The region’s preference for cash – typically a reflection of its informal economy – is rapidly declining thanks to the rise of digital payment alternatives. At the same time, the number of financial startups has multiplied, as more entrepreneurs and traditional players compete in a hot market.

Authorities and regulators should encourage this positive trend: it is an opportunity to include the unbanked population, making financial products more accessible to formal and informal workers and allowing small businesses to expand their operations at a lower cost. . At the same time, it contributes to reducing the region’s disastrous bureaucracy and stimulating the necessary increase in productivity through technology.

READ ALSO: Yape and Plin dethrone the use of a banknote: BCRP reveals the monetary evolution

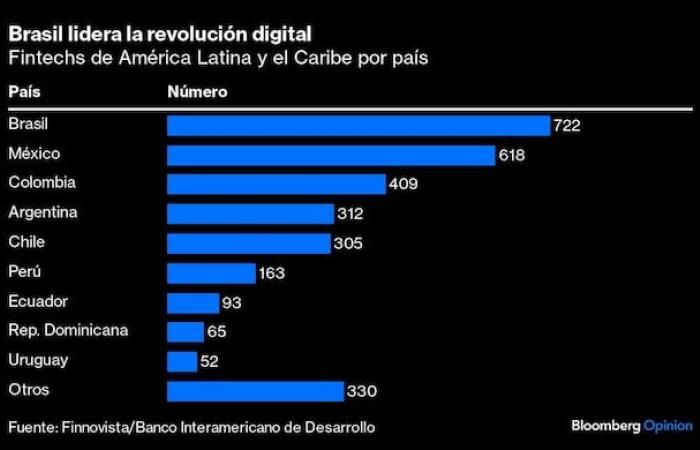

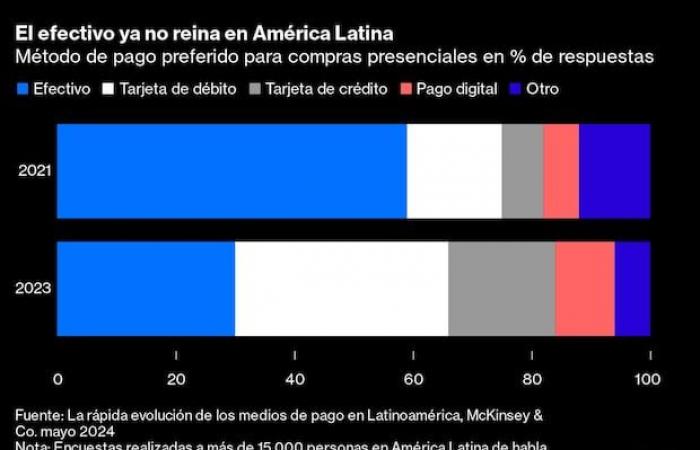

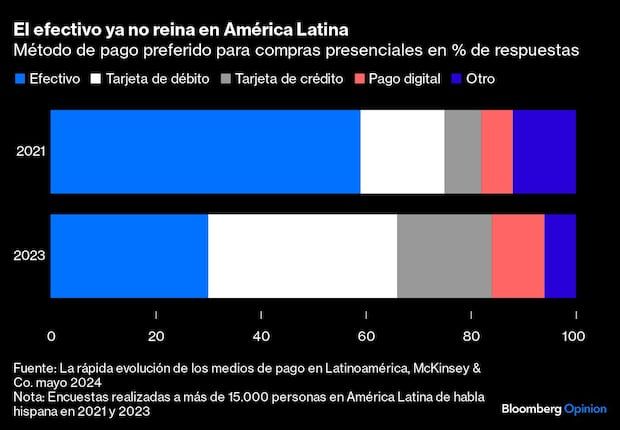

The evidence for this new trend is striking: according to a report from May McKinsey & Co.., in just two years the debit card replaced cash as the preferred means of payment among Spanish-speaking Latin Americans. A study by the Inter-American Development Bank and Finnovista published last week revealed that the number of fintechs in Latin America and the Caribbean grew by 340% to exceed 3,000 companies in just six years until 2023. And seven in 10 Latin American adults have already made or received payments through digital means , according to the Beyond Borders 2024 survey.

There are many factors driving this evolution, among which the confinement due to the covid-19 pandemic stands out: the months we spent at home and working remotely made millions of people try new payment options through cell phones and platforms. of electronic banking to avoid going to physical branches, which allowed them to become familiar with the mechanics.

Ease of use, speed and better control of expenses are some of the main reasons cited for opting for digital payments and debit cards, especially among the younger population. There are also reasons for technology adoption; Latin Americans are heavy users of mobile phones and social media. The boom in remittances – almost US$ 160 billion was transferred to the region last year – has also prompted customers to try new digital options for their finances.

The disruption is most visible in Brazilwhere the central bank’s Pix instant payment system has reached over 160 million users since its launch in late 2020. This is nothing short of revolutionary: when I lived in Rio de Janeiro, every month I had to print out a PDF receipt and head to the bank to pay my rent to a teller. And that was between 2010 and 2016 – not that long ago! Now Nu Holdings Ltd.a São Paulo-based fintech that was just starting out when I lived there, already has more than 100 million customers across its regional operations, primarily in Brazil but also in Mexico and Colombia, making it one of the largest digital banks in the world.

READ ALSO: The rise of the fintech industry drives new business areas in law firms

In Argentinatriple-digit inflation had the unexpected side effect of boosting the use of payment apps among long-suffering Argentines tired of carrying more and more worthless bills in their wallets, while earning considerable returns thanks to the investment options of the platforms.

Of course, major structural shortcomings still need to be overcome, from the difficulty of changing customer behavior to the irresistible allure of cash when making irregular or tax-evading transactions. In the McKinsey report, 70% of respondents still said they had used cash in the last 30 days.

This is an obvious area in which the Government is interested in promoting digital tools that provide transparency and formality, starting with the tax and public procurement platforms themselves to work towards the so-called interoperability that allows different apps to operate with any business or client. without regulatory distinctions.

Pedro Rivas, director of Mercado Pago in Mexico, also mentions telecommunications infrastructure problems such as the lack of cellular network coverage in some parts of the country. “On a scale of one to ten in the market development cycle, we are only in four“, he commented. “Cash is still our main competitor”.

Payment Marketthe fintech unit of MercadoLibre Inc., recorded a 38% annual increase in monthly active users in Latin America during the first quarter, totaling 49 million customers and more than US$5.5 billion in assets under management.

With a population of almost 130 million and a sizable informal market, Mexico is the battleground in which traditional banking and financial technology companies are fueling competition. Regulators should follow Pix’s strategy to speed up the process, especially now that Brazil plans to take the system beyond its borders.

In any case, the era of consumers and merchants getting everything from loans to credit cards through a mobile app is here and unstoppable. Thanks to the digital revolution, a generation of Latin Americans who never had access to financial tools can finally benefit from them. The reign of cash seems to be falling behind in the region.

By Juan Pablo Spinetto

READ ALSO: BCP: Six proposals to reduce the use of cash

Start standing out in the business world by receiving the most exclusive news of the day in your inbox Here. If you don’t have an account yet, Sign up free and be part of our community.