Hear

A bright apartment on Av. del Libertador 100, in Vicente López. Large desks with work positions without dividers, smaller tables for team meetings and some scattered rooms for private meetings. Far from what the image of a traditional bank could be, this is how the base of Brubank is configuredone of the main digital banks in Argentina.

Created by Juan Bruchou, former CEO of Citibank, and Pablo Sánchez, former CEO of Mango Payments, Brubank defines itself as a technology company that, authorized by the Central Bank, provides financial services under the premise of simplicity, ease, transparency and immediacy. Six years after its launch and with more than 4 million users, the bank has now shaped a proposal.

Under the motto “the bank of entrepreneurs and start-ups”, the company launched Brubank Empresas, a specific service for small businesses. “SMEs and entrepreneurs are the productive engine of the economy and the largest source of employment in the country. They continue to invest and bet on Argentina, so we want to help them fulfill their dreams and help them grow,” said Juan Bruchou to THE NATION.

The objective was clear: to respond to one of the main pain points of this segment: the bureaucratic burden what different types of operations involve. “Many times, companies had to face extensive processes and present multiple physical papers to request credit, for example. We want to debureaucratize the processes, so that people can concentrate on the business itself and are not dealing with a bank to do it. We want to simplify operations so that, with a few clickscan operate from anywhere, from a line at the supermarket, on the street or on the beach on vacation,” he stressed.

Brubank Empresas was launched this week, after a year of development and through a project that involved more than 50 people and demanded a investment close to US$20 million. And throughout these few days, more than 500 entrepreneurs and small businesses have already registered on the platform. “We started this week, so we will launch the products little by little,” Bruchou anticipated.

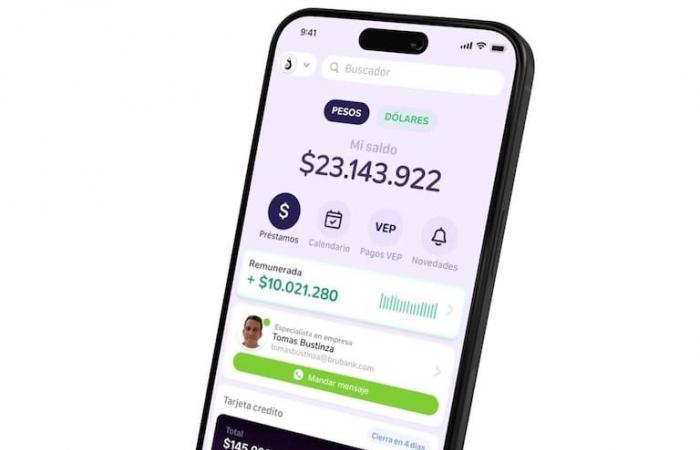

With this solution, companies can open an account on-line in just a few minutes, at no cost. In addition, they can manage their operations digitally, without having to visit a physical branch, while having a remunerated account to invest and withdraw money immediately.

“This was a requirement from our clients, who had their own businesses and who were not satisfied with their banking experiences and wanted something different. One of the points that stands out for us is the user experience, and the user experience comes through a superior product., made with the best technology and attention,” he noted. Along these lines, Brubank Empresas enabled a support and personalized attention channel via WhatsApp, available 24 hours a day and run by specialists.

“You don’t have to be a technology expert to use Brubank. We made the complex into something simple, and the solution is even designed to be used from a cell phone. With two clicks, people can request a loan, make a transfer, or collect payment using a QR code. And since we operate with cloud systems, our bank never ‘goes down’,” he stressed.

Currently, according to official data, SMEs represent 90% of companies and between 60 and 70% of formal employment in Argentina.