The energy shortage situation has put on the table the discussion about what will happen to the gas supply beyond 2026. In a context in which gas imports come to the rise and could continue to grow from the next one, the impact on the final consumer can be reviewed.

An investigation carried out by Sergio Cabrales and Juan Benavides, deputy researchers of fedesarroll in energy issues concluded that, in the event that half of the gas supply in Colombia is supplanted with imports, The rise in the gas rates of five main cities in the country (Bogotá, Medellín, Cali, Barranquilla and Bucaramanga) could reach up to 45.8%.

In a less optimistic scenario, In which the country has to resort in its entirety to imports in the near future, rates would increase to 91.5%. A higher cost of imported gas compared to national production, added to insufficiency in transport infrastructure projects are the main reasons.

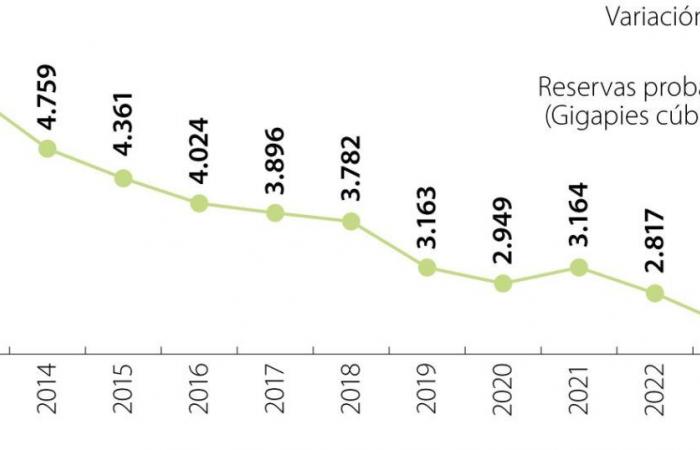

The projections of analysts They took as a starting point the detriment of the last 10 years of gas reserves, Parallel to growth in energy resource imports from two main markets, the United States and Trinidad and Tobago.

Data from the National Hydrocarbons Agency account for a drop of 2,135 Giga feet from 2013 to 2023 (5508 cubic feet daily vs 2,323), It represents a 43% production drop in a decade.

Analysts detail that the decline in production has been due to points such as the low success factor of the perforations, The null incentives to new investments together with an unattractive regulatory environment.

They added that the increase in state participation in oil revenues, which has discouraged the arrival of new investments and generated departures from hydrocarbon companies such as Exxonmobil, Shell, Repsol, Conocophillips, Chevron and BP. Known as ‘government Take’, the government’s slice in the income generated by extractive activities, went from 63% to 80% with the tax reform of 2022.

To this is added the brake in the exploratory activity due to government policy focused on the energy transition. While between 2010 and 2014 they were drilling between 110 and 130 wells annually, the figure fell to 34 last year. This has been reflected in greater complexity in the procedures of environmental licenses and a regulatory environment that prolongs the execution deadlines that results in loss of profitability of the projects.

On the import side, since the closure of 2024, the gas that arrives from abroad to Spec (only regasifying) has also been used for the electricity sector to meet the essential demand, which includes the residential, commercial demand, vehicular natural gas, refineries and compressing stations. In 2024, of the total national gas supply, 23.8% came from imports compared to 8.1% last year.

The researchers They emphasize that the growing dependence on imports will result in higher gas service rates because bringing it from the outside would be represents a price per gas molecule up to three times higher.

As an explanation, the residential use gas rate, known as the unit cost of benefit (CU), is composed of the product between cubic meters and the variable unit cost (CUV). This CUV in turn consists of the cost of the gas molecule (G), plus transport