Banco Pichincha is the largest in Ecuador and has been in Colombia for more than 50 years. It is part of one of the most powerful Ecuadorian business groups, the Pichincha Group, of which former president Fidel Egas Grijalba, which includes banks in Peru, Spain, Panama, Miami, Casa de stock Picaval, Seguros del Pichincha, Diners Club Ecuador, among other companies, which include media outlets such as Teleamazonas.

Fidel Egas is considered by Forbes to be the second richest man in Ecuador. His flagship company is the bank that is 118 years old and of which he was president from 1992 to April 2015. It was the result of the union of 52 Quito residents who founded it on April 11, 1906, with 600,000 sucres, managed by Manuel Jijón Larrea and a clear vocation for foreign trade working closely with the English firm Glyn Mills Currie.

In 30 days he managed to accumulate 60% of the capital with low-value shares that attracted a large group of people of average fortune, historians say. In 1927, just when the Central Bank of Ecuador was created, Alberto Acosta Soberón took over management, who was there for 44 years. In 1928, it had been capitalized to the considerable sum of USD 3.2 million, giving a strong boost to the bank that had started with 7 employees at the intersection of Venezuela and Sucre streets.

Today Banco Pichincha has 5.6 million clients, 297 branches, more than 6,000 employees. In 2023, 58% of its disbursements of USD 7.5 billion went to productive activities; more than $2.1 billion were injected into agriculture alone.

Landing in Colombia

He arrived in Colombia on June 7, 2011, for 45 years he had offered financial services at the Inversora created in 1964 by investors in Bucaramanga. With a license from the Superfinanciera, it began operations as a bank that June 7, changing its corporate name to that of its parent company, Banco Pichincha. It initially acquired 50% of Inversora and, in 1997, increased its stake to 94.7%.

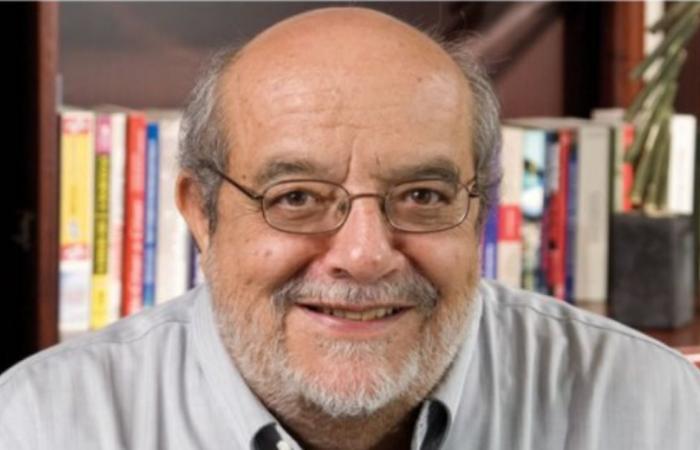

Germán Rodríguez Perdomo, an expert in finance and international relations who graduated from the Externado Colombia University, has been the president of the bank since June 2022.

Pichincha currently has 180,000 clients, the bank account represents 65.3% of the portfolio, business banking is focused on clients with annual sales exceeding $25,000 million and USD 10 million has been invested in the development of the Pibank platform. This is the new bet with profitable and easily accessible products and solutions, which has given good results with a 27% increase in deposits from individuals last year.

In fiscal year 2023, the Bank continued to report losses of $133,118 million, an improvement of 20.98% compared to the previous year. However, the Group continues to invest in its Colombian subsidiary and has capitalized the entity with $139,500 million.

| See also: The strategy with which Alpina conquered the Ecuadorian market

-.