- The German government transferred BTC worth millions of dollars.

- However, buying sentiment continued to dominate the market.

The last month of the second quarter of the year has been of the best interest for bitcoin investors [BTC]This was the case as BTC experienced multiple price corrections.

Meanwhile, the German government has taken a measure that could have a negative impact on the price of the king of cryptocurrencies.

Are investors selling Bitcoin?

Data from CoinMarketCap’s revealed that over the past 30 days, BTC witnessed a price drop of over 11%. In the past seven days alone, the value of the coin fell by over 6%.

At the time of writing, BTC was trading at $61,043.62 with a market cap of over $1.2 trillion. Thanks to the price drop, over 12% of BTC investors were left out of pocket, according to data from IntoTheBlock.

While that was happening, the latest Lookonchain tweet release revealed that the German government transferred BTC worth millions of dollars.

To be precise, the German government transferred 750 BTC, worth $46.35 million, of which 250 BTC, worth $15.41 million, were transferred to Bitstamp and Kraken.

As a result, AMBCrypto planned to check the data to determine whether selling pressure on BTC was high.

Our data analysis

of CryptoQuant revealed that the net deposit of BTC on exchanges was high compared to the average of the last seven days, suggesting high buying pressure.

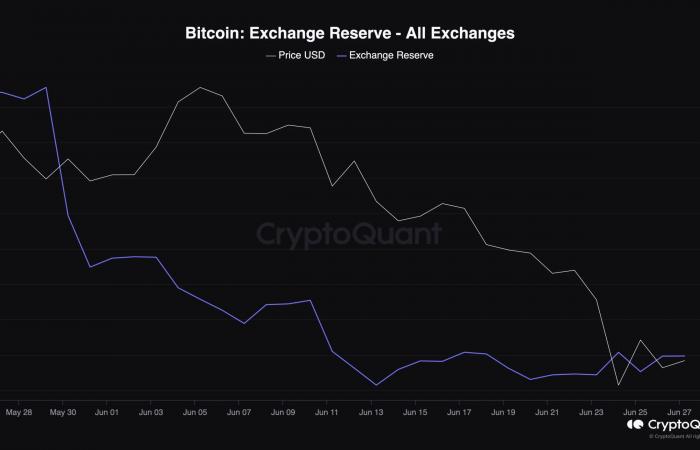

The cryptocurrency king’s exchange reserve also fell sharply last month, further establishing the fact that investors were buying BTC as its price fell.

However, selling sentiment was dominant among US investors as its Coinbase Premium was in the red at the time of publication.

Source: CryptoQuant

What to expect from BTC

High buying pressure often results in price increases. Therefore, AMBCrypto checked Glassnode data and found a bullish metric.

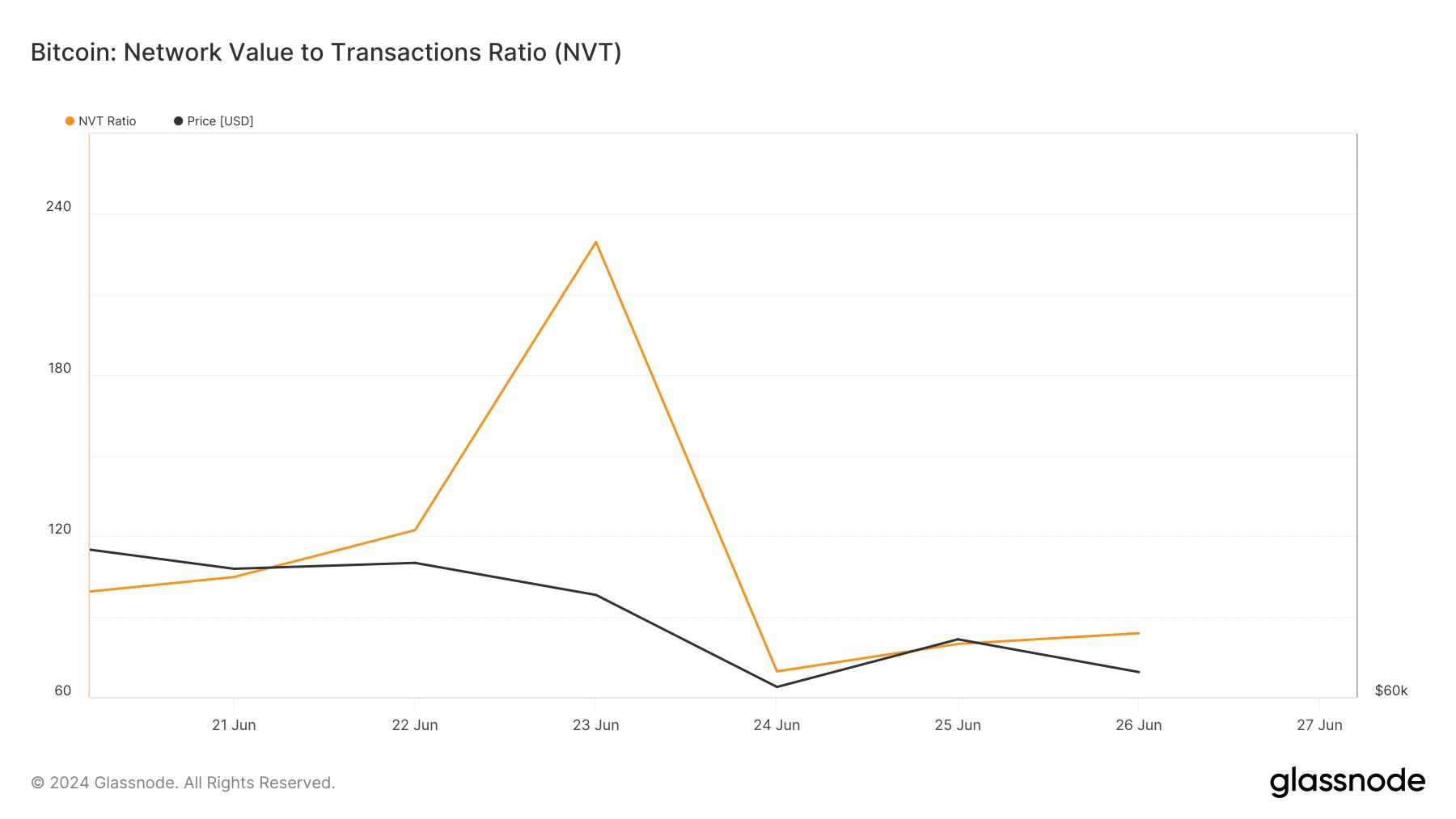

According to our analysis, BTC’s NVT index has fallen sharply over the past few days. Generally, a drop in the metric means that an asset is undervalued, which hints at a possible price increase in the following days.

Source: Glassnode

Read Bitcoins [BTC] Price prediction 2024-25

We then planned to analyze the daily chart of the coin to better understand if it was expecting a price increase. According to our analysis, the BTC Relative Strength Index (RSI) was close to the oversold zone.

This could put more buying pressure on the coin and help push its price up. The Chaikin Money Flow (CMF) also recorded a slight rebound, indicating a possible price increase. However, the MACD remained in favor of the bears.

Source: TradingView

Next: NEAR Turns Bearish, Trading Volume Drops 30% – Is a Pullback Still Possible?

This is an automatic translation of our English version.