Nvidia fills headlines in the economic press, both for its record profits and its spectacular rally stock market which has led it to become the most valuable company on Wall Street. So far this year alone, the shares of the maximum exponent of artificial intelligence They have shot up 170%. But the situation is not the same for all companies related to this technology: many of them fall on the stock market.

In fact, if we take as reference the Nasdaq CTA Artificial Intelligence Index, the index that collects the performance of companies involved in the creation, development and use of artificial intelligence technologiesjust over half of its components accumulate annual falls.

In the worst case, these decreases exceed 85%, but, in general terms, they are between 10% and 30%. Among the companies that have lost value in the market in 2024 are names as well-known as those of Intel, Tesla, Dassault, Taiwan Semiconductor, STMicroelectronics, Salesforce, Infineon, Alibaba or C3.AI.

The names of the companies that do go up on the stock market are also known. IBM, Palo Alto, Marvel Tech, Palantir, Qualcomm or Micron Technologies are some of them. Likewise, the group of winners includes Amazon, Microsoft, Apple, or Meta, who are also exposed to the phenomenon of artificial intelligence. The advances range from 10% to 50%, although Some companies accumulate promotions that exceed 60%.

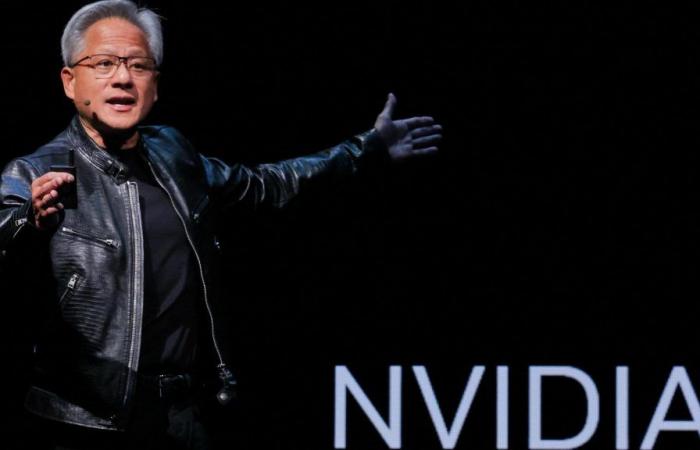

And Nvidia leads those increases. This same week, the chip designer surpassed Apple and Microsoft as the largest listed company in the S&P 500. “This achievement is driven by an unprecedented rally, as Artificial intelligence (AI) has gone from being a media phenomenon to becoming a reality”, considers Ben Laidler, eToro analyst.

For the most part, experts remain optimistic about the company co-founded and directed by Jensen Huang. As an example, Generali Investments expects that “Nvidia’s share in the AI microchip market remains above 80% for several yearsthanks to the company’s technological leadership over its rivals and the high barriers to entry in the sector.”

Going forward, “the strong growth of Nvidia, in which Generali Investments remains “fully invested,” “will inevitably carry over to the supply chain.” Therefore, the firm is convinced that “companies that supply components or services to AI graphic processing units will also win.”

The pull of Nvidia, and the rest of the values that rise during the year, means that The Nasdaq CTA Artificial Intelligence Index has a positive annual balance of 8.55%.

It is not the only index that reflects the evolution of companies with exposure to AI and that increases in 2024. For example, the S&P Kensho Artificial Intelligence Index, which identifies and follows companies that lead the advancement in artificial intelligence technologies and their applications, rose 14.43%.

At the same time, the ROBO Global Artificial Intelligence Index, designed to track the performance of leading companies in innovation in artificial intelligence in various industries, rose 10.30%.

Among the indices most used by the market to take the temperature of securities that are related to AI, the only exception is the NYSE FactSet Global Robotics and Artificial Intelligence Index. The indicator, which includes global companies involved in robotics, lost 0.91%.

Potential or bubble

Thus, artificial intelligence already has stock market winners and losers. Companies that rise or fall on the stock market due to their greater or lesser exposure to a market whose potential, According to UBS analysts, it could amount to 1.16 trillion dollars in 2027. They believe that “it is time for investors to size up and take advantage of the investment opportunity.”

Even though “the rise of AI so far has greatly benefited the largest technology companies”, at UBS they consider that “that is a characteristic of the new investment landscape” in this type of technology “and not a mistake.” They expect the market “to be dominated by an oligopoly” and “monolithic players throughout the value chain.

Therefore, in addition to semiconductors, they like “oligopolies that are positioned throughout the technological ecosystem, encompassing chips, cloud computing, and generative AI models and applications”.

The high expectations regarding artificial intelligence have quickly raised a question: Should we fear a technological bubble? In their response to this question, the experts at Generali Investments highlight that “The sector still has a significant upward path” and that they would take advantage of “any weakness as a buying opportunity.”

Because? “We are coming out of one of the worst periods in 18 months for technological fundamentals since the great financial crisis of 2008”. “With significant negative earnings revisions behind us,” they believe, “we can expect a strong cyclical recovery in technology, even forgetting the enthusiasm around AI.”