Ideas clave:

- The great institutional bets could boost an important rebound.

- The price of the XRP could shoot 138% if the resistance is broken.

- The MACD seems bullish, but a fall at 0.70 $ is still at stake.

The XRP price has dropped 0.8% in the last 24 hours to quote $ 2.18, as part of a 6.5% drop in the last 7 days. The price decrease occurs while the daily volume of operations increases by 26.7% to 1,619 million dollars, which means a recent increase in market activity.

With an ETF that reaches 67 million dollars in managed assets (AUM) and some wild graphic signals, we could be facing a 138% rise this week.

ETF Goes BRRR – $67M AuM and Counting

According to a Jungle Inc. Post Crypto News On X, the XRP ETF has just reached 67 million dollars in AUM this week. It is a huge flexion for the adoption of the XRP, which shows that institutional money is beginning to enter.

More liquidity, more eyes, more profits. This ETF pumping is a sign that the big players are betting on the future of the XRP, and is giving the price a serious potential as rocket fuel.

Meanwhile, normative clarity is finally glimpsed for XRP. After years of legal drama with the SEC, rumors of a favorable agreement or sentence circulate. If this is fulfilled, it could be the final catalyst for the XRP to shoot. The market hates uncertainty, and with the clarity that is coming, the XRP could overcome resistance as if nothing.

On May 3, the co -founder of Ripple, Chris Larsen, said that most of the XRP supply will be in circulation in 2037, which could “see a price of $ 5,000 or more.”

The price of the XRP at a crossroads: a value gap or a 138% pump on the way?

This 3 -day XRP/USD graph shows the price at 2.18 to May 5, 2025. The XRP also presents a fair value gap (FVG) highlighted in the graph between 0.7 and 0.9 $.

For the uncultured, the FVGs are like magnets in the market: the price usually returns to fill these holes before making their next great movement. It is likely that the price of XRP has to take advantage of this FVG area and bouncing strongly, otherwise, it could mean the end for layer 1.

The simple mobile average (SMA) of 50 days is at $ 2,4028 and acts as dynamic resistance, and the relative force index (RSI) in 48.43 shows that XRP is not yet overcapted.

The graph also shows a key resistance in 2.3 $, which coincides with the Fibonacci level 0.382. If XRP breaks it, the following objective is around $ 3.42, which marks the previous maximum in the graph. A jump of 138% from the current price of 2.17 would place the cryptoactive around $ 5.23.

The convergence/divergence indicator of mobile socks (MACD) is showing a possible bullish crossing, with the histogram flowing slightly above the zero line. If the bulls intervene, we could see how the XRP shoots up to $ 3.42 this week.

On the other hand, if the current resistance around 2.3 $ is maintained, the XRP can become bassist. Combined with the pull of the fair value gap, the asset can find its path to 0.7 $, which means a 59% drop from the current price.

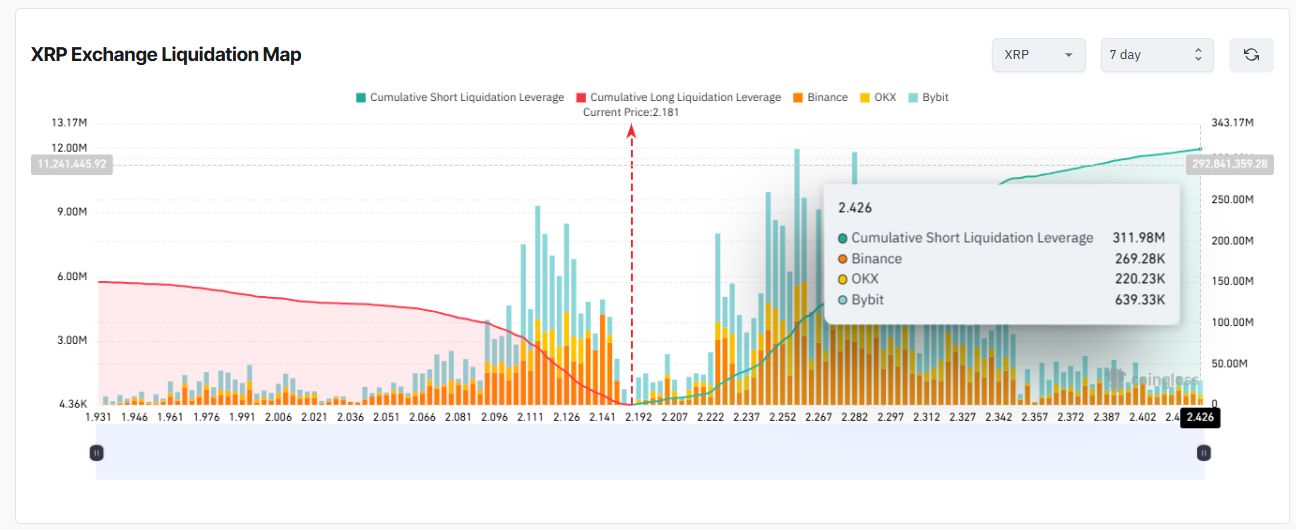

Coinglass data suggests that bears control the market, since the liquidations of short positions accumulated in the last 7 days double those of long positions.

What is the next for the price of XRP? Even the moon or chill?

So where are we going? The fact that the ETF reaches 67 m $ of AUM changes the rules of the game, and with the increase in adoption in the real world, the XRP seems spicy. The graph is shouting “uncertainty” with that FVG filling down, and a clear path to $ 3.42 at the top.

A 138% rise this week is totally at stake, but investors have to monitor that MACD in case some poaching bassist occurs.

The fundamentals of the XRP are aligning with the technical aspects, although the futures operators are more obsessed with earning fast money with an XRP sale.

Discharge of responsibility

This article only has informative purposes and does not provide financial, investment or other advice. The author or persons mentioned in this article are not responsible for any financial loss that may occur by investing or trade. Please investigate before making any financial decision.