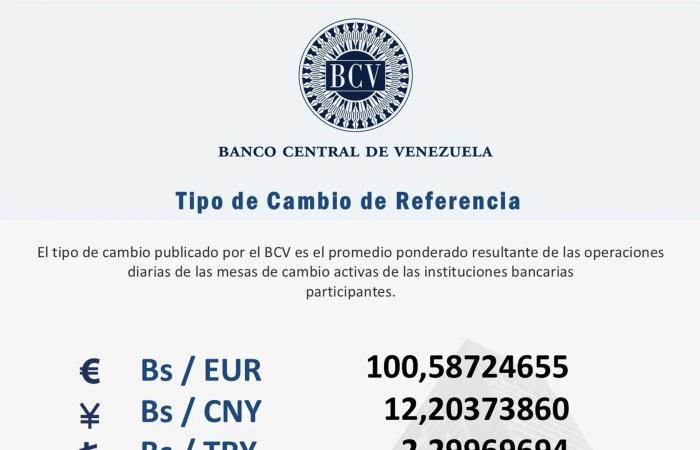

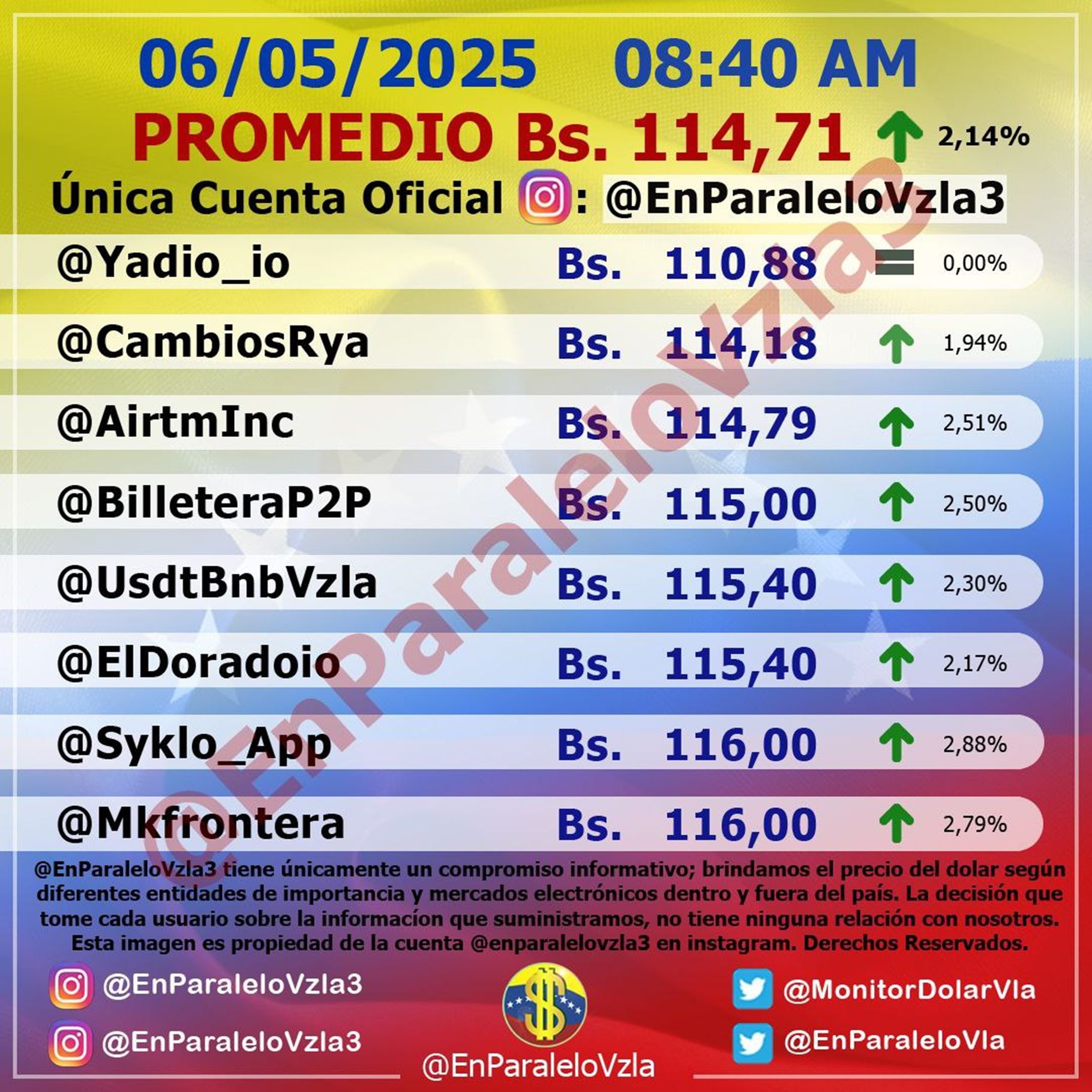

The parallel dollar opened on Tuesday, May 6 at 114.71 bolivars, while the official rate of the Central Bank of Venezuela was 88.72 bolivars, which It represents a difference of 29.33% between both quotes.

This exchange gap continues to generate distortions in the country’s economy and affects the purchasing power of Venezuelans, especially in the purchase of food and basic products.

Given this sustained disparity between the official dollar and the dollar of the parallel market, an average reference rate has emerged, Employed by many businesses and service providers as an intermediate route to set prices.

This Tuesday, it was 101.72 bolivars, a value that is approximately 14.66% above the official rate and 11.32% below the parallel dollar.

What does this difference mean to Venezuelans?

In practice, the existence of three exchange rates – the officer, the parallel and the average rate – further complicates the economic life of the population. Many businesses no longer set prices either to the official or parallel value, but adopt this intermediate rate to avoid abrupt fluctuations and reduce the impact of exchange control In its operations.

However, salaries, especially those of the public sector and pensions, continue to be calculated based on the official rate, which sharpens the loss of purchasing power.

The minimum wage in Venezuela It remains around the 130 monthly bolivars, equivalent to just $ 1.46 at the parallel rate. This amount is insufficient even to cover a day of food for an average family.

The constant increases of the dollar increase basic products such as rice, eggs, flour, meat and medicines, and has forced many citizens to depend on external aid, remittances or informal works to survive.

-Why exists this disparity between rates?

Economics experts agree that the difference between the official dollar and the parallel is due, in part, State intervention in the exchange market, that seeks to maintain a controlled exchange rate to contain inflation.

However, this strategy It is unsustainable without a stable foreign currency offer. When the BCV reduces the injection of dollars to the market, the value of the parallel dollar tends to increase due to poor availability and high demand.

In addition, the little transparency in the assignment of official currencies, the low level of international reserves and distrust in monetary policy They take many economic actors to the parallel market as an alternative to preserve their income.

Related news

mayo 6, 2025

mayo 5, 2025

mayo 5, 2025

mayo 5, 2025

mayo 5, 2025

mayo 5, 2025

Independent journalism needs the support of its readers to continue and ensure that the awkward news that you do not want you to read, continue to be at your fingertips. Today, with your support, we will continue working hard for a journalism free of censures!Support El Nacional