Dedollarization, that process that makes more and more countries move away from the US currency, is underway. And although for many it is an intermittent trend, with ups and downs for several decades, in recent months it has gained strength that has not been present other times.

A clear case is that of China, which has not only been managing its international trade in yuan since last year, but is attracting investments to its country in its national currency.

The momentum of the Asian nation is dragging other countries with it, among which neighboring Russia stands outwhich under the leadership of Vladimir Putin has outlined the de-dollarization strategy as a way to confront the set of sanctions imposed by the West, within the framework of the war with Ukraine.

The two Asian giants are part of the BRICS bloc and together with a conglomerate of more than 8 countries – covering more than 45% of the world’s population – they are looking for a way to take power away from the dollar.

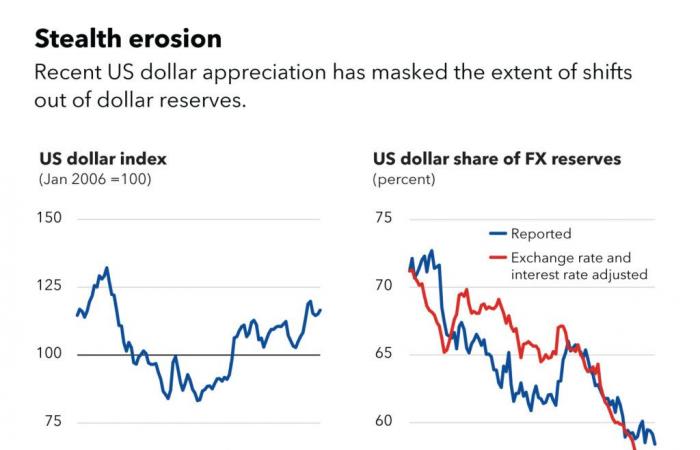

Their actions are becoming more and more noticeable, even as the US currency remains firm and It continues to dominate world reserves at 60%.

The signs of de-dollarization are increasingly evident, highlighting the increase in gold purchases by central banks and the inclusion of currencies other than the dollar as reserves.

All of this, as a result of a reconfiguration of the world economic order which is influenced, in large part, by the policy of imposing sanctions implemented by the US and its allies.

Central banks have bought more gold in recent years than since records began in 1950. China, Russia and India are the nations that have turned the most to the precious metal as a medium to reduce your dollar holdings.

The weakening of the dollar It is already recognized by organizations such as the International Monetary Fund (IMF), which in a recent report indicates that the inclusion of new currenciesas part of the reserves, has been causing a “slow erosion” of the role of the dollar.

These non-traditional reserve currencies are attractive to reserve managers because they provide diversification and relatively attractive returns, and because they have become increasingly easier to buy, sell and hold with the development of new digital financial technologies.

IMF report.

Who can replace the dollar?

The path of events highlights a shift in confidence in the US dollar towards other safe haven assets. A scenario in which the main question that many ask is What currency could take the place of the dollar?

There are 180 currencies recognized as legal tender in different countries and territories around the world, and there are other reserve currencies such as the euro, the Japanese yen, the British pound and the yuan.

The Chinese currency is emerging as one of the favorites, but there are more and more digital currency options that are entering the competition, including those that central banks plan to launch. It is worth mentioning in this regard the initiative carried out by the BRICS, advancing in the development of its own payment system based on CBDC and its own stablecoins.

Even though in the immediate bitcoin (BTC) and other cryptocurrencies They don’t look like the assets that could replace the dollarin the face of de-dollarization, many experts agree that it is an option.

In this way, in the new financial system that is being formed, bitcoin can be integrated into the alternatives available to countries seeking economic independence. An example of this is El Salvador and its commitment to having reserves in BTC. Unrealized gains exceed 50% of the investment.

On this topic, Andrew Peel, an expert in Digital Asset Markets at Morgan Stanley, believes that, as the search by States for alternatives to the dollar continues, cryptocurrencies such as bitcoin become in new attractive models of trade and investment.

Bitcoin will gain ground

The history of Bitcoin is marked by the minority support it had in its beginnings, accompanied by a stigma that associated it with criminal acts for a long time.

The decentralized nature of the network, governed by a philosophy that promotes financial freedomstill generates distrust among many members of traditional finance.

However, the resilience of the currency created by Satoshi Nakamoto is paying off. Bitcoin covers more ground every day. BTC adoption is on the rise, demonstrating its ability to survive. There are already more than 800 million people around the world who own the cryptocurrency.

Its revaluation in the market awakens the appetite of many institutional investors and its drive led to achieving the unthinkable: the approval of bitcoin spot ETFs in several markets, the United States being the highlight. Now, there are fewer who doubt that the digital currency has gained “safe haven” statusespecially in the conflictive environment that characterizes the current political agenda.

«On the one hand, cryptocurrencies can become a global reserve or an alternative payment system. As a digital commodity, bitcoin can make a small contribution to the reserves held by central banks,” analysts at the CoinUnited exchange point out.

But given the current resistance of many central banks to accepting the cryptocurrency (mainly questioning its volatility), some drawbacks are recognized for States to decide to add bitcoins to their reserves.

Such a situation could change in the future, as BTC is perceived more as a digital product and not as “a speculative asset”, as predicted by Jim Thorne, Market Strategist at the Canadian wealth management company Wellington Altus.

For Thorne, the role of bitcoin in the coming economic situation will be crucial, since – in his opinion – the digital currency will end up becoming a traditional asset.

Bitcoin will be a safe haven and attract a lot of capital. It will become a competitive store of value for all other stores of value, which could lead to a shift in investment trends away from the real estate sector.

Jim Thorne, Market Strategist at Wellington Altus.

«Bitcoin demonstrates many attractive characteristics as a bit asset or reserve asset. It may not become the next international reserve currency, but at least “could compete with physical gold as part of the options,” Peel ruling.

A conclusion shared by cryptocurrency expert Kent Phillips, who draws attention to the consolidation of bitcoin like the digital gold of the Internet. Although he thinks the currency’s recognition as a reserve asset will take longer, he is confident that “its limited supply and a global community that manages it and protects it from corruption” will end up giving the digital currency an advantage.