Key facts:

-

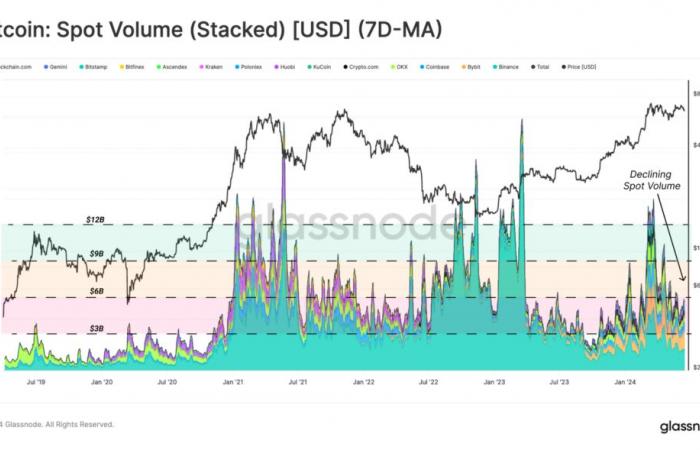

Trading volumes in the derivatives and spot markets decreased.

-

For Glassnode, a decisive price movement is necessary to increase trading activity.

With bitcoin (BTC) trading around $66,000 (USD) a week ago, it continues within the consolidation period that began three months ago in the area below its new all-time high.

“A balance appears to be established in both demand and sales, leading to relatively stable prices and a notable lack of volatility,” said analysis firm Glassnode. In her view, “this stagnation in market movement translates into a degree of boredom, apathy and indecision on the part of investors.”

While a balance is formed between supply and demand of bitcoin, spot and derivatives trading volumes are down, as the chart shows. “Historically, this suggests that a decisive price movement in either direction is necessary to stimulate the next round of market activity,” Glassnode noted.

For now, the demand side has been enough to absorb the selling pressure, but insufficient to promote further bullish growth. As the graph shows, BTC price should rise only 10% to surpass its all-time high (ATH) of USD 73,700 reached in March, a level that surpassed the peak of USD 69,000 marked three years earlier.

“Usually, immediately after a new ATH, the market needs enough time to consolidate and digest the introduced excess supply,” Glassnode explains. He indicates that, as a balance is established, this leads to a decrease in realized profits and selling pressure, which contributes to passing resistance.

As reported by CriptoNoticias, US stock markets have declined in correlation with bitcoin recently due to a tightening of future monetary policy. The Federal Reserve (Fed) has planned an interest rate cut for 2024, instead of more as it had previously anticipated and the market expected.

Such a scenario takes place in the middle of the northern hemisphere summer, a season from June to September in which markets tend to fall. Therefore, the consolidation period could be extended, unless a catalyst such as the expected launch of Ethereum exchange-traded funds (ETFs) in the economic powerhouse reinforces demand or bearish events encourage supply.

Almost 90% of BTC are in profits

Despite the sideways market conditions, bitcoin investors have largely remained profitable. Currently, on average maintain a solid unrealized profit of around 120%. Meanwhile, 87% of the circulating supply is in profits, as seen below.

While such levels of unrealized gains could motivate investors to sell, the failure to do so reflects his bullish conviction. This strategy of hodl (maintaining the currency) is key for the price to rise as soon as demand gains strength.