During the UCAB Business Week, economists from the consulting firm pointed out that the prospect of improving GDP is insufficient, but there are opportunities that companies can take advantage of. They recommended focusing sales efforts on the base of the consumer pyramid. For its part, Conindustria spoke of 8.8% growth in manufacturing production, although it warned that structural obstacles prevail.

A growth of 4% in the Gross Domestic Product (GDP) at the end of the year is the main projection offered by economists Asdrúbal Oliveros and Jesús Palacios, from the firm Ecoanalítico, based on analysis of different variables, during a conference held on Thursday, June 13, as part of the activities agenda of the UCAB Business Week 2024.

To improve the level of economic activity, Ecoanalítica sumo 5.1% growth in consumption and an annual inflation rate of less than 70%despite the fact that electoral uncertainty could generate unexpected alterations in these projections.

«The elephant in the room is the political issue at the center of the optics. Unfortunately, politics plays the main role as a variable in economic development, but what happens in the presidential elections will be a very clear anchor in how 2024 and the coming years will end up developing,” highlighted Jesús Palacios, senior economist at Ecoanalítica and professor at UCAB.

If the year closes with these results, there would be a positive performance of the economy, after a 2023 that did not meet expectations. However, the specialists clarified that percentage improvement comes from a very low basehence It does not represent pronounced progress nor does it mark the pace of growth that the country requires.

Despite the insufficient recovery, Palacios positively valued the relative—and fragile—stability that characterizes the economic dynamics current, with moderately controlled inflation that has led to the increase in the prices of goods and services being less than in previous years.

(See also: Hyperinflation distorted monetary and fiscal policies)

He said that part of this stability involves more cautious actions by the Government, which has opted for tax discipline even in an election year. That is, the State spends less money, so there is a smaller flow of bolivars in the economy, which generates less pressure on the exchange rate, Palacios commented. On the other hand, he warned that these policies generate less economic dynamism and, therefore, slower growth.

«The Government spends less and maintains tax discipline that conditions growth in the economy. “The economic cycle does not come with the strength with which we anticipated in an electoral year”Palacios said.

In this regard, the managing partner of Ecoanalítica, Asdrubal Oliveroshe qualified by stating that Yes, there was an increase in public spending, but timid enough not to put pressure on the inflation rate.

«There has been an increase in spending, but more timid than we expected, that is why we lowered our growth prediction. The Government is being very careful in how it spends. If spending increases excessively and the economy does not have the capacity to absorb it, it puts pressure on inflation and devaluation.he explained.

Little growth, some market opportunities

Although structural conditions remain deficient, for Ecoanalítica specialists there are certain processes that open a range of options for investment in the country.

They emphasized the prevalence of uneven growthconcentrated in very specific regions and economic activities, but which offer a loophole in the midst of the crisis.

Specifically, they pointed to Lara and Portuguesa as emerging statesthe latter with a tgrowth rate around 10% a product of its value in the agricultural industry.

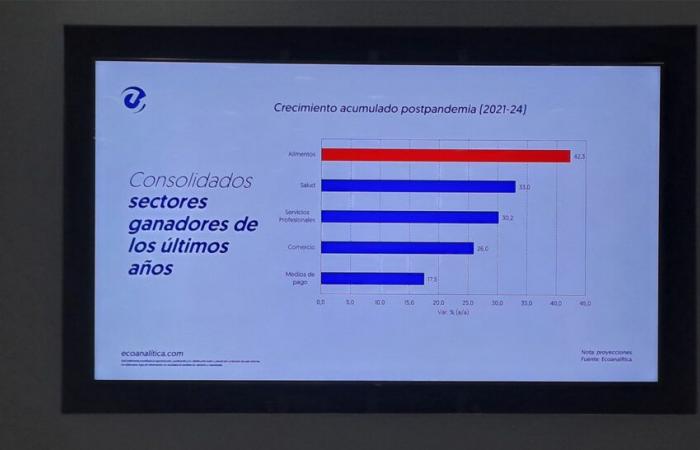

Likewise, they spoke of an important margin in both the food and health sectors, which, being essential, do not stop generating consumption despite how depressed purchasing power is.

Not in vain, Between 2021 and 2024, there has been accumulated growth of 42.3% in the food sector and 33% in the health sector, the experts pointed out.

Oliveros and Palacios clarified that, despite the opportunities that this represents, there is high competition, so the best way to stand out in the market is to offer differentiating elements with quality proposals or schemes that allow costs to be lowered to be competitive through prices.

Oliveros highlighted that many companies are working on these elements, with financial engineering processes, to reduce costs, pay the minimum possible taxes and optimize productionin addition to finding mechanisms different from those of the competition.

«It is not only reducing costs, but also innovating, how I do things differently. Many companies are working on technology, incorporating elements of automation. In artificial intelligence and its sales and customer service processes there is a reduction in costs. They are elements linked to optimization»he expressed.

Target the bottom of the pyramid as a sales strategy

According to the representatives of Ecoanalítica, another factor to take into account is related to the strata to which companies direct their goods and services, since 85% of Venezuelan consumers generate individual incomes of less than $300 per month.

They indicated that mass consumption companies should target the base of the pyramid, despite low wages and impoverished purchasing power.

«There are many areas of opportunity here, in understanding the consumer. There is a big mistake in assuming that 20% can buy and 80% can’t. It turns out that there are opportunities in these population segments, people buy in any stratum, they just buy differently and need an adequate offer for it. “That’s where the opportunities for companies are,” argued Asdrúbal Oliveros.

The national industry grows, but with barriers

Aside from the companies that innovate and stand out in the market, the vast majority try to adapt to an adverse context and find obstacles to increasing production, even having the capacity to do so, because there is not enough consumption.

This was the scenario described by Attilio Granone, member of the board of directors of the Venezuelan Confederation of Industrialists (Conindustria), in a presentation he gave about the outlook for the national manufacturing sectoron June 13, in the Padre Gustavo Sucre auditorium of the UCAB.

(See also: 18 perspectives on business in Venezuela provided by the UCAB 2024 Business Congress)

Granone explained that the Venezuelan industrial park has been one of the great victims of the approximately 80% drop in GDP that Venezuela suffered between 2014 and 2021. because it reduced the number of factories, from more than 12,000 to the current 2,072. In other words, in 2024 there will be around 17% of the industries that operated before the crisis.

In this negative scenario, the growth in the use of installed capacity of companies seems to be hopeful, pues went from 18% to 37.6% in the last five years.

However, since reaching its peak of 39.9% in the fourth quarter of 2022, it fell as a result of a disappointing 2023 in terms of production and consumption.

High operating costs and low competitiveness

Granone explained that the low percentage of use of installed capacity means that «more than half of any company in the country is unemployed», making it impossible to improve competitiveness, since the operating costs are the same, but the units produced are less than half. That differential ends up being transferred to the price.

Compared, the use of average installed capacity of countries such as Colombia or Brazil —neighbors of Venezuela— is 73% and 79%, respectively, so they do use their costs in more solid production.

«Every product that leaves the company here is going to be more expensive to produce. To compete with products from Brazil or Colombia, we have to figure things out. “When you wonder why everything is more expensive, there is a reason.”he reflected.

Added to this barrier is the high tax burden to which companies are subjected. The data shows that Tax collection in dollars increased 94% since the beginning of 2023thanks to a greater emphasis by the Government on collecting taxes to finance itself in the face of the weakness of the oil sector.

«“We have replaced the generation of State resources and we are the ones who are providing those resources.”highlighted the also president of the Association of Graphic Arts Industrialists (AIAG).

Beyond all the difficulties facing the sector, Granone pointed out that the good news is that, by 2024, Conindustria expects an increase of 8.8% in national manufacturing production at the end of 2024after the first quarter of the year closed with an increase of 16.9% compared to the same period in 2023.

The industrialist emphasized, however, that the high percentage is due to a very low base last year, but that it is still insufficient to celebrate.

♦Text: Brian Contreras/Photos: Christian Lazo and Brian Contreras