Investing.com – After Tesla’s (NASDAQ:) shareholder meeting last week approved Elon Musk’s $56 billion compensation package, as well as the company’s administrative relocation to the City of Austin, Texas, The shares of the electric car manufacturer started this week with gains of more than 4%, while good news was known for the introduction of its autonomous vehicles in the Chinese market.

With a boost of 4.6% in the first hours of trading this Monday, June 17, Tesla shares stood at $186.16, which according to InvestingPro It has a profit potential of around 2%.

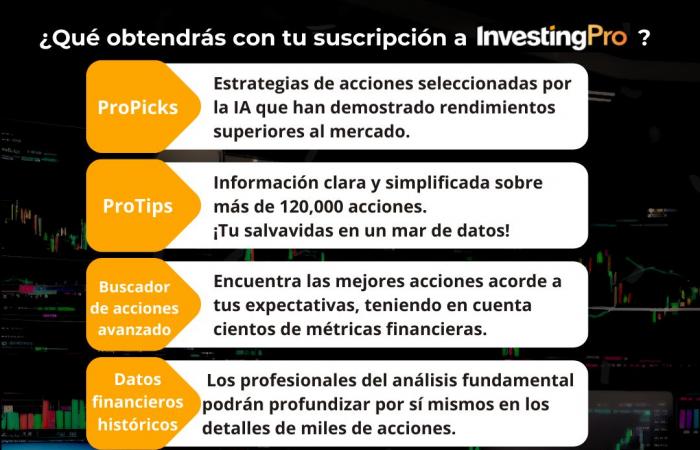

Source: InvestingPro

According to 12 mathematical models of the Fair Value tool of InvestingProthe target price for Tesla shares is $189.74, while for 41 analysts it is located at $182.88.

The Fair Value (VR) tool is a financial asset valuation method that uses mathematical models to estimate their current market price.

VR models are based on various factors, including:

Historical market data: Past prices of similar assets are analyzed to identify patterns and trends.

Asset characteristics: Aspects such as risk, liquidity and profitability of the asset to be valued are considered.

Current economic conditions: Macroeconomic factors such as interest rates, inflation and GDP growth are taken into account.

There are different mathematical models for asset valuation, each with its own strengths and weaknesses. Some of the most used models include:

Discounted Cash Flow (DCF) Model: This model estimates the present value of the future cash flows that the asset is expected to generate.

Multiple valuation model: This model compares the asset to be valued with similar assets that are already listed on the market and assigns a multiple appropriate to its characteristics.

Risk-based valuation models: These models consider the risk of the asset and incorporate it in the final valuation.

The Fair Value tool, together with its mathematical models, provides a rigorous and transparent methodology to estimate the value of financial assets in various situations. Take advantage now by subscribing to InvestingPro with a special discount for a limited time!

We recommend you read: Elon Musk’s euphoria goes out! Tesla falls after mega payment of 56,000 million dollars. Should we invest?

Tesla obtains approval to test its autonomous driving system in Shanghai

The upward momentum in Tesla shares coincided with approval to test its advanced driver assistance systems on some streets in Shanghai, marking progress towards the implementation of its Full Self-Driving (FSD) suite in the competitive Chinese automotive market.

According to Bloomberg, Tesla secured permission to carry out these tests in Shanghai. This development represents a step forward in Tesla’s global efforts to expand its self-driving technology outside of the United States, with China being the first country to make this leap.

In addition to Shanghai, the American automaker could get approval in Hangzhou, located in Zhejiang province, where local officials are considering allowing Tesla tests, although they have not yet made a final decision.

Initial testing in Shanghai will be carried out by Tesla personnel, who will operate the vehicles on public roads. The company’s initial plan is to test 10 vehicles, but over time more cars and cities could be included in the early phases of testing.

Tesla is in the early stages of rolling out its vehicles on Chinese streets. In May, it gained tentative approval to operate FSD in China, after clearing several regulatory hurdles that included mapping and navigation functions. To do this, Tesla collaborated with the Chinese company Baidu (NASDAQ:), resolving concerns about data security, an issue that had worried government authorities.

The company will not only collect millions of miles of data, thus improving the accuracy and robustness of its system, but will also encourage Chinese consumers to opt for its vehicles in a market where competition in electric vehicles is intense and many models are more economical.

CONGRATULATIONS! You are eligible for a spectacular discount to purchase InvestingPro’s powerful tools. As a reader of this article, we give you the code BESTPRO so you can purchase your subscription with an additional 10% discount about current promotional prices. ONLY 10 COUPONS AVAILABLE! Just click here or select one of the following options to apply your offer:

Note to reader:This article is not an investment recommendation. It is suggested to perform a thorough analysis using InvestingPro tools before making any investment.