Key points:

-

Bitcoin has historically surpassed gold, more recently by a factor of six.

-

The rise of gold to USD 5,000 could prepare the stage for significant Bitcoin profits.

-

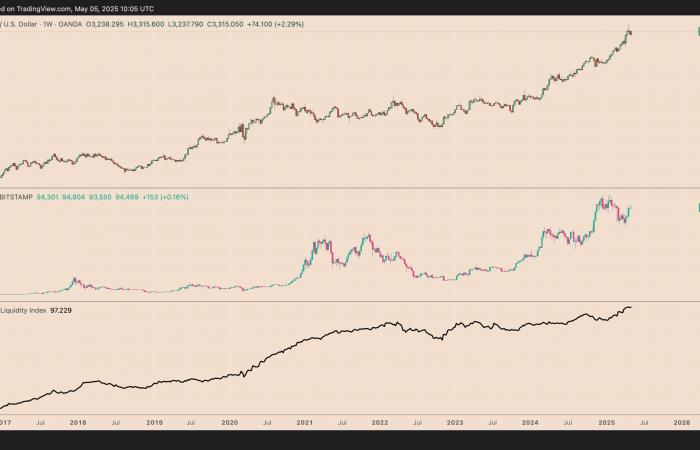

The weakening of the US dollar and the increase in global liquidity remain key factors for both assets.

The march of gold to USD 5,000 per ounce and beyond has become an important issue among hard asset bundles, including Yardeni Research Chief, Ed Yardeni, and multimillion -dollar investor John Paulson.

But what could happen to the price of Bitcoin (BTC), promoted as “digital gold” by many, if the precious metal rises even more?

BTC’s price shot 6 times the last time gold rebounded

Bitcoin has historically delivered much more substantial profits than gold when its markets rise simultaneously.

From March 2020 to March 2022, during ultra lax monetary policies of the Federal Reserve, the price of BTC shot approximately 1.110%, while gold increased only 35.5%.

In the rebound from November 2022 to November 2023, which coincided with an increase in the global money supply (M2), gold won around 25%, while Bitcoin shot 150%, that is, almost 6 times more.

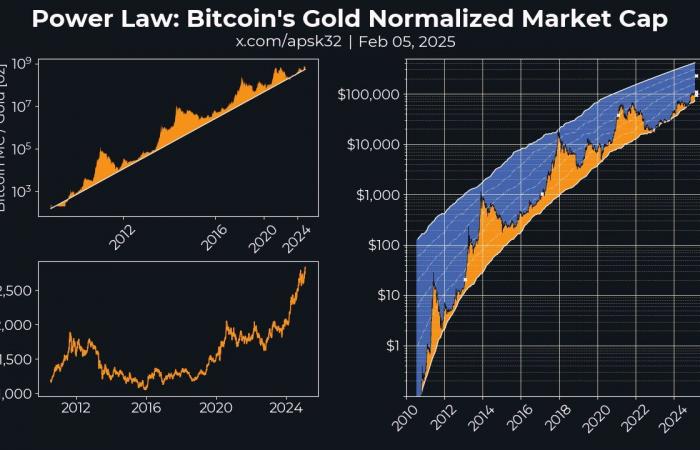

The rise of gold from its current value of around USD 3,265 to USD 5,000 will be equivalent to 50%profits. So, if the story is repeated, Bitcoin could grow by 300% or reach a price of USD 285,000 per BTC.

That is in line with the projected price objective for Bitcoin of the APSK32 analyst, which is based on a normalized power law model against gold market capitalization.

The gold rise will drive Bitcoin to USD 250,000, according to a veteran fund manager

Frank Holmes, CEO of US Global Investors, provides that gold will reach USD 6,000 during Trump’s presidential mandate, arguing that the metal has lagged behind the increase in the global money supply M2.

He links this ambitious objective to Trump’s tariff policies, which, he believes, could weaken the US dollar by approximately 25%, increasing the attractiveness of gold along with a strong demand for central banks and a sub -deputy position of investors.

Holmes predicts that Bitcoin could overcome its supply resistance in USD 97,000 and ascend to USD 120,000 – USD 150,000 in the short term, with a long -term potential to reach USD 250,000 as adoption accelerates.

BTC can reach USD 155,000 if the lagging correlation with the gold is maintained

At the end of April, gold reached a historical maximum of USD 3,500, with an increase of 33.35% so far this year (YTD). It has corrected slightly to get to USD 3,237 to May 5. In comparison, Bitcoin has risen just 0.82% so far this year.

Some market observers, including the cryptollic analyst, point out Bitcoin’s past behavior of following gold with a delay, suggesting a possible movement towards the USD 155,000 level if it manages to get out of its current consolidation range.

Bitcoin’s 30% drop since its historical maximum of around USD 110,000 seems mild compared to past sales of more than 50%. This resilience strengthens its role next to gold and increases the probability that it can follow the gold rebound if market conditions improve.

This article does not contain tips or investment recommendations. Every investment and commercial operation entails risks, so readers must carry out their own research before making a decision.