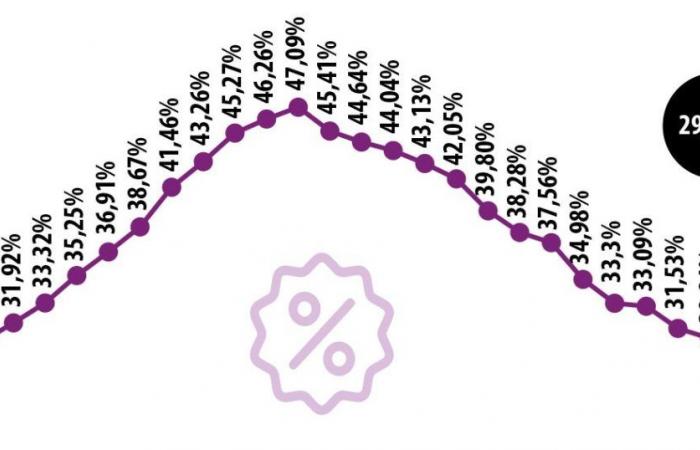

According to the Superfinanciera, this indicator for July will be 29.49%, which represents a reduction compared to the usury of July, which remained at 30.84%

The usury rate continues its downward trend, which started in the first months of last year after the banks started the so-called rate war.

According to the Superfinanciera, this indicator for July will be 29.49%, which represents a reduction compared to the usury of June, which remained at 30.84%. This will be the maximum rate that your financial institution can charge you when requesting a loan, so purchasing with these plastics will be cheaper this month.

In fact, this reduction leaves the indicator at minimum levels not seen since May 2022.when the usury rate was at 29.57%.

Analysts expect that this behavior in interest rates will help the reactivation of consumption and the application for credit.following the decline seen last year.

Within the framework of the moves regarding rates in the banking sector, Bancolombia paved the way for a new rate war after lowering the interest on housing loans, placing it at 10% EAWith this, the entity became the one of least interest in this segment.

For now, other banking entities have not commented on the matter.