The government sent four specific signals that The flotation between bands will be more managed than free. The dollar is again in the center of the sustainability of the economic program because the current account had a new negative record in March and already accumulates ten consecutive months in red. The Casa Rosada celebrates the energy surplus but the bloody of currencies for tourism already surpasses it. The Central Bank does not accumulate reservations and They ensure that Javier Milei will use the IMF dollars to maximize their electoral chances.

Less than a month after the CEPO departure many economists warn that the promise that under the new scheme the dollar would float between bands, it is just that, a promise. PXQ consultancy listed at least four facts that mark the intention of the government to actively influence the price:

1-The economic team assured that Reserves will not be purchased inside the bands And that the Central Bank will only do it when the exchange rate drills $ 1,000, despite the agreement with the IMF indicates otherwise.

2-The President Javier Milei reiterated his decision to increase retentions For the soybean complex and recommended exporters to liquidate now To have better prices.

3-The Central Bank enabled non-resident investors to enter and exit through the official market as long as the funds respect a minimum period of permanence in the country of 180 days.

4-Movements were observed in contracts Future dollar that allow to assume that there was Official Intervention.

For former Deputy Minister of Economy Emmanuel Álvarez Agisholder of the firm, ”the scheme that was initially flotation between bands and endogenous interest rate to the monetary goal, It is becoming one of flotation administered with primary money creation to meet treasure needs. ”

The problem of exchange anchor

The priority of economic policy today goes down inflation. The representatives of the economic team were made clear to businessmen in various meetings during the last fifteen days. The noble objective hides that behind that is the government’s intention to get better to the elections although it implies deteriorating the sustainability conditions in the medium term.

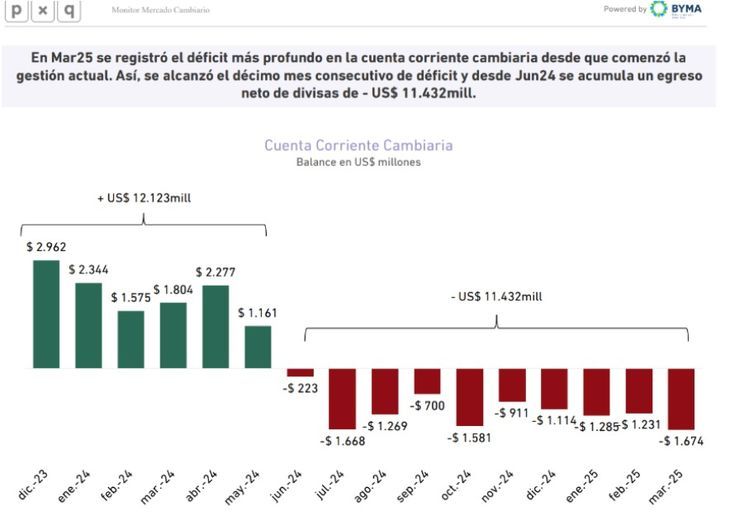

The key to reducing the inflation rhythm is again The exchange anchor. This tool led to the Central Bank from reaching a Record deficit for this management in the current exchange account: Red was US $ 1,674 million, in this way a negative ten -month run hilvanó in which the currency departure exceeds US $ 11,000 million.

WhatsApp Image 2025-05-03 at 20.03.48.jpeg

Although March will mark a bump in the recovery of the activity, imports grew at a greater rate than exports. In addition, the prefinancing of foreign sales was significantly reduced by exchange uncertainty. But The main challenge is still in the services account, where tourism explains the bulk of the deficit.

IMF dollars and elections

In the Casa Rosada they usually minimize questions about the exchange rate. “This time is different,” they argue, and exhibit the surplus of the energy balance reached thanks to the Vaca Muerta phenomenon. But economist Amílcar Collante published a revealing fact: Since the middle of last year the tourist deficit systematically exceeded the energy surplus.

WhatsApp Image 2025-05-03 at 20.04.05.jpeg

According to the Central Bank data, 62% of travel expenses are paid with own dollarsbut now travelers can buy these cheapest tickets in the official market and add demand. Meanwhile, The monetary entity failed to buy a single dollar under the new scheme despite being at the time where seasonally more currencies are settled For the thick harvest.

For Álvarez Agís The operation of this scheme is not compatible with a BCRA that bought dollars crucial factor to reduce country risk and return to voluntary credit markets. “The political objective of using the exchange rate as an anchor for inflation clashes against the need to accumulate reservations,” he said in a recent report.

The IMF for now turns a blind eye and the eyes perch on the role of the United States to unlock the unconventional initial disbursement of US $ 12,000 million that Argentina received. “Apparently the political support once again allowed the government to use the IMF dollars to maximize their chances at the polls,” concluded the head of PXQ.