Bloomberg — A frenetic two-week period for GameStop Corp. (GME) investors — which included an annual meeting thwarted by a technical glitch and the company’s most visible shareholder reshuffling its portfolio — has left the stock price virtually at a standstill. the same place where it started.

Also read: GameStop soars with the return of “Roaring Kitty”

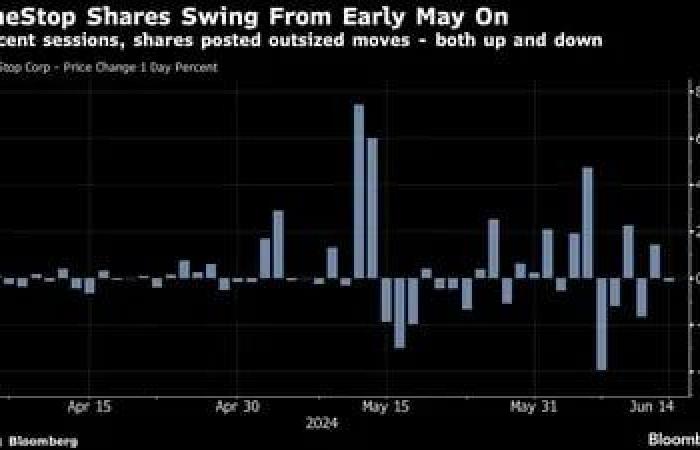

Shares of the video game retailer, which are up 24% since the beginning of the month, have experienced double-digit percentage swings in each of the last 10 sessions. While that kind of volatility is common in the world of meme stocks, GameStop’s catalysts have been anything but typical. For example, on Thursday, when the stock rose 14% despite technical difficulties that forced thousands of GameStop speculators to search for unofficial streams on Twitch, begin to.

‘Roaring Kitty’ and meeting glitch spark GameStop volatilityGameStop shares rise.

Just hours after the postponement, Keith Gill – the meme stock investor known online as “Roaring Kitty” – posted a screenshot showing that he had exited his 120,000 call options while adding a bunch of shares. The post on Reddit, where Gill is known as “Deep F–ing Value,” showed that Gill no longer had GameStop call options that expired next week and had a strike price of $20. Instead, the screenshot showed that he held more than nine million common shares, up from five million on Monday, a position valued at more than US$250 million and that would place it among the largest holders of the company.

Of course, when it comes to meme stocks, the retail audience is key. Indeed, retail investors’ adoration of GameStop CEO Ryan Cohen has led others to jump after Gill or double down on their own bets. With Gill’s options unloaded, the contract with the highest open interest entering Friday was a 128 call that needed the stock to rise more than fourfold to get into the money by the end of the session.

‘Roaring Kitty’ and meeting glitch spark GameStop volatilityGameStop shares have been rocking since early May.

Iterations of that contract have been trending for weeks, since Gill’s return to social media platforms X, Reddit and YouTube. Hundreds of thousands of loyal fans flocked to her livestream last week, where she touted her stake in GameStop and her faith in Cohen. Meanwhile, shareholders must wait until Monday to attend delayed company meeting.

The enthusiasm surrounding GameStop has been evident with how much it has traded in recent weeks. More than 615 million shares changed hands this week, which represents a slight decrease from last week’s more than three-year high, 776 million. But it’s still the sixth week in which volume is more than double normal since the original meme craze faded.

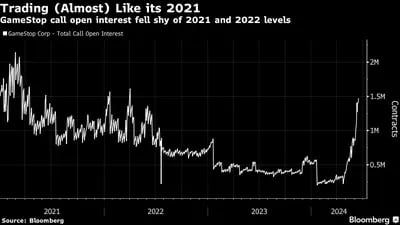

Meanwhile, the number of call options outstanding soared to its highest level in two years, as traders take leveraged bets that stocks could surge higher.

‘Roaring Kitty’ and meeting glitch spark GameStop volatilityNegotiation (almost) as in 2021.

Despite all the maneuvers, GameStop shares closed Friday just below $29, only slightly above where they were at the end of trading two weeks ago. In between, the stock has seen wild jumps, and the company has taken advantage of those moves to sell shares and shore up its balance sheet. This week, it completed an offering that raised $2.14 billion, and in the past month it has brought in more than $3 billion in new capital.

GameStop’s improving treasury position led skeptics like Andrew Left to close their bearish bets. But experts still wonder what’s next for the retailer that has seen its sales continually decline.

“It’s clear that GameStop has less fundamentals,” said Rohan Reddy, research director at Global X Management. “All of this points to a greater state of euphoria.”

Read more at Bloomberg.com