Spot bitcoin (BTC) exchange-traded funds (ETFs) experienced the first net inflow since June 12, with $31 million in capital inflows.

In this way, the 11 financial instruments in the United States They broke the negative streak of seven consecutive business days of net outflows of capital, as reflected in the data collected by the SoSo Value portal.

Yesterday, the Fidelity Wise Origin Bitcoin Fund (FBTC) led the market with an inflow of $48.8 million, bringing its total net inflow to $9.2 billion.

In contrast, the Grayscale Bitcoin Trust ETF (GBTC) had capital outflows, losing 30.3 million dollarsand the ARK 21Shares Bitcoin ETF (ARKB) recorded a minor outflow of $6.2 million.

The world’s largest bitcoin ETF, iShares Bitcoin Trust (IBIT), recorded no inflows or outflows, although its trading volume reached 1.1 billion dollarsaccording to data from Coinglass.

Eric Balchunas, ETF specialist at Bloomberg, commented that Investment in IBIT has increased by 30% since its launchoutperforming the popular QQQ, an exchange-traded fund that tracks the NASDAQ 100 index.

This “two steps forward, one step back” trend is normal, he said. By this he refers to the inflows and outflows of money from the ETFs. In his opinion, investors should get used to it, he added. Furthermore, he pointed out that the amount of money that enters IBIT, 14,000 million dollars, exceeds initial expectations of $12 billion to $15 billion for the first 12 months.

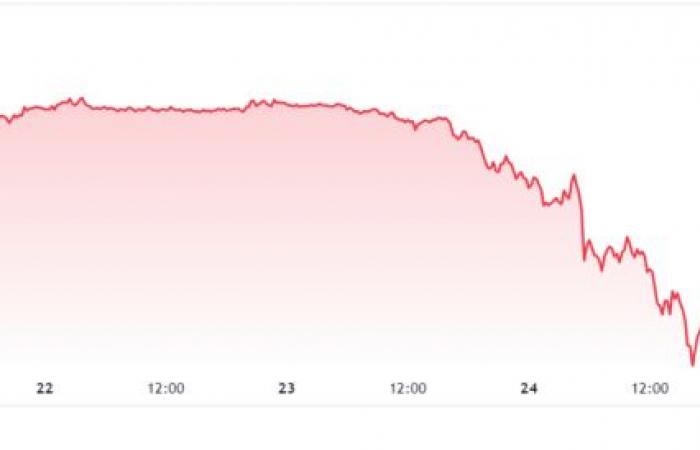

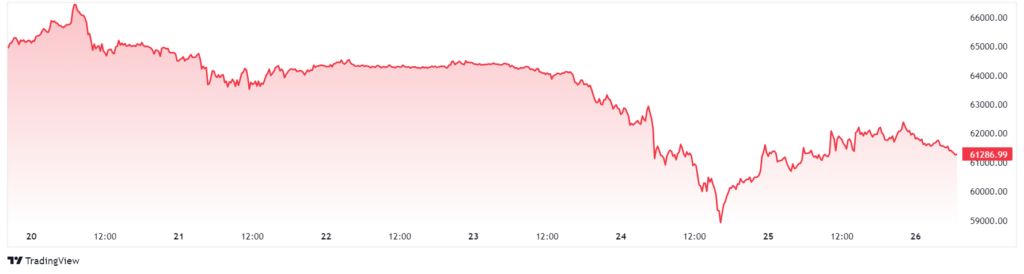

ETFs slightly boosted bitcoin price

The good performance of most ETFs caused the BTC price to recover after falling below $60,000. This occurred after the rehabilitation trustee of the bankrupt Mt. Gox exchange reported that it is about to begin compensation to its users, as reported by CriptoNoticias.

Historically, the market shows concern about bitcoin sales by Mt. Gox creditors upon receiving the refund, due to the large profit taking that they could receive.

However, today BTC has recovered slightly and is around $61,200, even reaching $62,000 overnight, according to TradingView. This reflects that Mt. Gox would not imply great sales pressure (or, at least, that’s what the market expects).

Much less when bitcoin ETFs have accumulated more than USD 15,000 million since their launch last January. When there are capital inflows into funds, as was the case yesterday, it is bullish for the price of bitcoin due to how spot ETFs work as they are backed by the underlying asset.

Spot ETF management companies must purchase and hold bitcoin in their treasuries to back their shares. This process of acquiring bitcoin creates direct and tangible demand in the market. As the amount of bitcoin available decreases, it can lead to an increase in price due to limited supply.