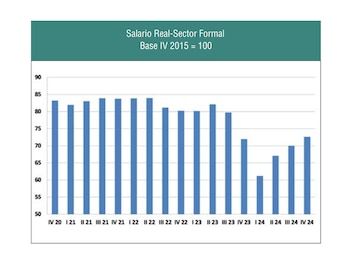

The acceleration of inflation at the end of 2023 led to a loss of formal real salary of 23% between the second quarter of 2023 and the first of 2024. From there, the wages began to recover above the prices, remaining at the end of last year 18% above the beginning of that exercise. But without reaching the level prior to the debacle or any level between 2006 and mid -2023.

From the point of view of the demand for work, the question is how the labor cost is after the deceleration in the price increases.

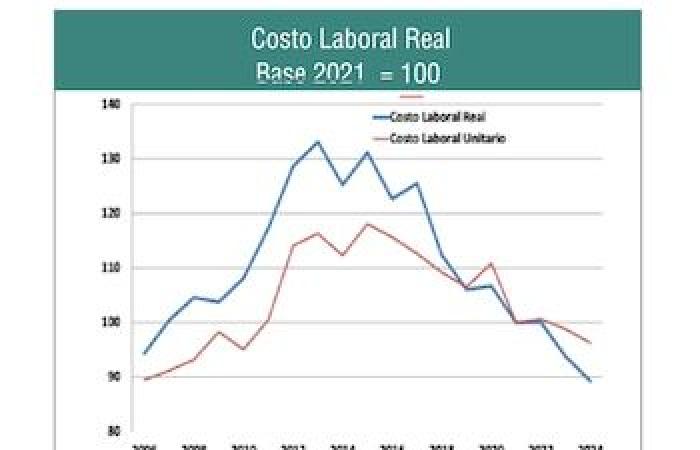

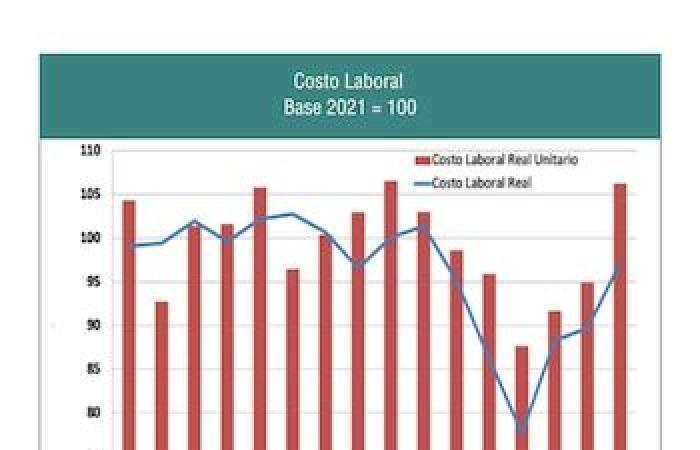

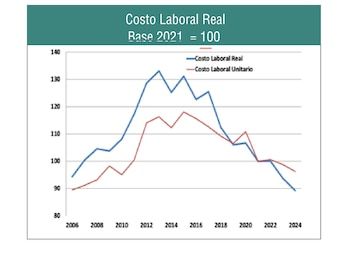

The real labor cost relates the cost of labor (salaries and work taxes, mainly) with the price of the goods it produces.

The real salary began to recover, but without reaching the level prior to the debacle or any level between 2006 and mid -2023

To the extent that the cost grows less than the price, labor is lowered in relative terms, generating an incentive to increase production.

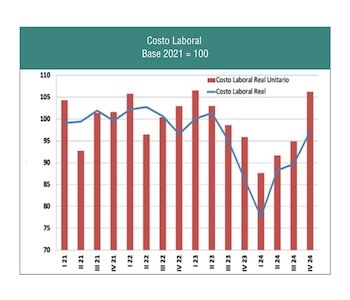

Like the real salary, the real labor cost begins to be reduced to mid -2023, losing 23% to the first quarter of 24; From there, 25 percent are recovered until the end of the year.

Again, despite this increase, the closing level of 2024 was lower than any period between 2006 and mid -2023.

A more precise measure of real labor cost, makes a productivity correction. Because? Because if the labor cost grows in relation to the price, but the workforce turns out to be more productive, the labor cost per unit produced falls.

So why did productivity play for? While the labor cost since the end of 2023 fell, the average productivity also did, which implies that the labor cost fell, but less in relation to the amount produced.

To the extent that the cost grows less than the price, the labor is reduced in relative terms, generating an incentive to increase the production

In 2024, while the labor cost was recovered, average productivity did not do the same -in reality only a quarter -which enhanced the increase in labor cost.

In any case, the average unit labor cost of 2024 is below any value since 2010.

Another interesting angle is to analyze the labor cost in dollars, which gives a vision of the country’s competitiveness in the world. Higher dollars costs do not generate investment incentives in the country.

Although throughout the year the recovery of wages well above the devaluation led to an increase in the labor cost in dollars of almost 60%, the average of 2024 is the lowest of at least the last 15 years.

In a long -range perspective, the labor cost is at one of the lowest levels of the last decades.

Reforms that underpin cost reduction, not only in the labor market, would reinforce investment incentives and, therefore, contribute to economic growth.

The author is a faithful economist, this note was published in Cayuncture Indicators 673, April 2025