One of the doubts that most worry patients about health, given the changes that the system is having with the intervention of seven EPS and the request for voluntary retirement of three other players is the future that the complementary plans will have.

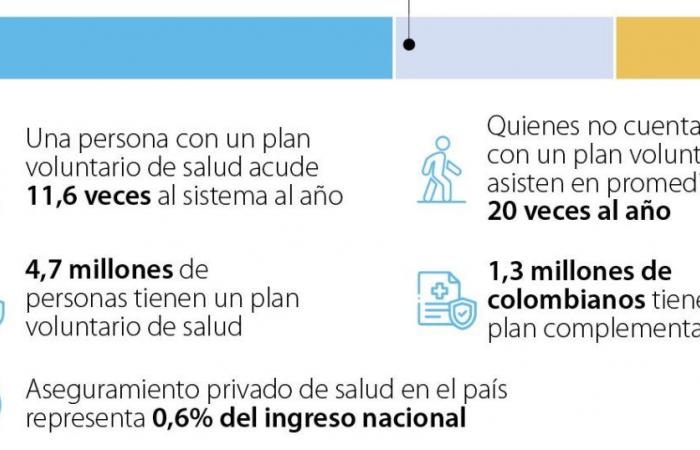

The general health social security system of the benefit plan allows some entities to offer users services known as voluntary plansamong which are prepaid medicine, health policies and complementary plans.

More than 3.8 million Colombians access this type of services and the latter represent 16% of the total voluntary health plans. According to figures from Acemi, Fasecolda and Proesa, at least 1.3 million people have a complementary service.

But as their name indicates, these services were created to complement the health benefits plan, with simple additions that are preferred by users and patients.

“These additionals existed precisely to give more money to the EPSwhich allowed them to have a direct source of income, because it was seen that in general very little was paid for health, and people wanted to pay more, but a prepaid one was already very expensive,” said Paúl Rodríguez, a professor at the Universidad El Rosario and researcher.

Unlike prepaid medicine, in which companies are totally independent of the EPS, These services would lose the way they have operated until now.

“How is a business tied to the EPS?, in itself loses its meaning. These plans surely change radically and have two paths: either they become prepaid medicine, or they become a plan close to that of ambulances, like Emermédica, They have fast service, but very limited”Rodriguez explained.

Jesús Albrey González, president of the Medical Law Bar Association, agreed with this. “The complementary plans are an extension of the health benefit plan and must be managed by the same EPS where the patient is affiliated, it cannot be managed in any other way. When a disaffiliation is generated for any of the reasons written in the law, the existing relationship ends.”

González indicated that there may be an impact on patients who have complementary plans, because many of the EPS are not authorized by Supersalud to subscribe to this type of services and would lose the benefits they had with other entities, in the event of be liquidated or removed from the system.

Until now, three EPS asked the National Government for authorization to voluntarily withdraw from the system: Compensar, Sura and Salud Bolívar. It all began after learning of the first interventions of the Government with the control of Nueva EPS and Sanitas.

After the decision was known, at the beginning of April Compensar asked the National Health Superintendency to liquidate its EPS by its own decision, finding its operation unviable in the face of an evident financial crisis. “The liquidity that the fund has had for so many years, with an impeccable operation, where the compensation fund has stood out, confirms that there is a financial solidity, in the fund, that we cannot put at risk.“said Carlos Mauricio Vásquez, general director of Compensar.

Shortly after, like a domino effect, Sura made the same request to voluntarily exit the system, after having had net losses. for $360,000 million between 2022 and 2023, which led to the depletion of society’s assets.

The most recent news came with the same request from Salud Bolívar, an EPS with just over 3,500 members.