.00 pesos

- Meal: Purchase: 4,640.00 pesos – Sale: 4,800.00 pesos

- Cartagena: Purchase: 4,660.00 pesos – Sale: 4,820.00 pesos

- Pereira: Purchase: 4,650.00 pesos – Sale: 4,810.00 pesos

The euro is changed above $ 1.13

The euro changed above $ 1.13 after the publication of the growth figures of the activity of the American services sector. The euro changed to 3:00 p.m. GMT at $ 1,1343, compared to $ 1,1361 in the last hours of the European negotiation of the currency market of the previous day. The European Central Bank (ECB) today set the change of reference of the euro at $ 1,1343.

The euro remained stable above $ 1.13 after it was published that the activity of the US services sector improved up to 51.6 points in April (50.8 points in March), according to figures from the Supply Management Institute (ISM). A figure above 50 indicates that there has been an expansion of the services sector compared to the previous month. On the contrary, if the data is less than 50, it points a contraction.

Getty Images

The confidence of the Eurozone investor improved in May to -8.1 points, from -19.5 points in April, according to the Sentix index. The dollar was weakened due to investors’ concern for the lack of advances in commercial negotiations and before knowing the decisions of the Fed on Wednesday.

Unicredit analysts expect the Fed to maintain their interest rates between 4.25 and 4.50 %, because the US economy shows resistance and inflation rose in the first quarter. However, uncertainty about US government policy and its impact on the economy is “very high,” they add. The single currency was changed in a fluctuation band between $ 1,1313 and $ 1,1364.

EFE

Ángela Urrea Parra

Caracol news