The last fifteen years have been magical for the stock market, but don’t expect them to last. While it is true that US stocks may have the bright future that markets are currently predicting, the cost of growth will mean greater volatility.

In the wake of the financial crisis, investing solely in the S&P 500 has provided huge returns with relatively modest risk. Except for the occasional bad month, especially around the pandemic, there have been long periods of smooth and continuous gains.

Market volatility is about to reappearThe last decade and a half has been an exceptionally good time to invest in the S&P 500 based on cumulative returns over various 15-year periods.(Bloomberg)

Compared to previous 15-year periods, there have been much lower returns and similar, if not higher, variability in most months.

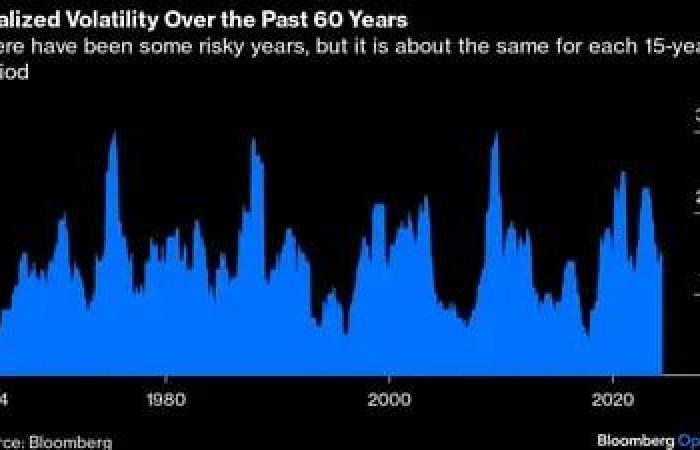

The chart below shows the annual volatility of monthly returns over the last sixty years. Although recorded annual volatility has experienced certain high-risk years, in most cases it has fluctuated around a similar range and is, on average, more or less the same over each 15-year period.

All of this means this: On a risk-adjusted basis, the last 15 years have been extraordinarily good to be an investor.

Market volatility is about to reappearThere have been a few years of risk, but it is roughly the same for every 15-year period in the last 60 years.(Bloomberg)

And the risk outlook looks even better.

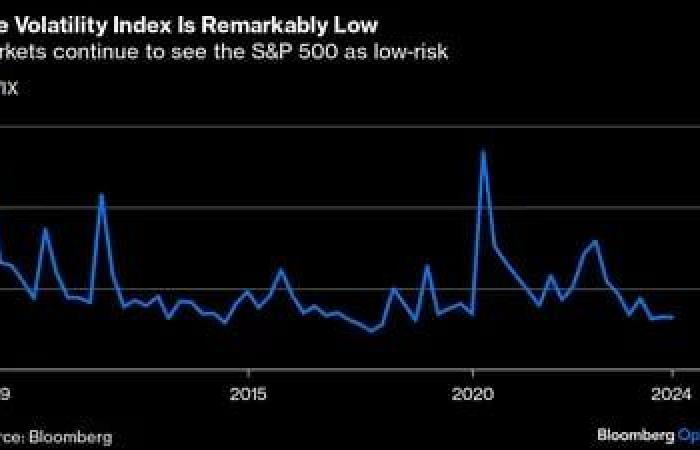

Stock prices look forward and appear to be counting on a profitable future for the S&P. The S&P 500’s implied volatility (the volatility suggested by one-month options contracts) has also been notably low lately, which indicates that markets continue to expect low risk.

Market volatility is about to reappearMarkets continue to view the S&P 500 as low risk.(Bloomberg)

Don’t be too complacent. A transformative period may well be imminent for the United States and the global economy, but it will also mean more risks.

First, much of the S&P’s growth is being driven by the so-called “Magnificent Seven” technology stocks.

There have been other periods of extreme concentration: The largest “Nifty 50” stocks dominated markets in the 1950s and 1960s, when the top 10 stocks represented a larger proportion of the S&P than they do today. But concentration levels are increasing, and at the rate big tech stocks are growing, market concentration will reach record levels in the coming years.

That means less diversification if you own the S&P 500. True, it could also mean less risk, because these are very large, mature companies, which tend to be less volatile than smaller ones. And past periods of high concentration were not especially volatile.

Still, concentration leaves investors (and the broader economy) more exposed to what happens to a few stocks rather than many. And in terms of diversification, seven is much less than 50, and all seven stocks are in the same industry that is not yet fully mature. This argues that this era of concentration will be riskier than in the past.

To be clear, the argument is not that technology is not the future. Artificial intelligence may well make the entire economy more productive, and big tech companies (especially Nvidia) are poised to reap the rewards. Rather, the argument is that too little attention is being paid to how difficult the path to that future will be.

Periods of extraordinary innovation are inherently unpredictable. Over the next decade or so, there will be many false starts, with overinvestment in some areas and underinvestment in others.

No one really knows how AI will transform the economy, and while it could justify the market’s positive growth prospects, there will be a lot of creative destruction along the way. That means more volatility in the stock market, especially among the Magnificent Seven.

There is another reason to expect more instability: The US economy is likely entering a period of higher interest rates and inflation. These periods tend to be accompanied by greater volatility across the board, including stock valuations.

So what to do with the VIX predicting low risk?

The Bank for International Settlements speculates that this may be explained by the growing popularity of structured investment products that aim to reduce risk for investors. He says these products employ a trading strategy that has tempered S&P volatility.

But its popularity and effectiveness may change in a more extreme macroeconomic environment. Additionally, the VIX (CBOE Volatility Index) is quite short-term (predicting volatility over the next month) and does not take longer-term structural forces into account.

Of course, higher volatility comes with benefits and risks. A transition economy presents unprecedented opportunities for businesses and investors alike. However, the one thing no one should expect is stability.

This note does not necessarily reflect the opinion of the editorial board or of Bloomberg LP and its owners.

Read more at Bloomberg.com