Can India be the new China? The country has already surpassed the Asian power in population and is on track to jump from the fifth largest economy in 2024 to the third in 2027, surpassing Japan and Germany in just three years. In a market context where growth is scarce globally, India has stood out with a growth of 7% in real terms. “It is exciting to be able to see the transformation towards which the country is heading,” acknowledges Hiren Dasani, co-head of Emerging Markets Equities at Goldman Sachs AM and lead manager of the Goldman Sachs India Equity Portfolio, on a recent visit to Madrid .

And what is more important for the investor, who India is one of the few emerging markets that has managed to translate economic growth into business profits.. Because this is one of the key messages that Dasani shared with clients during his presentation, which India is not only in a good place as a country but as an asset class.

“We are facing a very liquid equity market, with an investment universe of more than 300 companies with more than 1,000 million capitalization. There’s also more than 100 with more than 10,000 million when in 2023 there was not even one”, highlights the manager. The country’s rise has been accompanied by an improvement in its stock market. In 2003 the market cap was 3,000 million dollars at the 4.7 billion at the end of 2023.

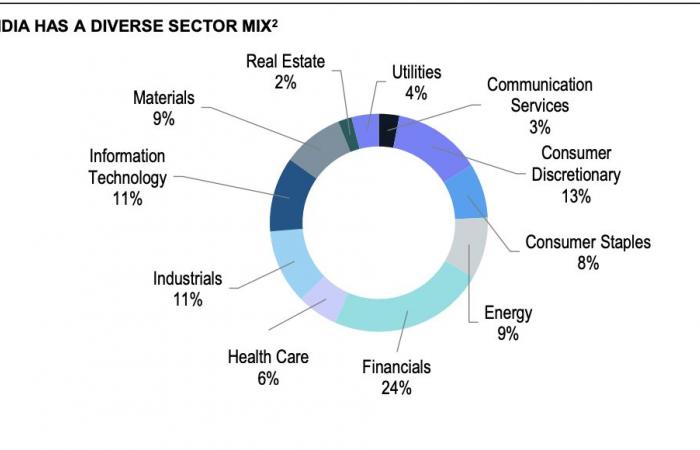

Besides, Due to the composition of the indices, more linked to the domestic cycle, they tend to show a lower correlation with global equities. As we see in the previous graph shared by GSAM, it has a very low correlation with other large emerging equity markets, such as China, but also with developed markets such as Japan and the United States. Likewise, it is a fairly balanced index sectorally:

And another positive factor: that From a technical point of view it is not an overbought market. The allocation of foreign funds is maintained at conservative levels and, where there is international capital exposure, it is biased towards large companies. “Foreign investors are ignoring small caps and IPOs, which leaves room for our management team to generate alpha on undiscovered gems,” he explains.

And Dasani highlights the other side of that balance as a positive point: that the exposure of domestic investors to their national equities still has a lot of room to grow. Domestic investment in India is mainly channeled through real estate. That said, in recent years there has been an upward trend. Domestic flows to funds have remained positive for the last four years, the percentage of savings in variable income is consolidating above 5% and flows to domestic funds through systematic savings funds (their SIPs) have increased.

Impact of the economy on fundamentals

At a fundamental level, the x-ray also presents a benign framework. After reaching a peak in 2018, Non-performing loans have fallen to their lowest level since 2008. As Dasani highlights, the deleveraging of companies is notable. The corporate debt ratio as a percentage of GDP has fallen from 62% in 2015 to 51.3% today.