- In the last seven days, MKR is up 6.17% defying current market odds.

- With increased whale activity, MKR buying pressure has driven the price higher.

MakerDAO [MKR] has continued to rise over the past seven days despite market volatility. At the time of writing, MKR has gained 2.01% over the past 24 hours.

The sustained rise of MKR amid the cryptocurrency market crash has sparked speculation about the forces behind the development.

First of all, the increase is due to commercial activities driven by intelligent accumulation of money. In a post shared on X, IcryptoAI posted,

“$MKR topped Smart Money’s accumulation list over the past 24 hours.”

IcryptoAI further explained that,

“Currently, the wallet holds 100.81 $MKR ($256.86K). Additionally, the wallet also holds 1.59K DMT ($144.93K).”

These whale activities and the continued rise of the market have left several cryptocurrency analysts speculating on the future prospects of the MKR market.

For example, crypto analyst @Market Maker predicts a rally towards $4,000.

He added that,

“By forming a falling wedge and also testing the horizontal resistance (in case of falling wedge + horizontal resistance), a breakout with a strong bullish rally towards $4000 is expected.”

These analysts base their prediction on Mkr having formed a perfect falling wedge on a daily time frame and is trying to break through it. Therefore, we will see a massive rally in case of a successful breakout and retest.

What do MKR’s fundamentals indicate?

MKR reported a money flow ratio (MFI) of 72 at the time of publication. The MFI of 72 shows increased buying pressure, which is substantial relative to selling activities. An MFI at this level is a bullish signal and shows that the uptrend could continue.

Source: Tradingview

Likewise, MKR has an RSI of 55 above its RSI-based MA of 45, indicating that the market’s uptrend is well positioned to continue.

The RSI-based crossover MA from below shows strong upward momentum with increased buying pressure when the RSI rises.

Furthermore, MKR’s positive Chaikin Money Flow (CMF) at 0.15 indicates increased buying pressure, resulting in accumulation. A positive CMF shows that buyers are dominant, which is a bullish sign and positive market sentiment.

Source: Tradingview

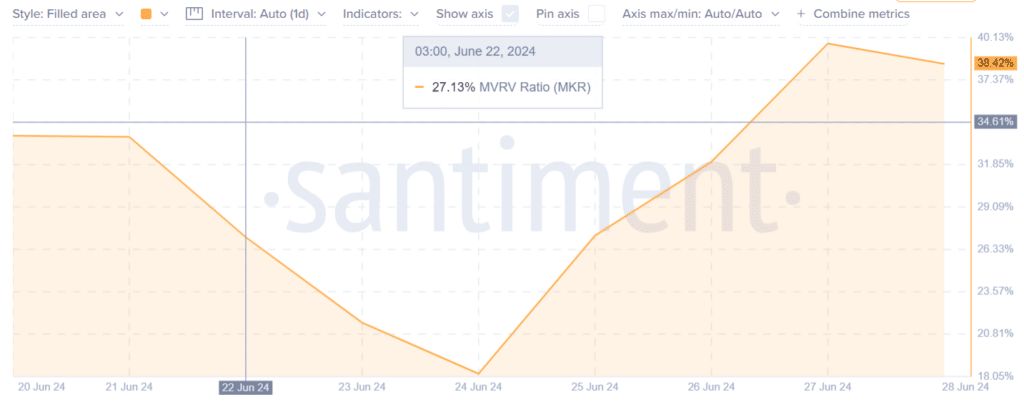

Looking further, Santiment’s AMBCrypto analysis shows that the coin has an MVRV ratio of 38.42% at the time of writing.

The MVRV ratio at this level shows that holders enjoy a profit of 38.42% compared to the purchase price. Therefore, the market is healthy and investors gain without reaching extreme levels that could lead to a sharp correction.

Furthermore, our analysis indicates that MKR has seen increasing open interest per trade. Over the past 7 days, MKR open interest per trade has increased from a low of $45.8M to a high of $61.48M.

The increase in open interest per stock implies greater activity and participation in the market. The increase in market activity shows confidence in the direction and stability of MKR, which is a bullish sign.

Source: Santiment

How far will Maker go?

At press time, MKR was trading at $2,600.76 and the market outlook remains positive as indicated by various indicators such as CMF.

How much is 1,10,100 MKR worth today?

The MFI and RSI suggest that the bull market will continue, subject to the continuation of the current momentum. Therefore, if the positive momentum sustains, MKR could reach the next resistance level around $2738 and then reach the much-awaited $3000.

However, if the market experiences a correction, it will find support around $2,503 and a further decline to $2,403.

Next: Is Dogecoin heading to $0.09? Key support levels show signs of a…

This is an automatic translation of our English version.