- Polygon noted a bearish market structure and was prepared for further losses

- The rebound in inactive circulation warned of a wave of selling pressure

Polygon Cryptocurrencies [MATIC] saw the downtrend intensify in June. It started with the price falling below the 2-month range on June 11. On June 16, the lows of $0.621 were retested as resistance.

This solidified the bears’ holdings and paved the way for a further move south. At press time, the $0.59 level was the next key resistance. Should the bulls anticipate further losses and stay on the sidelines of the market?

The next level of HTF support was also psychologically important

Source: MATIC/USDT on TradingView

With the $0.59 level turned into resistance, $0.5 is the next psychological and technical support level. It was important in September and October 2023 and launched the massive rally that saw the Polygon cryptocurrency reach highs of $1.29 in May 2024.

Therefore, a movement towards this support in search of liquidity is expected. The market structure on the daily time frame is severely bearish.

Therefore, the $0.5 level might not immediately reverse the downtrend, but perhaps could stop it temporarily.

The CMF was at -0.03 and traders can wait for it to fall below -0.05 to indicate a strong flow of capital out of the markets. The RSI was at 33 and indicated a firm downtrend in progress.

If the indicators continue to fall, it will negatively affect the chances of a bullish defense of the $0.5 support.

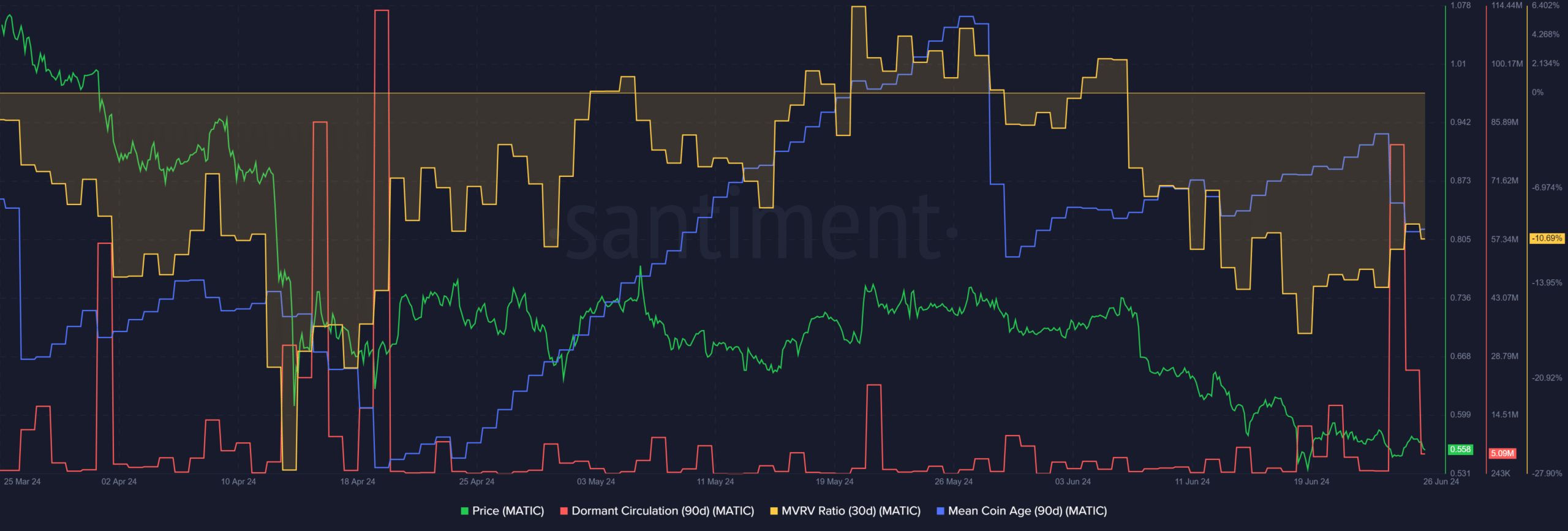

An Increase in Idle Circulation Suggests Next Price Movement

Source: Santiment

On June 24, the latent circulation experienced a large increase. The last time a jump of a similar proportion was seen was in mid-April, when prices tested the $0.6 support several times.

Read polygon [MATIC] Price prediction 2024-25

He noted the capitulation of Polygon’s crypto buyer and a similar scenario was unfolding again.

This could push prices even lower. The MVRV ratio was deeply negative, showing that short-term buyers were at a loss. Any bounce will likely be sold to break even for these traders, making recovery difficult.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.

Next: Jason Derulo’s Cryptocurrencies Pump 6000%, But Is JASON A Scam?

This is an automatic translation of our English version.