Investing.com – At mid-session this Monday, June 24, NVIDIA (NASDAQ:) shares showed a significant correction of around 6%, marking its third downward session in which it has erased more than 407.4 billion dollars (mdd) in its market capitalization value and losing the threshold of 3 trillion dollars in capitalization value. So far, this would be its worst daily decline since the 10% drop recorded on April 19.

In this way, the titles of what at times occupied the first position among the most valuable public companies in the world, surpassing Apple (NASDAQ:) and Microsoft (NASDAQ:), have reversed the gains since its split at a rate of 10 to 1. Between June 10 and noon today, the shares show a loss of 1.5% when trading at $118.64. Still, the stock retains a gain of approximately 8.2% so far this month.

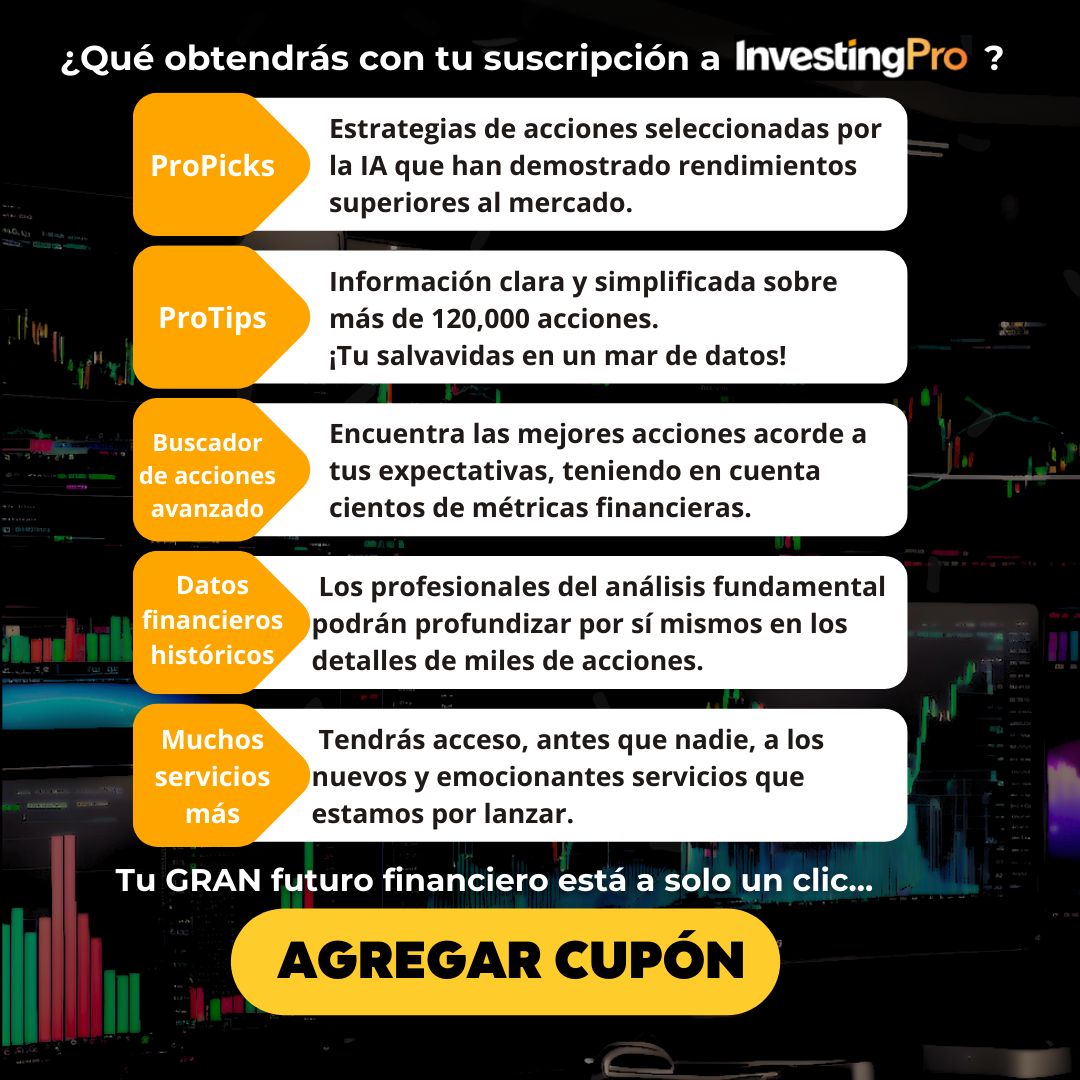

If you are an NVIDIA investor and don’t know how to neutralize the NVIDIA correction, take a look at the selections of the most advanced Artificial Intelligence: the ProPicks of InvestingPro.

| OFFER ESPECIAL:-10% EXTRA in 1 and 2 year plans There’s little time left! |

The strategies ProPicks are AI-driven picks of stocks that have the greatest potential to outperform market benchmarks.

Being a subscriber of InvestingProyou will know that NVIDIA is part of two of the strategies ProPicks that have delivered the most returns to investors: “Technological Titans” and “Outperform the S&P 500”.

Since the launch of the strategies, in October of last year and until the beginning of this month, the “Tech Titans” selection has delivered a return of +65.90%, while “Outperform the S&P 500” has shown a return of +28.21% , surpassing the benchmark S&P 500 index by +14.86%.

And since NVIDIA joined the “Outperform the S&P 500” strategy, the stock has risen almost 200%.

In pursuit of the highest market returns, strategies are updated monthly, informing investors which stocks they should buy, hold and sell each month. This diversification of shares will allow investors to neutralize these falls and even obtain explosive returns in times of correction such as the one NVIDIA has recorded in recent sessions.

So, to find out what to do with NVIDIA stock, you might want to subscribe to InvestingPro since we are a few days away from Artificial Intelligence balancing the strategies and knowing if it suggests keeping or selling the shares.

What is the potential of these strategies? Through an analysis known as “backtesting” it is possible to observe that in the period between January 1, 2013 and June 1, 2024, “Outperform the S&P 500” has delivered an explosive performance of 1,052.6%, outperforming by 782.6 % the return delivered by the S&P 500 of 270%.

And if that were not enough, the “Technological Titans” selection has shown a total return of 1,770.9%, 1,500.8% higher than the S&P 500 in this period.

How to know the real potential of NVIDIA?

The first thing you should do is subscribe to InvestingPro. Today is the time! Now you can get your subscription with a discount up to 50% and If you use the MEJORPRO coupon in this link, you will get an additional 10% discount on the 1 and 2 year plans. This is only valid for a few days!

Let’s say for example that you choose the 1-year InvestingPro subscription: If you apply the MEJORPRO coupon directly at this link, you can get it for less than 4 pesos a day.

But if you want to become a master of fundamental analysis, you can opt for the plan InvestingPro+ for 2 years and the investment you will make with your subscription will be less than 8 pesos per day. It is a unique opportunity!

Since you are subscribed to InvestingProyou can access the ProTips from NVIDIA, which are clear perspectives that record the positive and negative aspects of the company based on the analysis of a sea of financial data; as well as metrics such as its Fair Market Value, calculated from 13 financial models; in addition to the analysts’ target price, company valuations and hundreds of other metrics to do your own analysis and make the best decision.

With your access you will know that there are analysts who are optimistic about NVIDIA’s potential. InvestingPro reports that the consensus of analysts assigns an average target price of $130.38 to NVIDIA, but there are those who grant, in the maximum range, a price of up to $200 per share.

You would also have exclusive, real-time information on the latest adjustments to analyst expectations. For example, today it was reported that Jefferies raised its price target on the stock to $150 from $135 previously, with a Buy rating.

NVIDIA was described by analysts as a “king and kingmaker” within the technology industry, with its strategic decisions having the potential to significantly influence the growth trajectories of other companies such as Marvell and Analog Lab.

As investors, we look for investment opportunities all the time and wonder when it will be time to buy or sell a stock. But that should no longer be a concern, because when using the tools of InvestingProyou will have access to exclusive data and analysis with which you can determine when it is the right time to buy or sell a stock immediately.

with the coupon BESTPRO You will have a spectacular discount when you sign up for our 1 and 2 year plans. LAST HOURS! Get InvestingPro in less than 8 pesos a day. Get it right now by clicking this link!

You can also choose one of the following options to automatically apply your promotion: