Key facts:

-

Coinbase benefits from the growth of bitcoin ETFs in the United States.

-

Although COIN has increased in price in 2024, it still has a lower price than the launch price.

Shares of the bitcoin (BTC) and cryptocurrency exchange, Coinbase (COIN), they could triple their priceaccording to an analysis prepared by the firm Noah’s Arc Capital Management.

In May 2024, Coinbase recorded revenue of $1.64 billionthat is, a year-on-year increase of 111.98%.

According to the report, the platform increased its investor base and trading volume thanks to the launch of BTC exchange-traded funds (ETFs).

As Criptonoticas already reported, Coinbase custody of the BTC that backs 8 of the 11 ETFs issued. The companies that chose Coinbase are Bitwise, Ark Invest, WisdomTree, Invesco, Valkyrie, BlackRock, Franklin Templeton and Grayscale. Meanwhile, Fidelity, VanEck and Hashdex chose other custodians.

In this regard, the report highlights that “it is clear that Coinbase dominates this sector and is winning the institutional game, as demonstrated by its recent revenue figures.”

It is worth noting that, although COIN shares rose in 2024, They are still far from their historical maximumwhich was $380, as seen in the following graph:

Despite this growth in 2024, Noah’s Arc analysts consider COIN to be undervalued in the stock market and highlight the company’s growth potential relative to other exchanges. In the report they mention:

“Coinbase’s future revenue growth rate is higher at 22.48% compared to the industry average of 5.12%, indicating the company’s impressive performance relative to its peers. The company can exceed the average growth of the sector by 339.44%.”

Noah’s Arc Capital Management Report.

Specialists also consider that Coinbase provides a good service with the custody of BTC and adds that the company “currently has around 4% of BTC in circulation, or 890,000 BTC in its custody.”

This is important because it demonstrates Coinbase’s dominant position within the market, which is not only about holding ETF assets but also to generate commissions for that custody“These are less sensitive to price fluctuations than transaction fees. Therefore, even if BTC prices remain stable, the inflow of ETF assets can still provide a stable income stream,” the analysts explain in the report.

According to data from SosoValue, ETFs bitcoin generated tickets net of money for $14,000 million dollarsfrom the date of its market launch, January 24, 2024.

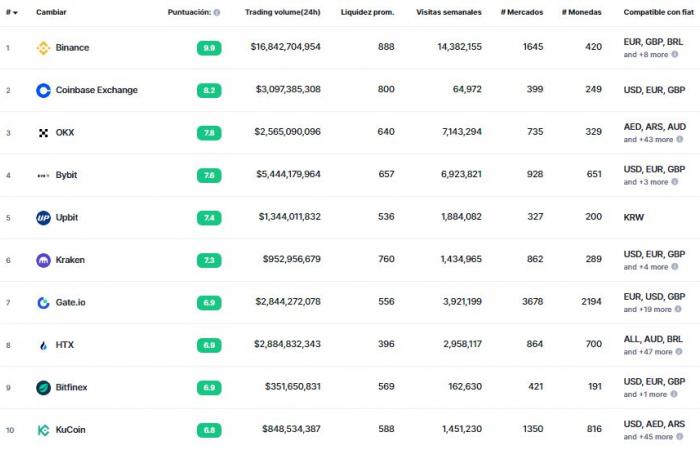

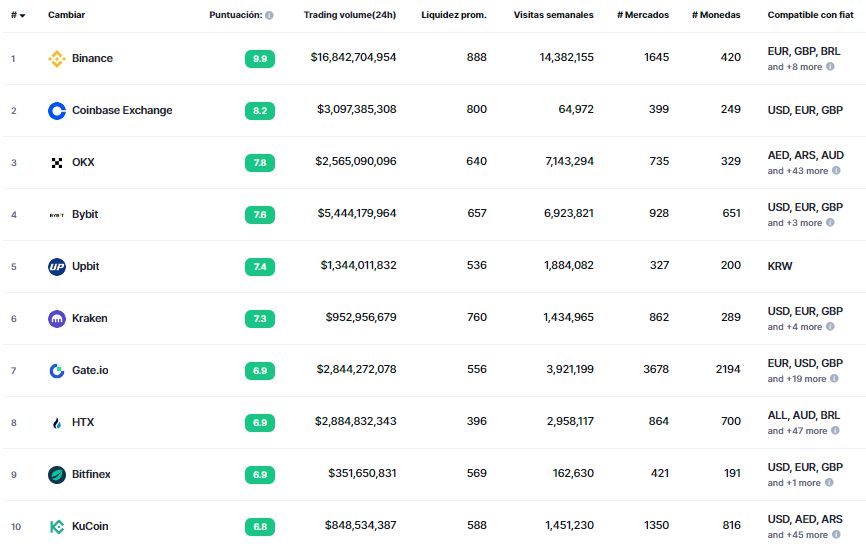

As CriptoNoticias already reported, Coinbase faces tough competition, not from ETFs, but from other exchanges, as the following image shows. The biggest rival is Binance, which has almost 8 times the trading volume, variety of cryptocurrencies, weekly visits and is compatible with 11 currencies issued by governments or financial entities.

But according to the firm’s comparative analysis, “we find that Coinbase’s Forward Price-to-Earnings (P/E) ratio is 199.70% above the industry average, while its growth rate is actually 339.44% above the industry average. This means that buying the stock right now at a 199% P/E premium will give you a growth rate that is 339.44% higher than the industry norm.”

Taking into account that the cryptocurrency market continues to evolve, thanks to the growing institutional interest and widespread acceptanceCOIN “provides an excellent opportunity for shares to trade at a higher premium than the sector median.”

This is following the launch of other products such as Base, the Ethereum L2 network developed by the exchange.

According to Coinbase CFO Alesia Haas during the company’s Q1 2024 earnings conference call: “Looking ahead to 2024, we’re going to make investments. We have planned to be cautious and modest to support the strong performance this year and some of the initial traction that we see, for example, in Base, in USDC and some of these other products, which are not as correlated to prices and volatility of the cryptocurrency market.

A less optimistic outlook

Unlike Noah’s Arc, analyst Gary Alexander argues that there are factors that suggest that COIN is not a good investment for the remainder of the year.

According to his vision, “it involves more risk than reward” due, mainly, to the competitive landscape. “I’m not that optimistic about Coinbase’s prospects in 2024 and beyond,” she opined, adding that the increase in trading on the platform may be temporary.

The analyst also distinguishes that most of the company’s trading income is derived from altcoin trading, something that for Alexander could be detrimental because “the cryptocurrency market will end up converging on a few major currencies.”

According to his projections, “Coinbase has very little strength to preserve its trading volume or user base.” “Stay away and invest elsewhere,” he concluded.